Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer solve the problem and explain your results. thank you! 1.24. Appropriate Transfer Prices: Opportunity Costs Olam International Limited sources and processes agricultural products

Please answer solve the problem and explain your results. thank you!

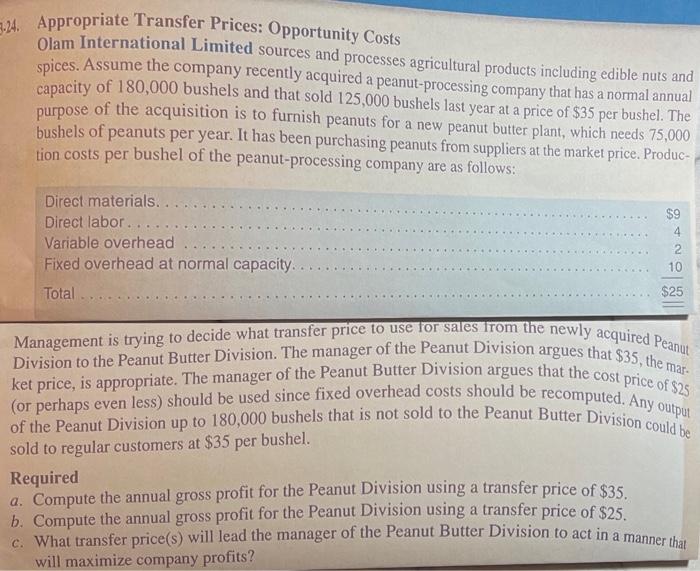

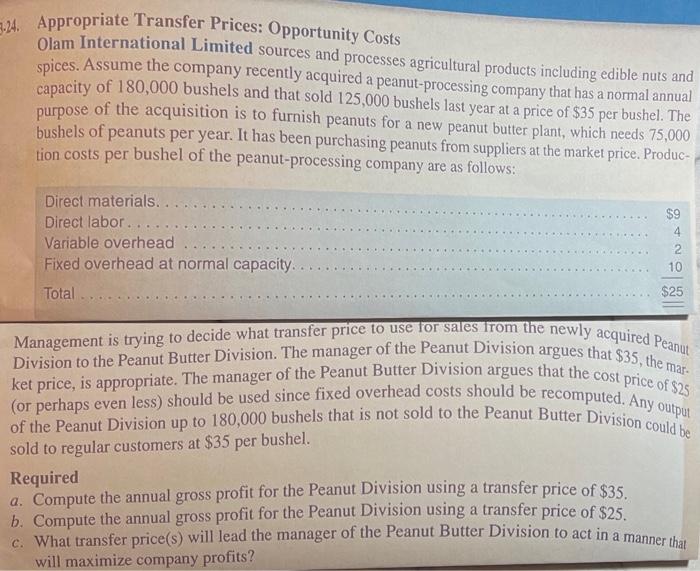

1.24. Appropriate Transfer Prices: Opportunity Costs Olam International Limited sources and processes agricultural products including edible nuts and spices. Assume the company recently acquired a peanut-processing company that has a normal annual capacity of 180,000 bushels and that sold 125,000 bushels last year at a price of $35 per bushel. The purpose of the acquisition is to furnish peanuts for a new peanut butter plant, which needs 75,000 bushels of peanuts per year. It has been purchasing peanuts from suppliers at the market price. Production costs per bushel of the peanut-processing company are as follows: Management is trying to decide what transfer price to use for sales from the newly acquired Peanut Division to the Peanut Butter Division. The manager of the Peanut Division argues that $35, the mar. ket price, is appropriate. The manager of the Peanut Butter Division argues that the cost price of $25 (or perhaps even less) should be used since fixed overhead costs should be recomputed. Any output of the Peanut Division up to 180,000 bushels that is not sold to the Peanut Butter Division could be sold to regular customers at $35 per bushel. Required a. Compute the annual gross profit for the Peanut Division using a transfer price of $35. b. Compute the annual gross profit for the Peanut Division using a transfer price of $25. c. What transfer price(s) will lead the manager of the Peanut Butter Division to act in a manner that will maximize company profits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started