Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer soon as possible thank you so much Long Problem Vitara Enterprises records all transactions on the cash basis. The accountant gave you the

Please answer soon as possible thank you so much

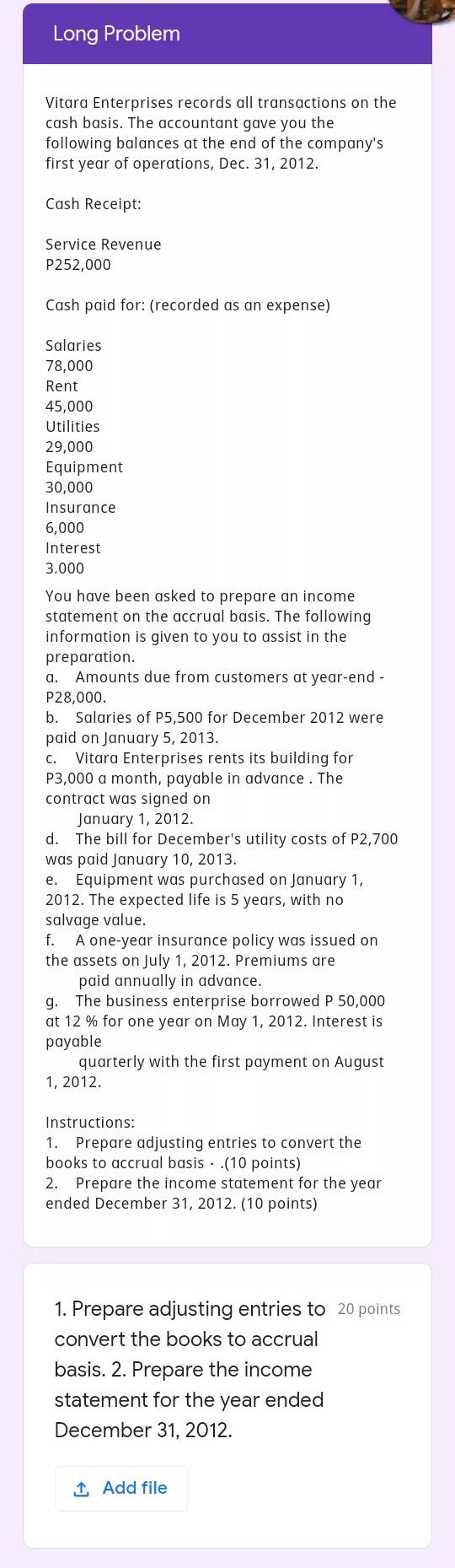

Long Problem Vitara Enterprises records all transactions on the cash basis. The accountant gave you the following balances at the end of the company's first year of operations, Dec. 31, 2012. Cash Receipt: Service Revenue P252,000 Cash paid for: (recorded as an expense) a. Salaries 78,000 Rent 45,000 Utilities 29,000 Equipment 30,000 Insurance 6,000 Interest 3.000 You have been asked to prepare an income statement on the accrual basis. The following information is given to you to assist in the preparation. Amounts due from customers at year-end - P28,000. b. Salaries of P5,500 for December 2012 were paid on January 5, 2013. Vitara Enterprises rents its building for P3,000 a month, payable in advance. The contract was signed on January 1, 2012 d. The bill for December's utility costs of P2,700 was paid January 10, 2013. Equipment was purchased on January 1, 2012. The expected life is 5 years, with no salvage value. f. A one-year insurance policy was issued on the assets on July 1, 2012. Premiums are paid annually in advance. g. The business enterprise borrowed P 50,000 at 12 % for one year on May 1, 2012. Interest is payable quarterly with the first payment on August 1, 2012. C. e. Instructions: 1. Prepare adjusting entries to convert the books to accrual basis ..(10 points) 2. Prepare the income statement for the year ended December 31, 2012. (10 points) 1. Prepare adjusting entries to 20 points convert the books to accrual basis. 2. Prepare the income statement for the year ended December 31, 2012. 1 Add fileStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started