PLEASE, ANSWER REQUIREMENT 2, PART B.

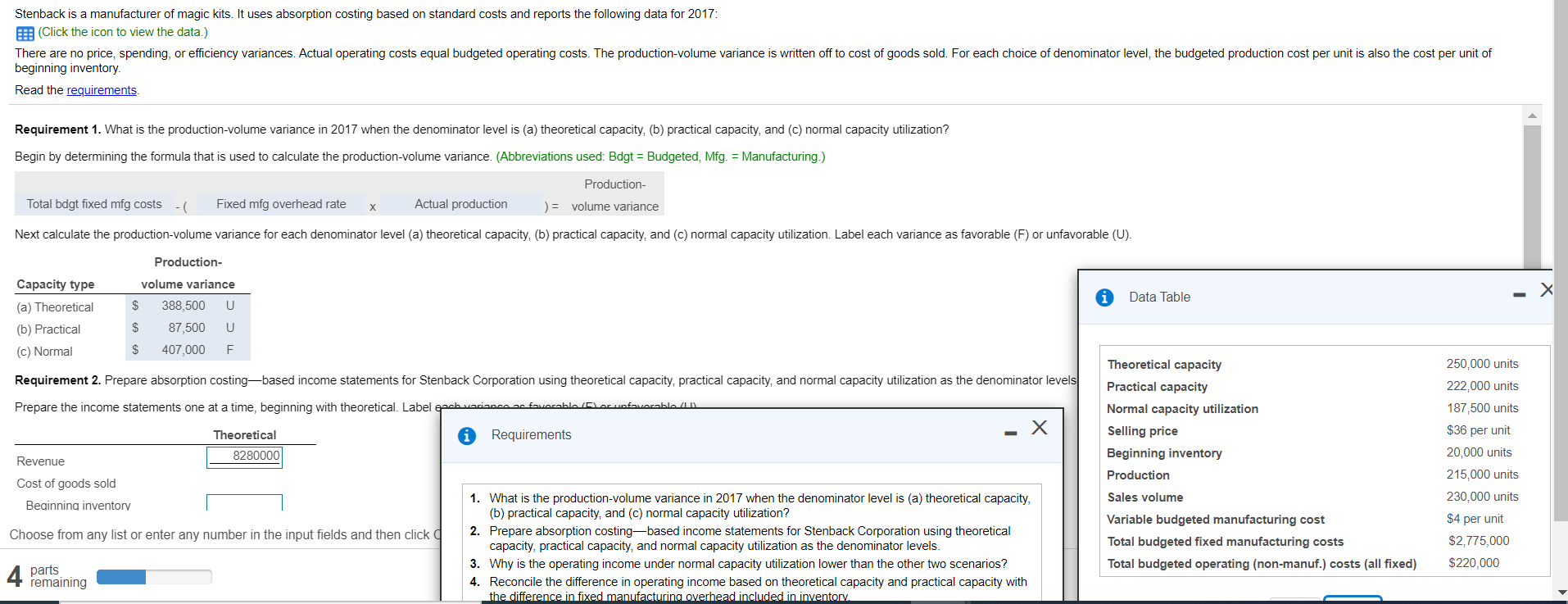

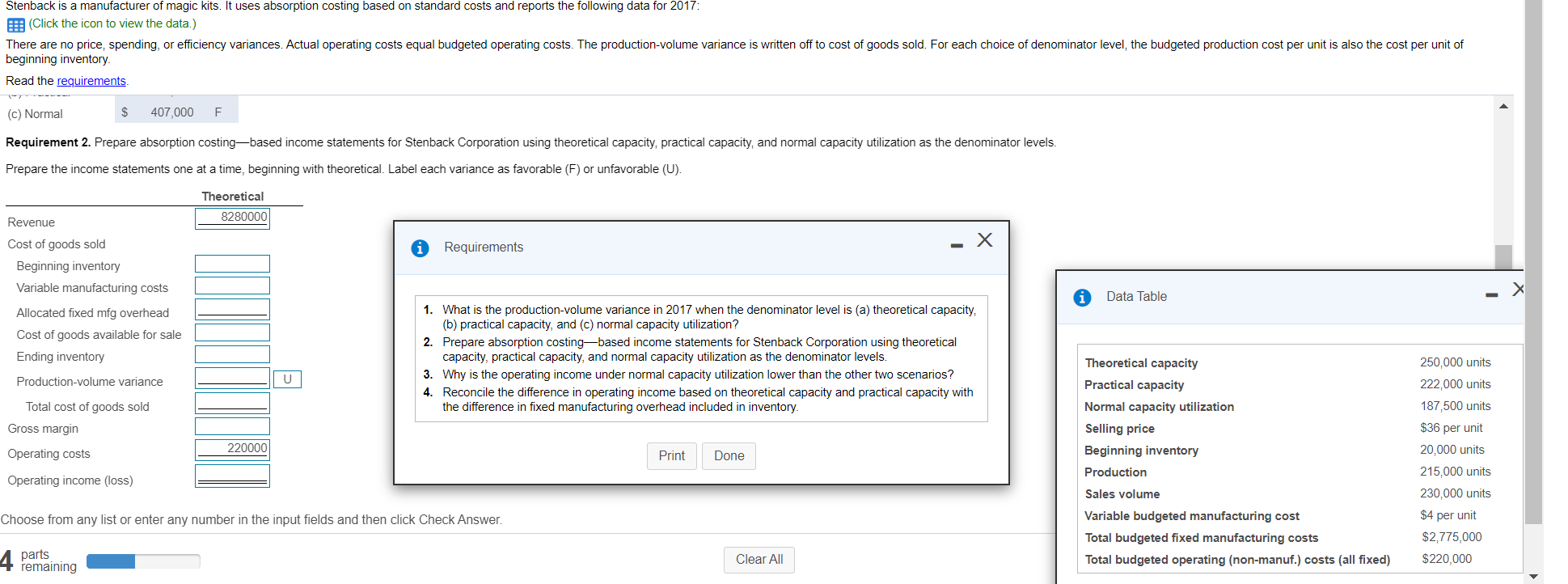

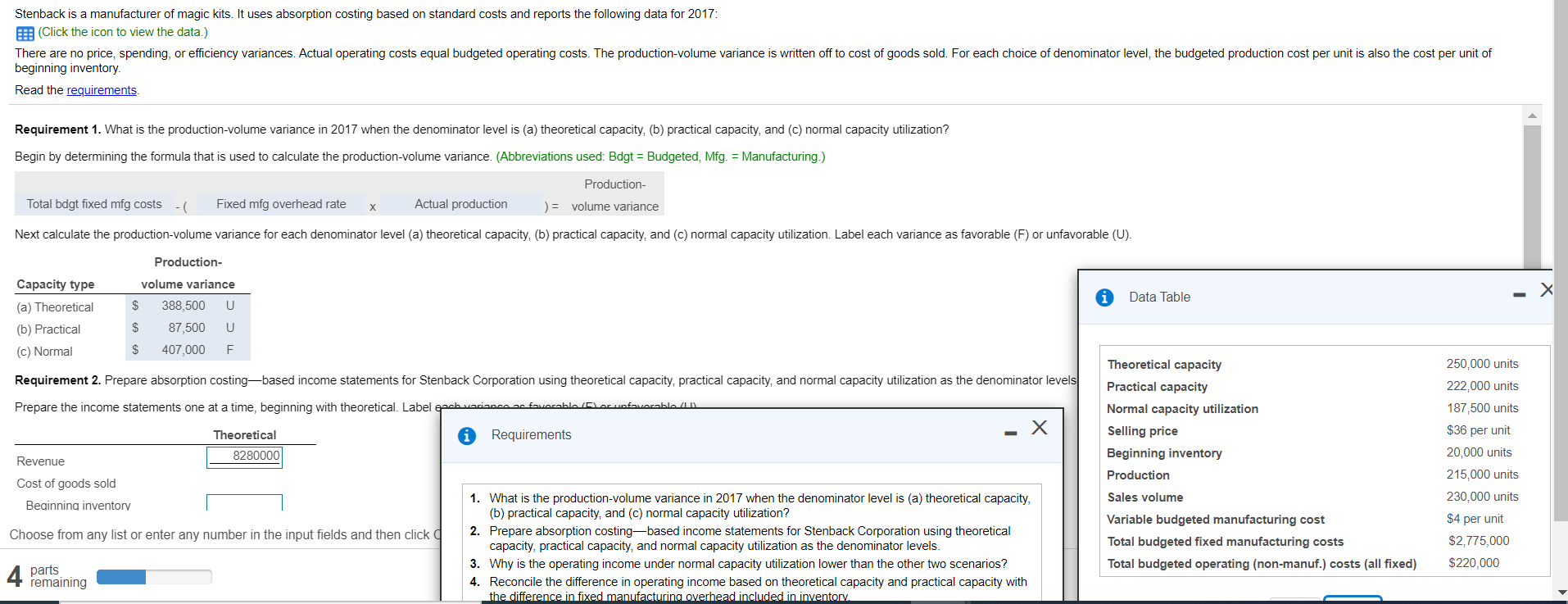

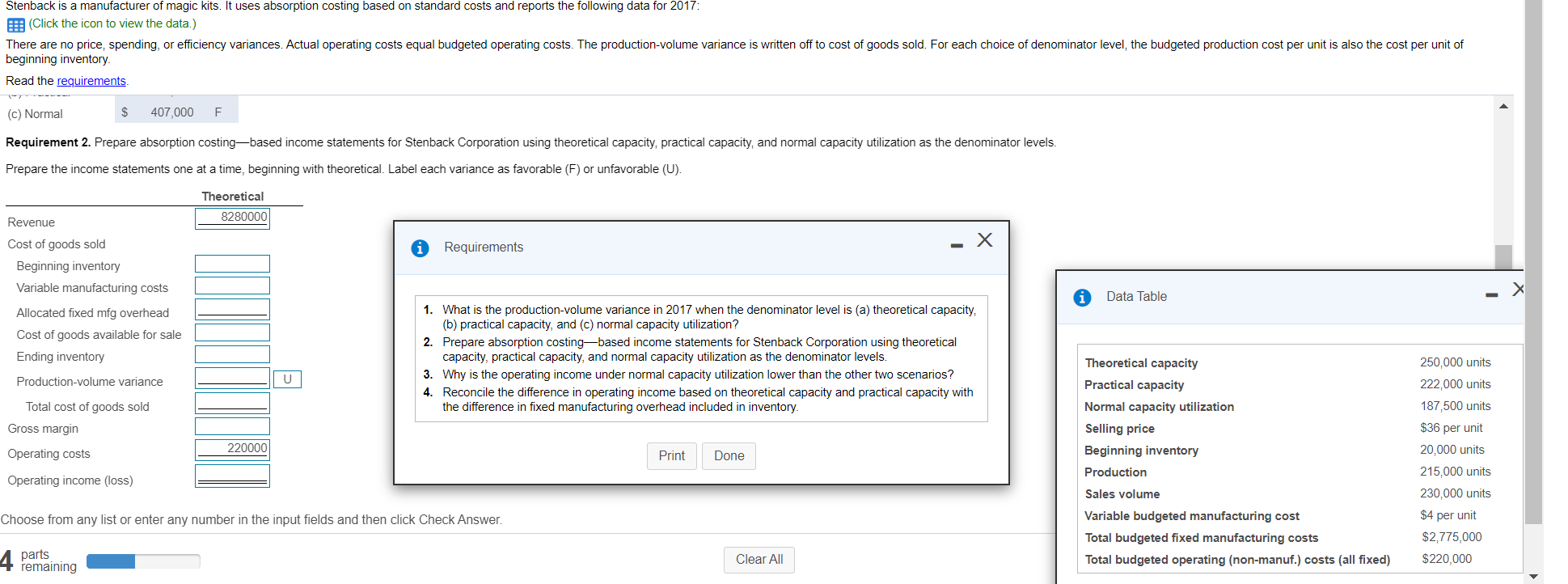

Stenback is a manufacturer of magic kits. It uses absorption costing based on standard costs and reports the following data for 2017: (Click the icon to view the data.) There are no price, spending, or efficiency variances. Actual operating costs equal budgeted operating costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator level, the budgeted production cost per unit is also the cost per unit of beginning inventory Read the requirements Requirement 1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization? Begin by determining the formula that is used to calculate the production-volume variance. (Abbreviations used: Bdgt = Budgeted, Mfg. = Manufacturing.) Production- ) = volume variance Total bdgt fixed mfg costs Fixed mfg overhead rate X Actual production Next calculate the production-volume variance for each denominator level (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization. Label each variance as favorable (F) or unfavorable (U). Production- Data Table Capacity type (a) Theoretical (b) Practical (c) Normal volume variance $ 388,500 U $ 87,500 U $ 407,000 F Requirement 2. Prepare absorption costing-based income statements for Stenback Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels Prepare the income statements one at a time, beginning with theoretical. Label asb variance a fonorable Clorunfavorable an X Requirements Theoretical 8280000 Revenue Theoretical capacity Practical capacity Normal capacity utilization Selling price Beginning inventory Production Sales volume Variable budgeted manufacturing cost Total budgeted fixed manufacturing costs Total budgeted operating (non-manuf.) costs (all fixed) 250,000 units 222,000 units 187,500 units $36 per unit 20,000 units 215,000 units 230,000 units $4 per unit $2,775,000 $220,000 Cost of goods sold Beginning inventory Choose from any list or enter any number in the input fields and then click 1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization? 2. Prepare absorption costing-based income statements for Stenback Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels. 3. Why is the operating income under normal capacity utilization lower than the other two scenarios? 4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with the difference in fixed manufacturing overhead included in inventory parts remaining Stenback is a manufacturer of magic kits. It uses absorption costing based on standard costs and reports the following data for 2017: E: (Click the icon to view the data.) There are no price, spending, or efficiency variances. Actual operating costs equal budgeted operating costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator level, the budgeted production cost per unit is also the cost per unit of beginning inventory Read the requirements (c) Normal $ 407,000 F Requirement 2. Prepare absorption costing-based income statements for Stenback Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels. Prepare the income statements one at a time, beginning with theoretical. Label each variance as favorable (F) or unfavorable (U). Theoretical 8280000 Revenue x Requirements Cost of goods sold Beginning inventory Variable manufacturing costs Data Table Allocated fixed mfg overhead Cost of goods available for sale Ending inventory 1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization? 2. Prepare absorption costing-based income statements for Stenback Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels. 3. Why is the operating income under normal capacity utilization lower than the other two scenarios 4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with the difference in fixed manufacturing overhead included in inventory. Production-volume variance U Total cost of goods sold Gross margin Theoretical capacity Practical capacity Normal capacity utilization Selling price Beginning inventory Production 220000 Operating costs Print Done 250,000 units 222,000 units 187,500 units $36 per unit 20,000 units 215,000 units 230,000 units $4 per unit $2,775,000 $220,000 Operating income (loss) Choose from any list or enter any number in the input fields and then click Check Answer. Sales volume Variable budgeted manufacturing cost Total budgeted fixed manufacturing costs Total budgeted operating (non-manuf.) costs (all fixed) parts remaining Clear All Stenback is a manufacturer of magic kits. It uses absorption costing based on standard costs and reports the following data for 2017: (Click the icon to view the data.) There are no price, spending, or efficiency variances. Actual operating costs equal budgeted operating costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator level, the budgeted production cost per unit is also the cost per unit of beginning inventory Read the requirements Requirement 1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization? Begin by determining the formula that is used to calculate the production-volume variance. (Abbreviations used: Bdgt = Budgeted, Mfg. = Manufacturing.) Production- ) = volume variance Total bdgt fixed mfg costs Fixed mfg overhead rate X Actual production Next calculate the production-volume variance for each denominator level (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization. Label each variance as favorable (F) or unfavorable (U). Production- Data Table Capacity type (a) Theoretical (b) Practical (c) Normal volume variance $ 388,500 U $ 87,500 U $ 407,000 F Requirement 2. Prepare absorption costing-based income statements for Stenback Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels Prepare the income statements one at a time, beginning with theoretical. Label asb variance a fonorable Clorunfavorable an X Requirements Theoretical 8280000 Revenue Theoretical capacity Practical capacity Normal capacity utilization Selling price Beginning inventory Production Sales volume Variable budgeted manufacturing cost Total budgeted fixed manufacturing costs Total budgeted operating (non-manuf.) costs (all fixed) 250,000 units 222,000 units 187,500 units $36 per unit 20,000 units 215,000 units 230,000 units $4 per unit $2,775,000 $220,000 Cost of goods sold Beginning inventory Choose from any list or enter any number in the input fields and then click 1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization? 2. Prepare absorption costing-based income statements for Stenback Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels. 3. Why is the operating income under normal capacity utilization lower than the other two scenarios? 4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with the difference in fixed manufacturing overhead included in inventory parts remaining Stenback is a manufacturer of magic kits. It uses absorption costing based on standard costs and reports the following data for 2017: E: (Click the icon to view the data.) There are no price, spending, or efficiency variances. Actual operating costs equal budgeted operating costs. The production-volume variance is written off to cost of goods sold. For each choice of denominator level, the budgeted production cost per unit is also the cost per unit of beginning inventory Read the requirements (c) Normal $ 407,000 F Requirement 2. Prepare absorption costing-based income statements for Stenback Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels. Prepare the income statements one at a time, beginning with theoretical. Label each variance as favorable (F) or unfavorable (U). Theoretical 8280000 Revenue x Requirements Cost of goods sold Beginning inventory Variable manufacturing costs Data Table Allocated fixed mfg overhead Cost of goods available for sale Ending inventory 1. What is the production-volume variance in 2017 when the denominator level is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization? 2. Prepare absorption costing-based income statements for Stenback Corporation using theoretical capacity, practical capacity, and normal capacity utilization as the denominator levels. 3. Why is the operating income under normal capacity utilization lower than the other two scenarios 4. Reconcile the difference in operating income based on theoretical capacity and practical capacity with the difference in fixed manufacturing overhead included in inventory. Production-volume variance U Total cost of goods sold Gross margin Theoretical capacity Practical capacity Normal capacity utilization Selling price Beginning inventory Production 220000 Operating costs Print Done 250,000 units 222,000 units 187,500 units $36 per unit 20,000 units 215,000 units 230,000 units $4 per unit $2,775,000 $220,000 Operating income (loss) Choose from any list or enter any number in the input fields and then click Check Answer. Sales volume Variable budgeted manufacturing cost Total budgeted fixed manufacturing costs Total budgeted operating (non-manuf.) costs (all fixed) parts remaining Clear All