Please answer. refer to the image. it is all complete questions. all you have to is to answer.

Please show solutions in every answer.

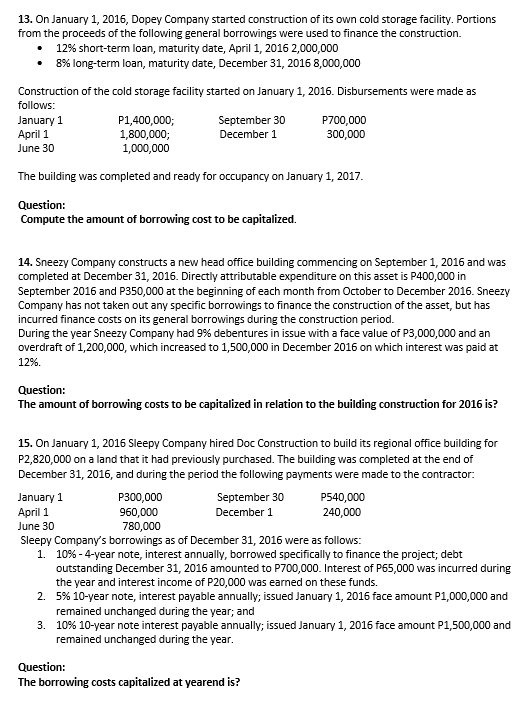

13. On January 1, 2016, Dopey Company started construction of its own cold storage facility. Portions from the proceeds of the following general borrowings were used to finance the construction. 12% short-term loan, maturity date, April 1, 2016 2,000,000 8%% long-term loan, maturity date, December 31, 2016 8,000,000 Construction of the cold storage facility started on January 1, 2016. Disbursements were made as follows: January 1 P1,400,000; September 30 P700,000 April 1 1,800,000; December 1 300,000 June 30 1,000,000 The building was completed and ready for occupancy on January 1, 2017. Question: Compute the amount of borrowing cost to be capitalized. 14. Sneezy Company constructs a new head office building commencing on September 1, 2016 and was completed at December 31, 2016. Directly attributable expenditure on this asset is P400,000 in September 2016 and P350,000 at the beginning of each month from October to December 2016. Sneezy Company has not taken out any specific borrowings to finance the construction of the asset, but has incurred finance costs on its general borrowings during the construction period. During the year Sneezy Company had 9% debentures in issue with a face value of P3,000,000 and an overdraft of 1,200,000, which increased to 1,500,000 in December 2016 on which interest was paid at 12%. Question: The amount of borrowing costs to be capitalized in relation to the building construction for 2016 is? 15. On January 1, 2016 Sleepy Company hired Doc Construction to build its regional office building for P2,820,000 on a land that it had previously purchased. The building was completed at the end of December 31, 2016, and during the period the following payments were made to the contractor: January 1 P300,000 September 30 P540,000 April 1 960,000 December 1 240,000 June 30 780,000 Sleepy Company's borrowings as of December 31, 2016 were as follows: 1. 10% - 4-year note, interest annually, borrowed specifically to finance the project; debt outstanding December 31, 2016 amounted to P700,000. Interest of P65,000 was incurred during the year and interest income of P20,000 was earned on these funds. 2. 5% 10-year note, interest payable annually; issued January 1, 2016 face amount P1,000,000 and remained unchanged during the year; and 3. 10 10-year note interest payable annually; issued January 1, 2016 face amount P1,500,000 and remained unchanged during the year. Question: The borrowing costs capitalized at yearend is