Answered step by step

Verified Expert Solution

Question

1 Approved Answer

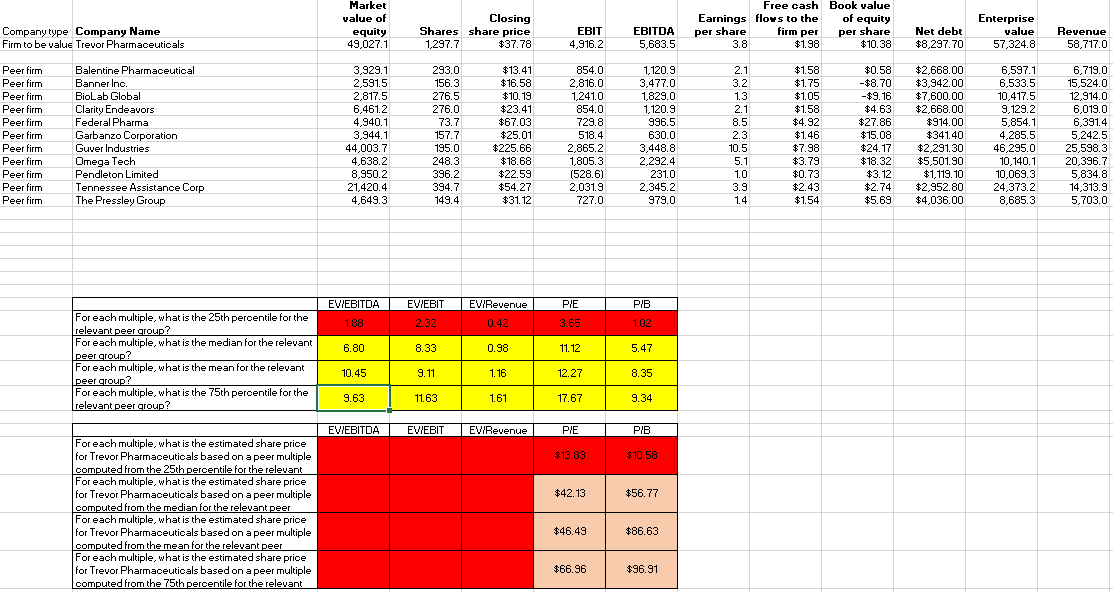

Please answer red boxes market comp analysis Market value of equity 49,027.1 Company type Company Name Firm to be value Trevor Pharmaceuticals Closing Shares share

Please answer red boxes

Please answer red boxes

market comp analysis

Market value of equity 49,027.1 Company type Company Name Firm to be value Trevor Pharmaceuticals Closing Shares share price 1,297.7 $37.78 Free cash Book value Earnings flors to the of equity 3.8 $1.98 $10.38 firm per EBIT 4,916,2 EBITDA 5,683.5 per share per share Net debt $8,297.70 Enterprise value 57,324.8 Revenue 58,717.0 Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Balentine Pharmaceutical Banner Ino. BioLab Global Clarity Endeavors Federal Pharma Garbanzo Corporation Guver Industries Omega Tech Pendleton Limited Tennessee Assistance Corp The Pressley Group 3,929.1 2,591.5 2,817,5 6,461.2 4,940.1 3,944.1 44,003.7 4,638.2 8,950.2 21,420.4 4,649.3 293.0 156.3 276.5 276.0 73.7 157.7 195.0 248.3 396.2 394.7 149.4 $13.41 $16.58 $10.19 $23.41 $67.03 $25.01 $225.66 $18.68 $22.59 $54.27 $31.12 854.0 2,816.0 1,241.0 854.0 729.8 518.4 2,865.2 1.805.3 (528.6) ( 2,031.9 727.0 1, 120.9 3,477.0 1,829.0 1,120.9 996.5 630.0 3,448.8 2,292.4 231.0 2,345.2 979.0 2.1 3.2 1.3 2.1 8.5 2.3 10.5 5.1 1.0 3.9 1.4 NENON $1.58 $1.75 $1.05 $1.58 $4.92 $1.46 $7.98 $3.79 $0.73 $2.43 $1.54 $0.58 -$8.70 -$9.16 $4.63 $27.86 $15.08 $24.17 $18.32 $3.12 $2.74 $5.69 $2,668.00 $3,942.00 $7,600.00 $2,668.00 $914.00 $34140 $2.29130 $5,501.90 $1,119.10 $2,952.80 $4,036.00 6,597.1 6,533.5 10,417,5 9,129.2 5,854.1 4,285,5 46,295.0 10.140.1 10,069.3 24,373.2 8,685.3 6,719,0 15,524.0 12,914.0 6,019.0 6,391.4 5,242.5 25,598.3 20,396.7 5,834.8 14,313.9 5,703.0 EVIEBITDA EVIRevenue PIE PIB EVIEBIT 2.32 1.88 0.42 3.65 1.02 6.80 8.33 0.98 11.12 5.47 For each multiple, what is the 25th percentile for the relevant peer group? For each multiple, what is the median for the relevant peer group? For each multiple, what is the mean for the relevant peer group? For each multiple, what is the 75th percentile for the relevant peer group? 10.45 9.11 1.16 12.27 8.35 9.63 11.63 1.61 17.67 9.34 EVIEBITDA EVIEBIT EVIRevenue PIE PIB $13.83 $10.58 $42.13 $56.77 For each multiple, what is the estimated share price for Trevor Pharmaceuticals based on a peer multiple computed from the 25th percentile for the relevant For each multiple, what is the estimated share price for Trevor Pharmaceuticals based on a peer multiple computed from the median for the relevant peer For each multiple, what is the estimated share price for Trevor Pharmaceuticals based on a peer multiple computed from the mean for the relevant peer For each multiple, what is the estimated share price for Trevor Pharmaceuticals based on a peer multiple computed from the 75th percentile for the relevant $46.49 $86.63 $66.96 $96.91 Market value of equity 49,027.1 Company type Company Name Firm to be value Trevor Pharmaceuticals Closing Shares share price 1,297.7 $37.78 Free cash Book value Earnings flors to the of equity 3.8 $1.98 $10.38 firm per EBIT 4,916,2 EBITDA 5,683.5 per share per share Net debt $8,297.70 Enterprise value 57,324.8 Revenue 58,717.0 Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Peer firm Balentine Pharmaceutical Banner Ino. BioLab Global Clarity Endeavors Federal Pharma Garbanzo Corporation Guver Industries Omega Tech Pendleton Limited Tennessee Assistance Corp The Pressley Group 3,929.1 2,591.5 2,817,5 6,461.2 4,940.1 3,944.1 44,003.7 4,638.2 8,950.2 21,420.4 4,649.3 293.0 156.3 276.5 276.0 73.7 157.7 195.0 248.3 396.2 394.7 149.4 $13.41 $16.58 $10.19 $23.41 $67.03 $25.01 $225.66 $18.68 $22.59 $54.27 $31.12 854.0 2,816.0 1,241.0 854.0 729.8 518.4 2,865.2 1.805.3 (528.6) ( 2,031.9 727.0 1, 120.9 3,477.0 1,829.0 1,120.9 996.5 630.0 3,448.8 2,292.4 231.0 2,345.2 979.0 2.1 3.2 1.3 2.1 8.5 2.3 10.5 5.1 1.0 3.9 1.4 NENON $1.58 $1.75 $1.05 $1.58 $4.92 $1.46 $7.98 $3.79 $0.73 $2.43 $1.54 $0.58 -$8.70 -$9.16 $4.63 $27.86 $15.08 $24.17 $18.32 $3.12 $2.74 $5.69 $2,668.00 $3,942.00 $7,600.00 $2,668.00 $914.00 $34140 $2.29130 $5,501.90 $1,119.10 $2,952.80 $4,036.00 6,597.1 6,533.5 10,417,5 9,129.2 5,854.1 4,285,5 46,295.0 10.140.1 10,069.3 24,373.2 8,685.3 6,719,0 15,524.0 12,914.0 6,019.0 6,391.4 5,242.5 25,598.3 20,396.7 5,834.8 14,313.9 5,703.0 EVIEBITDA EVIRevenue PIE PIB EVIEBIT 2.32 1.88 0.42 3.65 1.02 6.80 8.33 0.98 11.12 5.47 For each multiple, what is the 25th percentile for the relevant peer group? For each multiple, what is the median for the relevant peer group? For each multiple, what is the mean for the relevant peer group? For each multiple, what is the 75th percentile for the relevant peer group? 10.45 9.11 1.16 12.27 8.35 9.63 11.63 1.61 17.67 9.34 EVIEBITDA EVIEBIT EVIRevenue PIE PIB $13.83 $10.58 $42.13 $56.77 For each multiple, what is the estimated share price for Trevor Pharmaceuticals based on a peer multiple computed from the 25th percentile for the relevant For each multiple, what is the estimated share price for Trevor Pharmaceuticals based on a peer multiple computed from the median for the relevant peer For each multiple, what is the estimated share price for Trevor Pharmaceuticals based on a peer multiple computed from the mean for the relevant peer For each multiple, what is the estimated share price for Trevor Pharmaceuticals based on a peer multiple computed from the 75th percentile for the relevant $46.49 $86.63 $66.96 $96.91 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started