please answer requirement b fully thank you

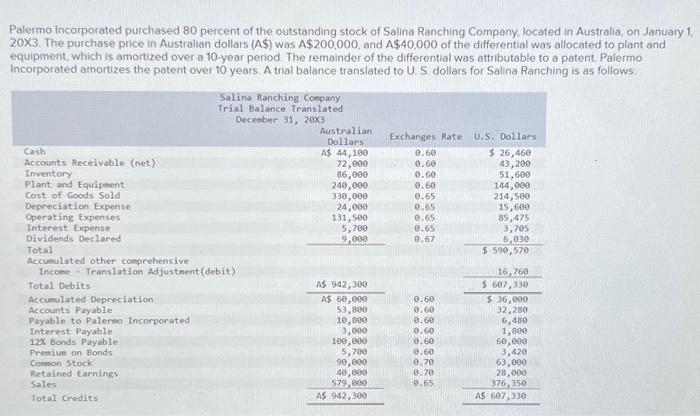

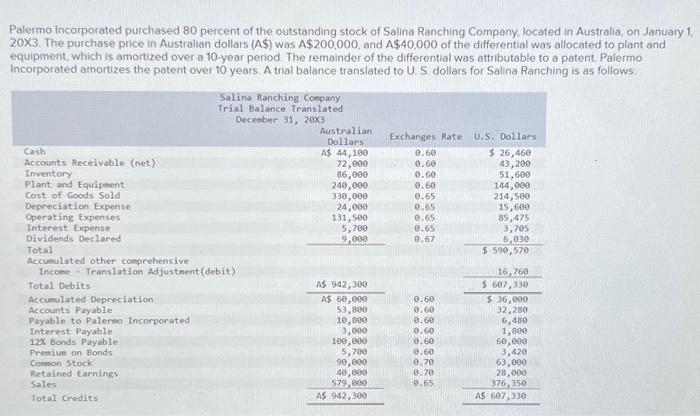

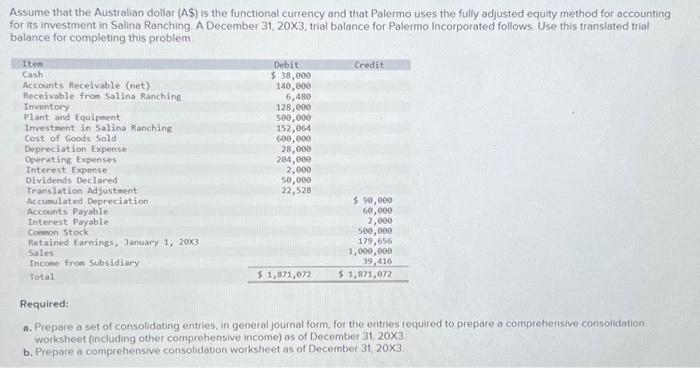

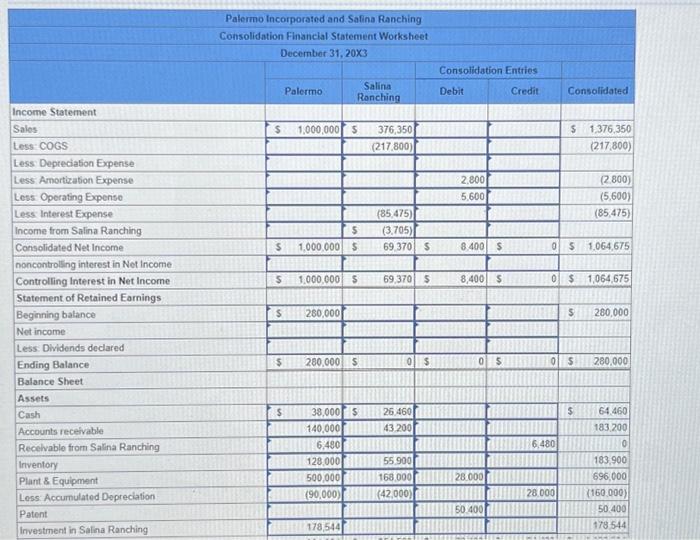

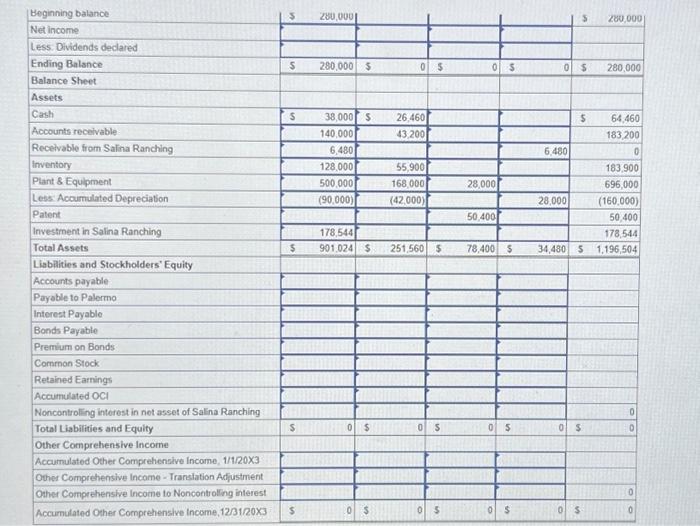

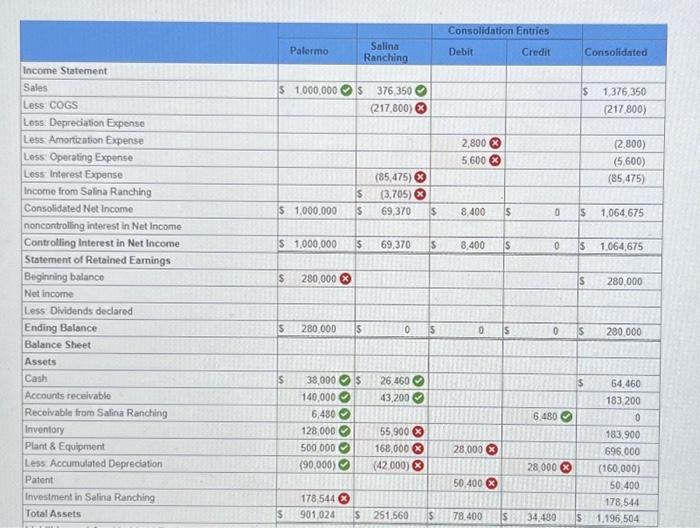

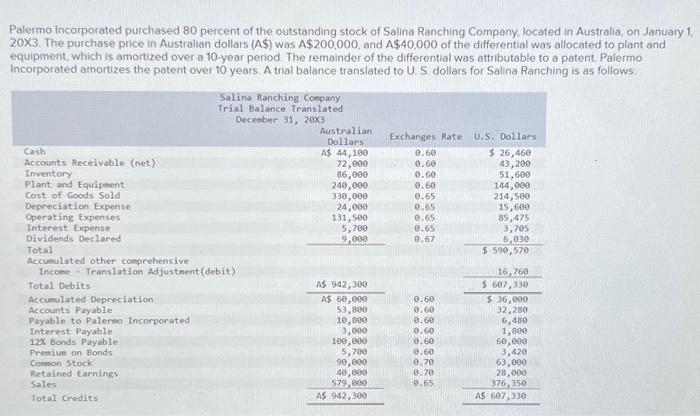

Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1 , 20X3. The purchase price in Australian dollars (A\$) was A$200,000, and A$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10 -year period. The remainder of the differential was attributable to a patent. Palermo Incorporated amortizes the patent over 10 years. A trial balance translated to U. S dollars for Salina Ranching is as follows. Assume that the Austratian dollar (AS) is the functional currency and that Palermo uses the fully adjusted equity method for accounting for its investment in Salina Ranching. A December 31,20X3, trial balance for Palermo Incorporated follows. Use this translated trial balance for completing this problem Required: a. Prepare a set of consolidating entries, in general journal form, for the entnes required to prepare a comprehensive consolidation worksheet (including other comprehensive income) as of Decernber 31, 20.3 b. Prepare a comprehensive consolidation worksheet as of December 31,203. Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1 , 20X3. The purchase price in Australian dollars (A\$) was A$200,000, and A$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10 -year period. The remainder of the differential was attributable to a patent. Palermo Incorporated amortizes the patent over 10 years. A trial balance translated to U. S dollars for Salina Ranching is as follows. Assume that the Austratian dollar (AS) is the functional currency and that Palermo uses the fully adjusted equity method for accounting for its investment in Salina Ranching. A December 31,20X3, trial balance for Palermo Incorporated follows. Use this translated trial balance for completing this problem Required: a. Prepare a set of consolidating entries, in general journal form, for the entnes required to prepare a comprehensive consolidation worksheet (including other comprehensive income) as of Decernber 31, 20.3 b. Prepare a comprehensive consolidation worksheet as of December 31,203