Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the all questions and not fix the grammar 8:28 4 Expert Q&A Done Susan and Bill are investing in a retirement account that

please answer the all questions and not fix the grammar

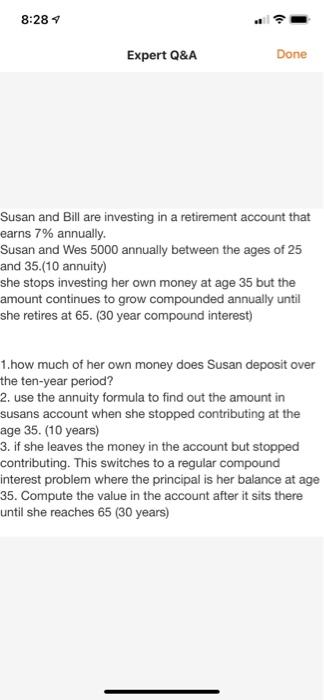

8:28 4 Expert Q&A Done Susan and Bill are investing in a retirement account that earns 7% annually. Susan and Wes 5000 annually between the ages of 25 and 35.(10 annuity) she stops investing her own money at age 35 but the amount continues to grow compounded annually until she retires at 65. (30 year compound interest) 1. how much of her own money does Susan deposit over the ten-year period? 2. use the annuity formula to find out the amount in susans account when she stopped contributing at the age 35. (10 years) 3. if she leaves the money in the account but stopped contributing. This switches to a regular compound interest problem where the principal is her balance at age 35. Compute the value in the account after it sits there until she reaches 65 (30 years) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started