Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the # 12-20 multiple choice questions: Textbook: Federal Income Taxation of Corporations and Shareholders, 7th Edition Course: Taxation of Reorganizations & Liquidations 12.

Please answer the # 12-20 multiple choice questions:

Textbook: Federal Income Taxation of Corporations and Shareholders, 7th Edition

Course: Taxation of Reorganizations & Liquidations

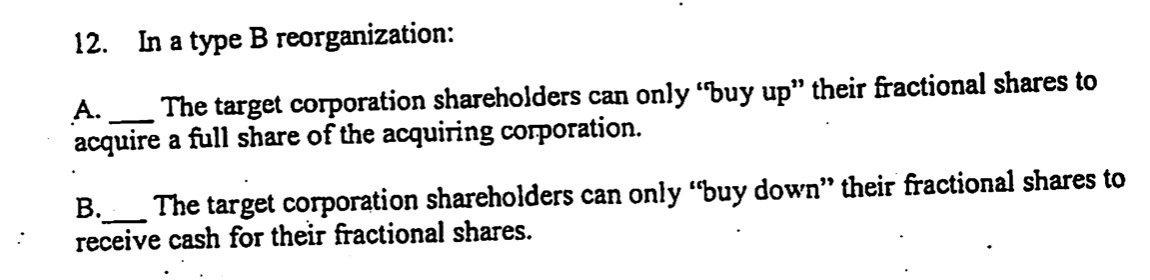

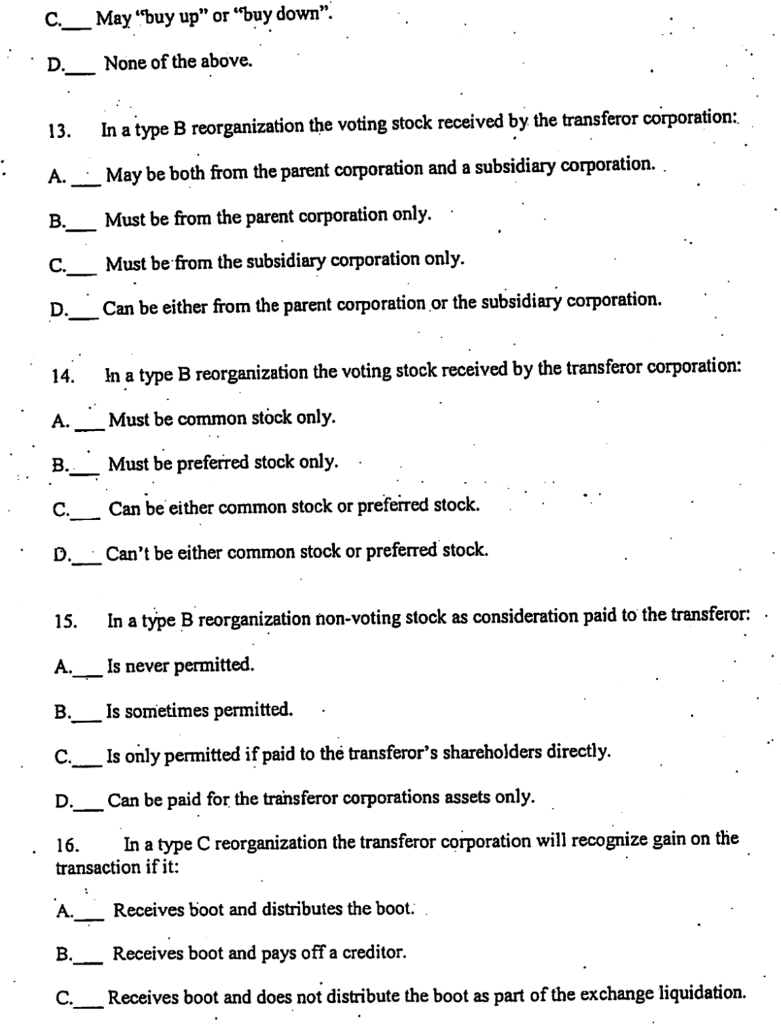

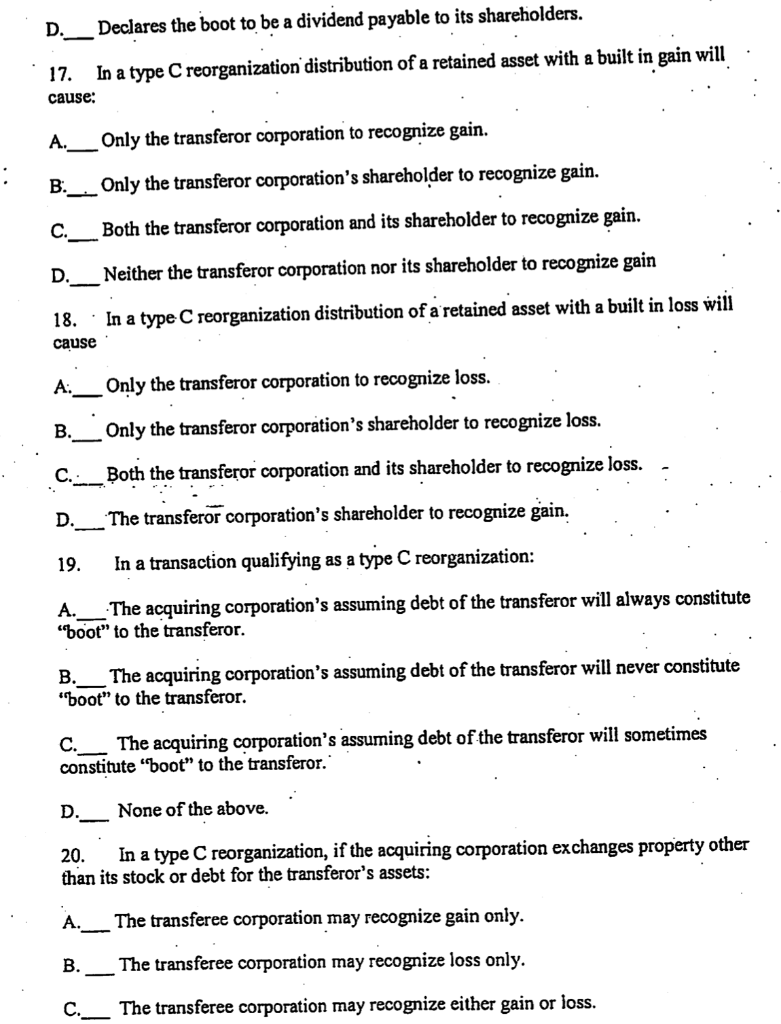

12. In a type B reorganization: A. _ The target corporation shareholders can only "buy up" their fractional shares to acquire a full share of the acquiring corporation. B. __ The target corporation shareholders can only buy down their fractional shares to receive cash for their fractional shares. : C.__ May buy up or buy down D.__ None of the above. 13. In a type B reorganization the voting stock received by the transferor corporation: A. May be both from the parent corporation and a subsidiary corporation. Must be from the parent corporation only.. c._ Must be from the subsidiary corporation only. Can be either from the parent corporation or the subsidiary corporation. In a type B reorganization the voting stock received by the transferor corporation: Must be common stock only. B.__ Must be preferred stock only. ao Can be either common stock or preferred stock. . D.__Can't be either common stock or preferred stock. 15. In a type B reorganization non-voting stock as consideration paid to the transferor: . A.___ Is never permitted. B._ Is sometimes permitted.. C.__ Is only permitted if paid to the transferor's shareholders directly. D.__Can be paid for the transferor corporations assets only. 16. In a type C reorganization the transferor corporation will recognize gain on the transaction if it: A. - Receives boot and distributes the boot. B. ___ Receives boot and pays off a creditor. C.__ Receives boot and does not distribute the boot as part of the exchange liquidation. D.__ Declares the boot to be a dividend payable to its shareholders. . 17. In a type C reorganization distribution of a retained asset with a built in gain will cause: A.__ Only the transferor corporation to recognize gain. . Only the transferor corporation's shareholder to recognize gain. Both the transferor corporation and its shareholder to recognize gain. D. Neither the transferor corporation nor its shareholder to recognize gain 18. cause In a type C reorganization distribution of a retained asset with a built in loss will A:__Only the transferor corporation to recognize loss. B.__ Only the transferor corporation's shareholder to recognize loss. C.__ Both the transferor corporation and its shareholder to recognize loss. - D.__ The transferor corporation's shareholder to recognize gain. In a transaction qualifying as a type C reorganization: A.__.The acquiring corporation's assuming debt of the transferor will always constitute "Boot" to the transferor. B. The acquiring corporation's assuming debt of the transferor will never constitute "boot" to the transferor. C. The acquiring corporation's assuming debt of the transferor will sometimes constitute "boot" to the transferor. D._ None of the above. 20. In a type C reorganization, if the acquiring corporation exchanges property other than its stock or debt for the transferor's assets: A.__ The transferee corporation may recognize gain only. B. _ The transferee corporation may recognize loss only. C. _ The transferee corporation may recognize either gain or loss. D. __ The transferee corporation recognizes neither gain nor loss. 12. In a type B reorganization: A. _ The target corporation shareholders can only "buy up" their fractional shares to acquire a full share of the acquiring corporation. B. __ The target corporation shareholders can only buy down their fractional shares to receive cash for their fractional shares. : C.__ May buy up or buy down D.__ None of the above. 13. In a type B reorganization the voting stock received by the transferor corporation: A. May be both from the parent corporation and a subsidiary corporation. Must be from the parent corporation only.. c._ Must be from the subsidiary corporation only. Can be either from the parent corporation or the subsidiary corporation. In a type B reorganization the voting stock received by the transferor corporation: Must be common stock only. B.__ Must be preferred stock only. ao Can be either common stock or preferred stock. . D.__Can't be either common stock or preferred stock. 15. In a type B reorganization non-voting stock as consideration paid to the transferor: . A.___ Is never permitted. B._ Is sometimes permitted.. C.__ Is only permitted if paid to the transferor's shareholders directly. D.__Can be paid for the transferor corporations assets only. 16. In a type C reorganization the transferor corporation will recognize gain on the transaction if it: A. - Receives boot and distributes the boot. B. ___ Receives boot and pays off a creditor. C.__ Receives boot and does not distribute the boot as part of the exchange liquidation. D.__ Declares the boot to be a dividend payable to its shareholders. . 17. In a type C reorganization distribution of a retained asset with a built in gain will cause: A.__ Only the transferor corporation to recognize gain. . Only the transferor corporation's shareholder to recognize gain. Both the transferor corporation and its shareholder to recognize gain. D. Neither the transferor corporation nor its shareholder to recognize gain 18. cause In a type C reorganization distribution of a retained asset with a built in loss will A:__Only the transferor corporation to recognize loss. B.__ Only the transferor corporation's shareholder to recognize loss. C.__ Both the transferor corporation and its shareholder to recognize loss. - D.__ The transferor corporation's shareholder to recognize gain. In a transaction qualifying as a type C reorganization: A.__.The acquiring corporation's assuming debt of the transferor will always constitute "Boot" to the transferor. B. The acquiring corporation's assuming debt of the transferor will never constitute "boot" to the transferor. C. The acquiring corporation's assuming debt of the transferor will sometimes constitute "boot" to the transferor. D._ None of the above. 20. In a type C reorganization, if the acquiring corporation exchanges property other than its stock or debt for the transferor's assets: A.__ The transferee corporation may recognize gain only. B. _ The transferee corporation may recognize loss only. C. _ The transferee corporation may recognize either gain or loss. D. __ The transferee corporation recognizes neither gain nor lossStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started