Please answer. refer to the image. it is all complete questions. all you have to is to answer.

Please show solutions in every answer.

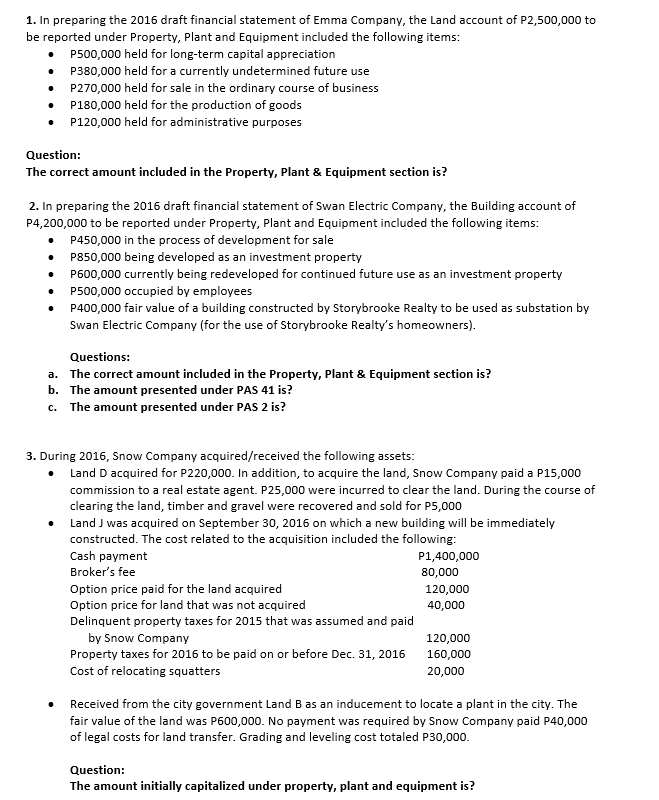

1. In preparing the 2016 draft financial statement of Emma Company, the Land account of P2,500,000 to be reported under Property, Plant and Equipment included the following items: P500,000 held for long-term capital appreciation . . P380,000 held for a currently undetermined future use P270,000 held for sale in the ordinary course of business P180,000 held for the production of goods P120,000 held for administrative purposes Question: The correct amount included in the Property, Plant & Equipment section is? 2. In preparing the 2016 draft financial statement of Swan Electric Company, the Building account of P4,200,000 to be reported under Property, Plant and Equipment included the following items: P450,000 in the process of development for sale . . P850,000 being developed as an investment property P600,000 currently being redeveloped for continued future use as an investment property . P500,000 occupied by employees P400,000 fair value of a building constructed by Storybrooke Realty to be used as substation by Swan Electric Company (for the use of Storybrooke Realty's homeowners). Questions: a. The correct amount included in the Property, Plant & Equipment section is? b. The amount presented under PAS 41 is? c. The amount presented under PAS 2 is? 3. During 2016, Snow Company acquired/received the following assets: . Land D acquired for P220,000. In addition, to acquire the land, Snow Company paid a P15,000 commission to a real estate agent. P25,000 were incurred to clear the land. During the course of clearing the land, timber and gravel were recovered and sold for P5,000 Land J was acquired on September 30, 2016 on which a new building will be immediately constructed. The cost related to the acquisition included the following Cash payment P1,400,000 Broker's fee 80,000 Option price paid for the land acquired 120,000 Option price for land that was not acquired 40,000 Delinquent property taxes for 2015 that was assumed and paid by Snow Company 120,000 Property taxes for 2016 to be paid on or before Dec. 31, 2016 160,000 Cost of relocating squatters 20,000 Received from the city government Land B as an inducement to locate a plant in the city. The fair value of the land was P600,000. No payment was required by Snow Company paid P40,000 of legal costs for land transfer. Grading and leveling cost totaled P30,000. Question: The amount initially capitalized under property, plant and equipment is