Answered step by step

Verified Expert Solution

Question

1 Approved Answer

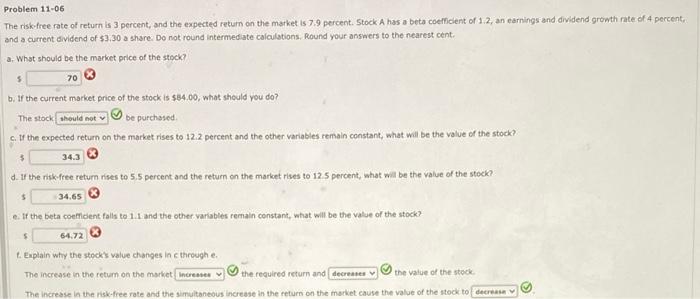

PLEASE ANSWER SOON Problem 11-06 The risk-free rate of return is 3 percent, and the expected return on the market is 7.9 percent. Stock A

PLEASE ANSWER SOON

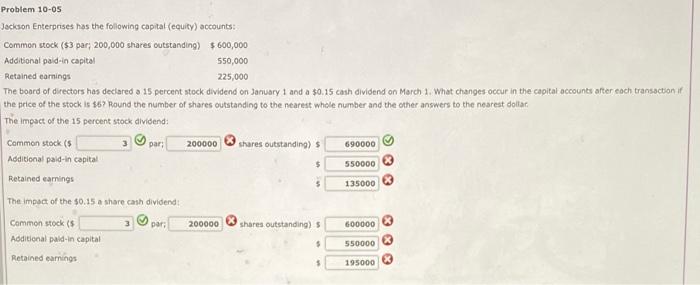

Problem 11-06 The risk-free rate of return is 3 percent, and the expected return on the market is 7.9 percent. Stock A has a beta coefficient of 1.2, an earnings and dividend growth rate of 4 percent and a current dividend of $3.30 a share. Do not round intermediate calculations, Round your answers to the nearest cent. a. What should be the market price of the stock 70 b. If the current market price of the stock is $84.00, what should you do? The stock should not be purchased c. If the expected return on the market rises to 12.2 percent and the other variables remain constant, what will be the value of the stock 5 5 d. If the risk free return rises to 5.5 percent and the return on the market rises to 12.5 percent, what will be the value of the stock? 34.65 e. If the beta coeficient falls to 1.1 and the other variables remain constant, what will be the value of the stock? $ $ 64.72 1. Explain why the stock's value changes in through e. The increase in the retum on the market increase the required return and decrease the value of the stock The increase in the risk-free rate and the simultaneous increase in the return on the market cause the value of the stock to decrease Problem 10-05 Jackson Enterprises has the following capital (equity) accounts: Common stock (53 par 200,000 shares outstanding) $600,000 Additional paid in capital 550,000 Retained earnings 225,000 The board of directors has declared a 15 percent stock dividend on January 1 and a $0.15 cash dividend on March 1. What changes occur in the capital accounts after each transaction the price of the stock is $6? Round the number of shares outstanding to the nearest whole number and the other answers to the nearest dollar The impact of the 15 percent stock dividendi Common stock (5 par: 200000 shares outstanding) 690000 Additional paid-in capital $ 550000 Retained earnings 135000 The impact of the 50.15 a share cash dividend 3 para 200000 shares outstanding) 600000 Common stock ( Additional paid in capital 550000 Retained earings 195000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started