Answered step by step

Verified Expert Solution

Question

1 Approved Answer

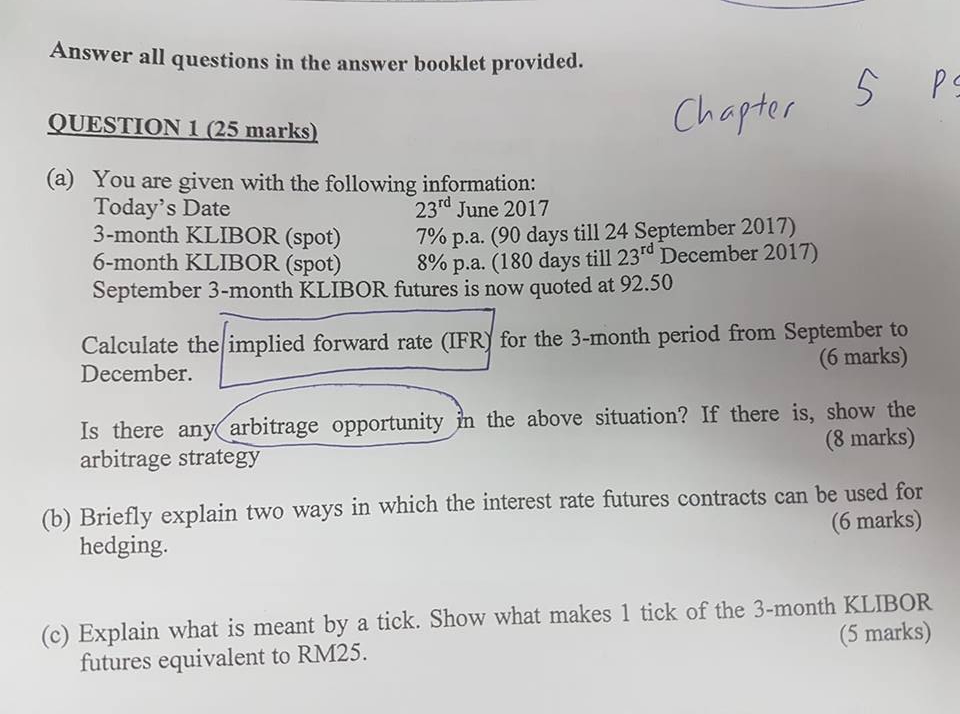

please answer step by step with detail explanation. Thank you Answer all questions in the answer booklet provided. QUESTION 1 (25 marks) (a) You are

please answer step by step with detail explanation. Thank you

Answer all questions in the answer booklet provided. QUESTION 1 (25 marks) (a) You are given with the following information: Chapter Today's Date 3-month KLIBOR (spot) 6-month KLIBOR (spo) September 3-month KLIBOR futures is now quoted at 92.50 23rd June 2017 7% pa. (90 days till 24 September 2017) 8% pa. (180 days till 23rd December 2017) Calculate the limplied forward rate (IFR for the 3-month period from September to (6 marks) December. Is there any arbitrage opportunity in the above situation? If there is, show the (8 marks) arbitrage strategy (b) Briefly explain two ways in which the interest rate futures contracts can be used for (6 marks) hedging. (c) Explain what is meant by a tick. Show what makes 1 tick of the 3-month KLIBOR (5 marks) futures equivalent to RM25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started