Please answer Req 1 + Req 1-3, thank you!

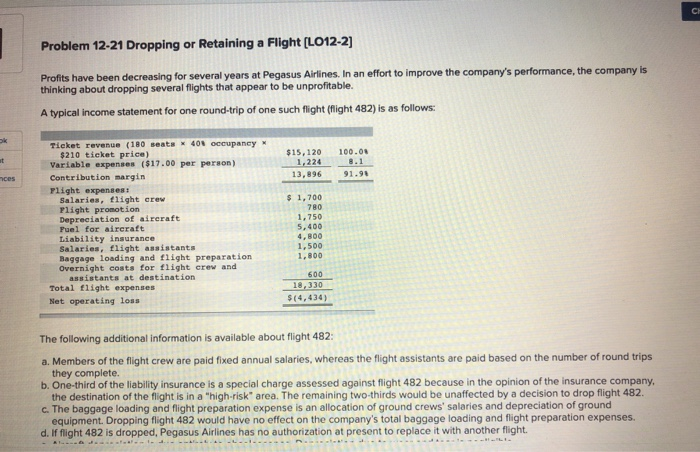

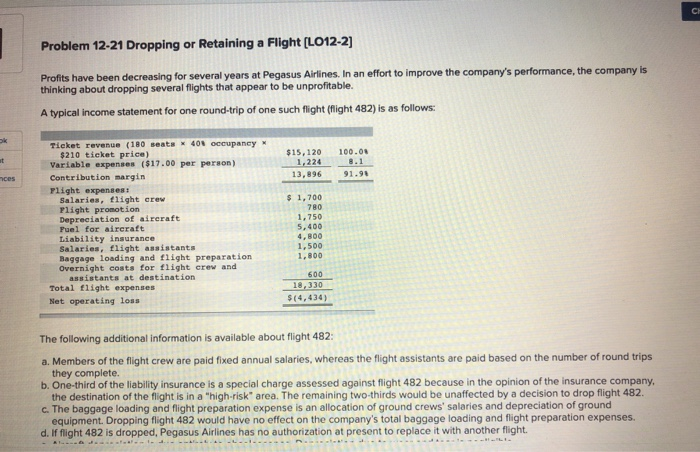

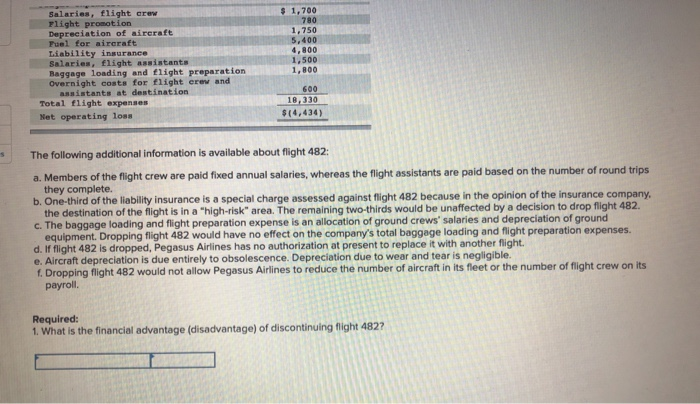

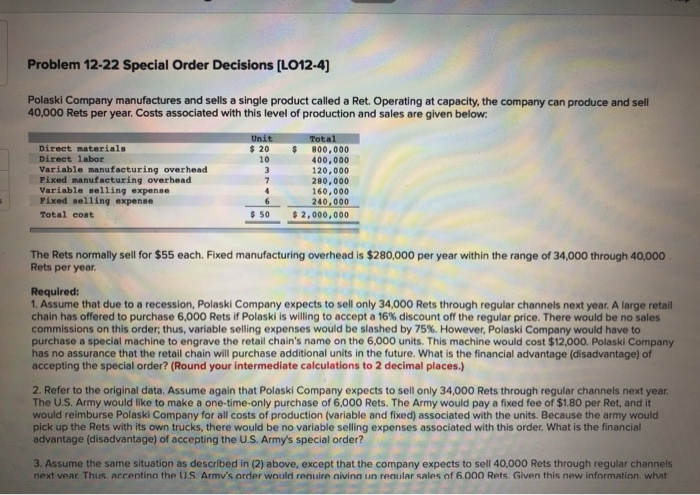

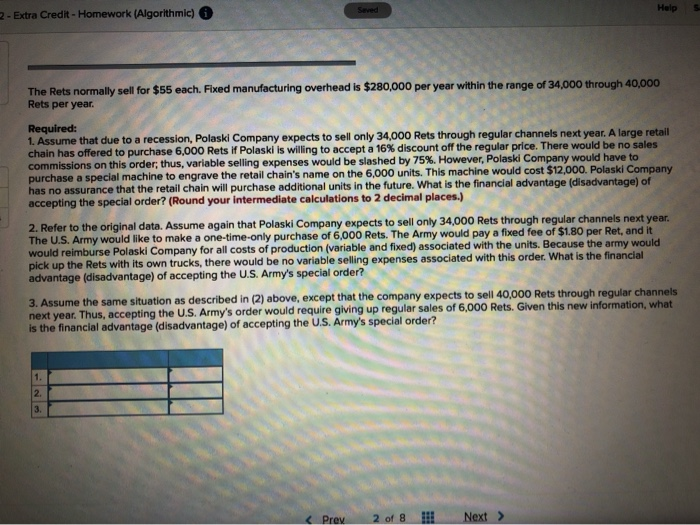

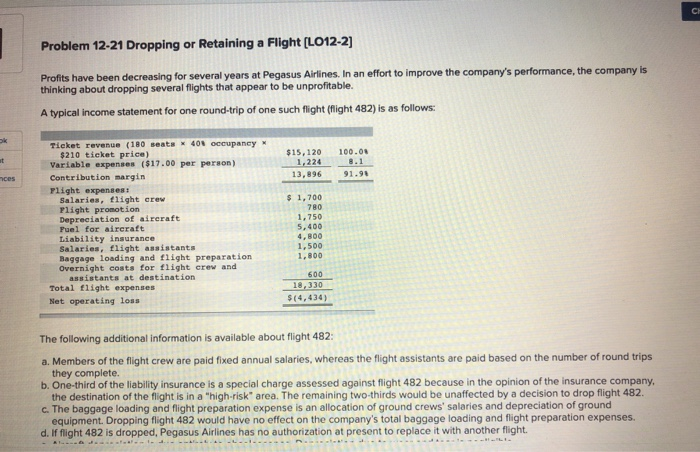

CH Problem 12-21 Dropping or Retaining a Flight (L012-2] Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the company's performance, the company is thinking about dropping several flights that appear to be unprofitable. A typical income statement for one round-trip of one such flight (flight 482) is as follows: at $15, 120 1,224 13,896 100.00 8.1 91.90 nces Ticket revenue (180 seats x 408 occupancy $210 ticket price) Variable expenses ($17.00 per person) Contribution margin Flight expenses: Salaries, flight crew Plight promotion Depreciation of aircraft Puel for aircraft Liability insurance Salaries, flight assistants Baggage loading and flight preparation Overnight costs for flight crew and assistants at destination Total flight expenses Net operating loss $1,700 780 1,750 5,400 4,800 1,500 1.800 600 18,330 $14,434) The following additional information is available about flight 482: a. Members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete b. One-third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the insurance company, the destination of the flight is in a "high-risk" area. The remaining two-thirds would be unaffected by a decision to drop flight 482 C. The baggage loading and flight preparation expense is an allocation of ground crews' salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company's total baggage loading and flight preparation expenses. d. If flight 482 is dropped, Pegasus Airlines has no authorization at present to replace it with another flight Salaries, flight crew Flight promotion Depreciation of aircraft Fuel for aircraft Liability insurance Salaries, flight assistants Raggage loading and flight preparation Overnight costs for flight crew and assistants at destination Total flight expenses Net operating loss $ 1,700 780 1,750 5,400 4,800 1,500 1,800 600 18,330 $(4,434) The following additional information is available about flight 482: a. Members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete. b. One-third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the insurance company, the destination of the flight is in a "high-risk" area. The remaining two-thirds would be unaffected by a decision to drop flight 482. c. The baggage loading and flight preparation expense is an allocation of ground crews' salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company's total baggage loading and flight preparation expenses. d. If flight 482 is dropped, Pegasus Airlines has no authorization at present to replace it with another flight. e. Aircraft depreciation is due entirely to obsolescence. Depreciation due to wear and tear is negligible. 1. Dropping flight 482 would not allow Pegasus Airlines to reduce the number of aircraft in its fleet or the number of flight crew on its payroll Required: 1. What is the financial advantage (disadvantage) of discontinuing flight 482? Problem 12-22 Special Order Decisions (L012-4) Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 40,000 Rets per year. Costs associated with this level of production and sales are given below: Unit $ 20 Direct materials Direct labor Variable manufacturing overhead Pixed manufacturing overhead Variable selling expense Fixed selling expense Total cost 10 3 7 4 6 $ 50 Total $ 800,000 400,000 120,000 280,000 160,000 240,000 $ 2,000,000 The Rets normally sell for $55 each. Fixed manufacturing overhead is $280,000 per year within the range of 34,000 through 40,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 34,000 Rets through regular channels next year. A large retail chain has offered to purchase 6,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order, thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain's name on the 6,000 units. This machine would cost $12,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order? (Round your intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that Polaski Company expects to sell only 34,000 Rets through regular channels next year. The U.S. Army would like to make a one-time-only purchase of 6,000 Rets. The Army would pay a fixed fee of $1.80 per Ret, and it would reimburse Polaski Company for all costs of production (variable and fixed) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 3. Assume the same situation as described in (2) above, except that the company expects to sell 40,000 Rets through regular channels next vear Thus, accepting the US Army's order would require alvina un regular sales of 6.000 Rets. Given this new information what Seved Help 2 - Extra Credit - Homework (Algorithmic) The Rets normally sell for $55 each. Fixed manufacturing overhead is $280,000 per year within the range of 34,000 through 40,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 34,000 Rets through regular channels next year. A large retail chain has offered to purchase 6,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain's name on the 6,000 units. This machine would cost $12,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order? (Round your intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that Polaski Company expects to sell only 34,000 Rets through regular channels next year. The U.S. Army would like to make a one-time-only purchase of 6,000 Rets. The Army would pay a fixed fee of $1.80 per Ret, and it would reimburse Polaski Company for all costs of production (variable and fixed) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 3. Assume the same situation as described in (2) above, except that the company expects to sell 40,000 Rets through regular channels next year. Thus, accepting the U.S. Army's order would require giving up regular sales of 6,000 Rets. Given this new information, what is the financial advantage (disadvantage) of accepting the U.S. Army's special order? 1. 2. 3.