Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the 4 questions thank you will leave a thumbs up if it is correct answer 5-8 Instructions: Use four decimal places for your

please answer the 4 questions thank you will leave a thumbs up if it is correct

answer 5-8

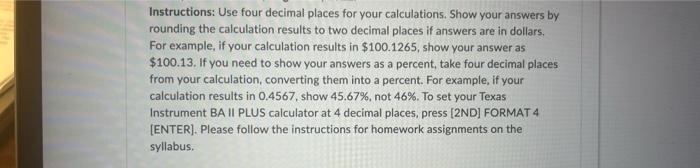

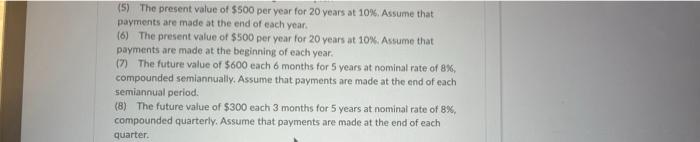

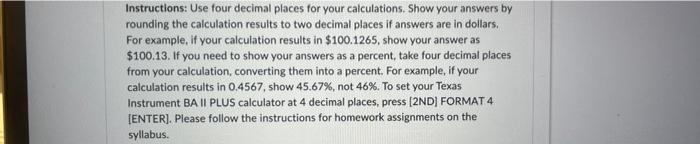

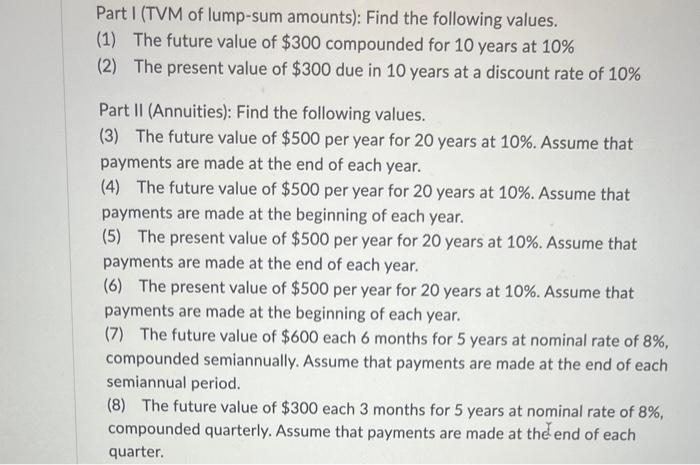

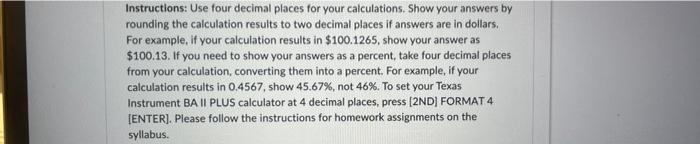

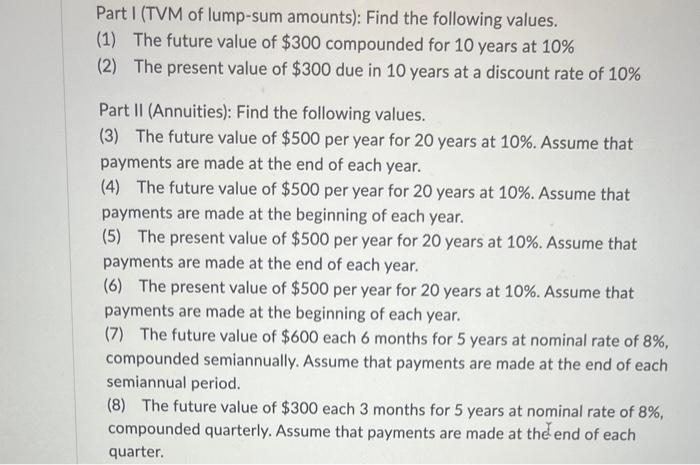

Instructions: Use four decimal places for your calculations. Show your answers by rounding the calculation results to two decimal places if answers are in dollars. For example, if your calculation results in $100.1265, show your answer as $100.13. If you need to show your answers as a percent, take four decimal places from your calculation, converting them into a percent. For example, if your calculation results in 0.4567, show 45.67%, not 46%. To set your Texas Instrument BA II PLUS calculator at 4 decimal places, press [2ND] FORMAT 4 [ENTER]. Please follow the instructions for homework assignments on the syllabus. (5) The present value of $500 per vear for 20 years at 10%. Assume that payments are made at the end of each year. (6) The present value of $500 per year for 20 years at 10%. Assume that payments are made at the beginning of each year. (7) The future value of $600 each 6 months for 5 years at nominal rate of 8%, compounded semiannually. Assume that payments are made at the end of each semiannual period. (8) The future value of $300 each 3 months for 5 years at nominal rate of 8%, compounded quarterly. Assume that payments are made at the end of each quarter. Instructions: Use four decimal places for your calculations. Show your answers by rounding the calculation results to two decimal places if answers are in dollars. For example, if your calculation results in $100.1265, show your answer as $100.13. If you need to show your answers as a percent, take four decimal places from your calculation, converting them into a percent. For example, if your calculation results in 0.4567, show 45.67%, not 46%. To set your Texas Instrument BA II PLUS calculator at 4 decimal places, press [2ND] FORMAT 4 [ENTER]. Please follow the instructions for homework assignments on the syllabus. Part I (TVM of lump-sum amounts): Find the following values. (1) The future value of $300 compounded for 10 years at 10% (2) The present value of $300 due in 10 years at a discount rate of 10% Part II (Annuities): Find the following values. (3) The future value of $500 per year for 20 years at 10%. Assume that payments are made at the end of each year. (4) The future value of $500 per year for 20 years at 10%. Assume that payments are made at the beginning of each year. (5) The present value of $500 per year for 20 years at 10%. Assume that payments are made at the end of each year. (6) The present value of $500 per year for 20 years at 10%. Assume that payments are made at the beginning of each year. (7) The future value of $600 each 6 months for 5 years at nominal rate of 8%, compounded semiannually. Assume that payments are made at the end of each semiannual period. (8) The future value of $300 each 3 months for 5 years at nominal rate of 8%, compounded quarterly. Assume that payments are made at the end of each

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started