Answered step by step

Verified Expert Solution

Question

1 Approved Answer

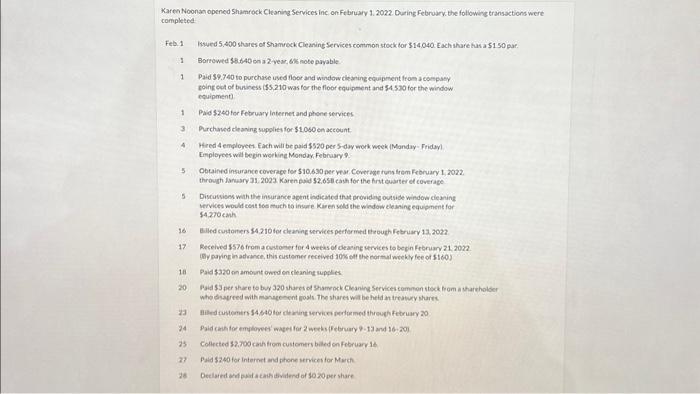

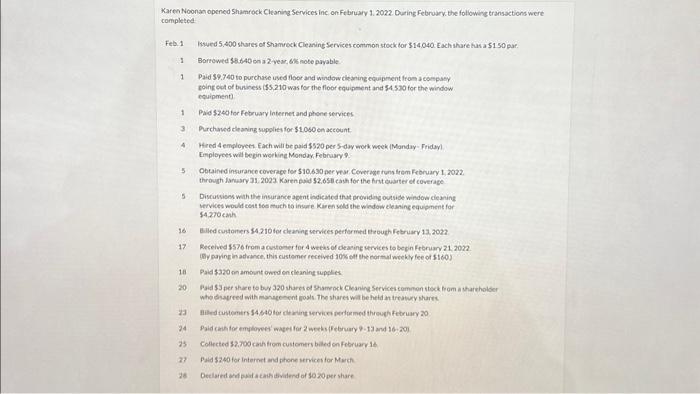

please answer the 2nd part Karen Noonan opened Shamrock Cleaning Services inc, on Fetarary 1.2022 Duting February. the followire transactions were completed: Feb.1 Hsued 5,400

please answer the 2nd part

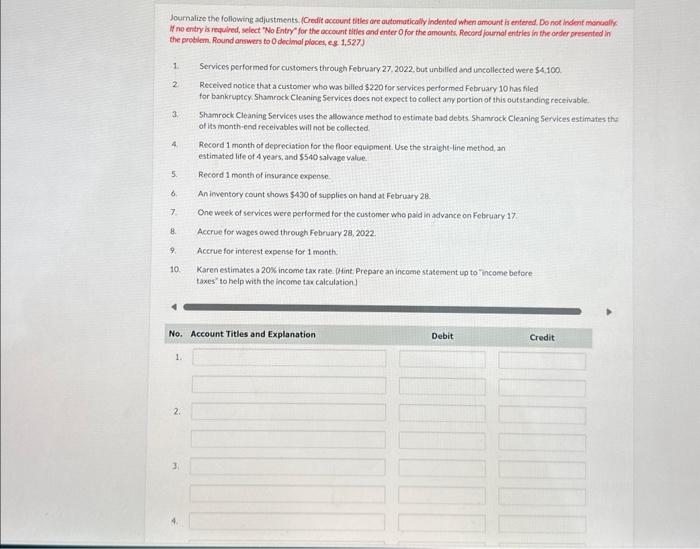

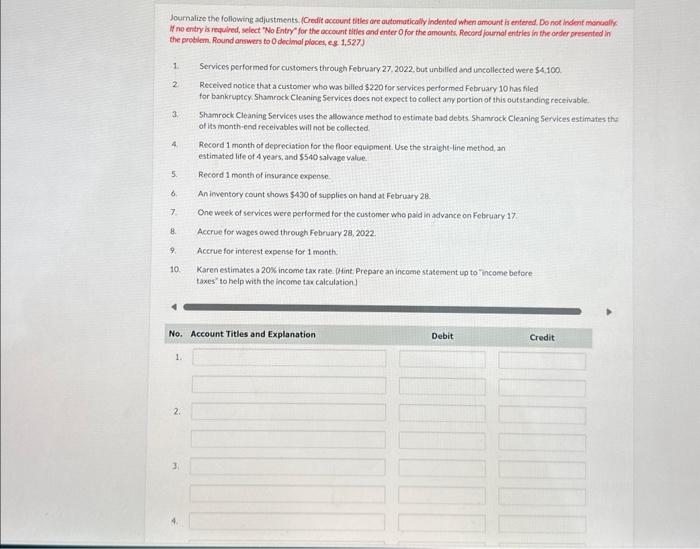

Karen Noonan opened Shamrock Cleaning Services inc, on Fetarary 1.2022 Duting February. the followire transactions were completed: Feb.1 Hsued 5,400 shares of Shamreck. Cle aning Services comtmon stock for \$14.040. Each share has a $150 par. 1 Borrowed 58640 on 2 vear, ens note pavable. 1 Paid 59.740 to purchase uved floor and window cleaning equipment from a eompasy ecuipment] 1 Paid $240 fer February internet and phone services 3 Drchaved eleaning supplies for $10 so en aceount: 4. Heed 4 employeer Each will be paid $520 per 5 -dw wok woek (Manday - Friday) Employees wil begin workine Monday, February? 5 Obcained insurance coverace for $10,630 per war. Coveragetuns frem February 1,2022. $4270cmh 17 Recehed $576 from a custoner for 4 wechs of deacine services to be pn fronuarv 21.2022 25. Collected $2700 cahtion customers biled on february is 27. Pald \$240for internet and phone sernices for Merk. Joumalize the following adjustments. fCredit account vitles are autpmatically indented when amount is entered. Do not indent monualfk. If no entry is required, select "No Entry" for the account tities and enter O for the amounts. Recond fournal entries in the onder presented in the problem. Round answers to 0 declmal ploces, es 1,527) 1. Services performed for customers through February 27, 2022, but unbilled and uncollected were $4,100. 2. Received notice that a customer who was billed $220 for services performed February 10 has filed for bankruptcy Shamrock Clcaning Services does not expect to collect ary portion of this outstanding receivable. 3. Shamrock Cleaning Services uses the allowance method to estimate bad debts Sharrock Cleaning Services estimates tha of its month-end receivables will not be collected 4. Record 1 month of depreciation for the floor equipment. Use the straight-line method, an estimated life of 4 years, and $540 salvage value. 5. Recerd 1 month of insurance expense 6. An irventory count shows $430 of supplies on hand at February 28 . 7. One week of services were performed for the customer who pald in advance on February 17 8. Accrue for wages owed through February 28, 2022 9. Acerve for interest expense for 1 month. 10. Karenestimates a 20x income tax rate. phint: Prepare an income statement ip to income before: taxes' to help with the income tax calculation]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started