Please answer the attached file, thank you!

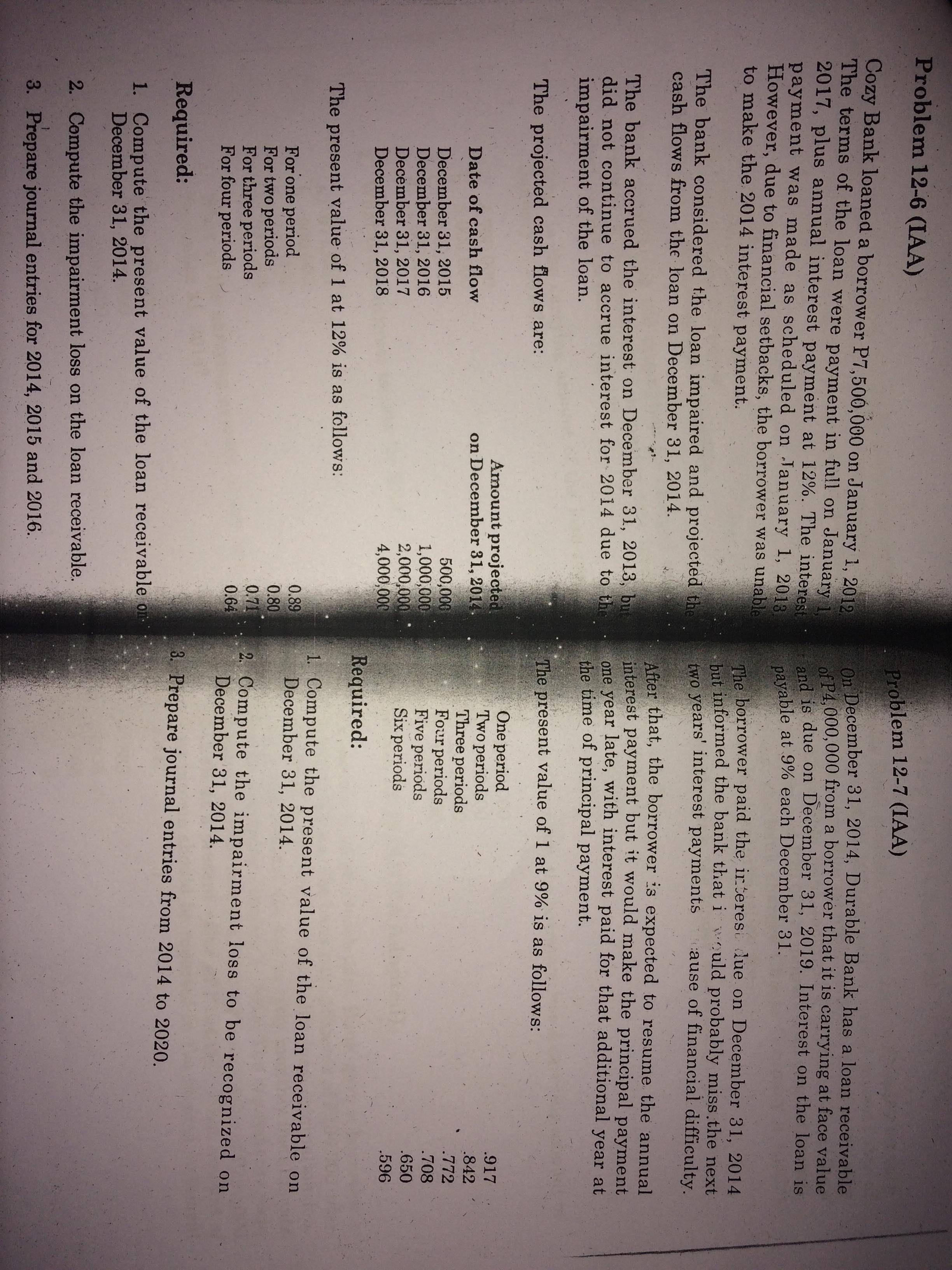

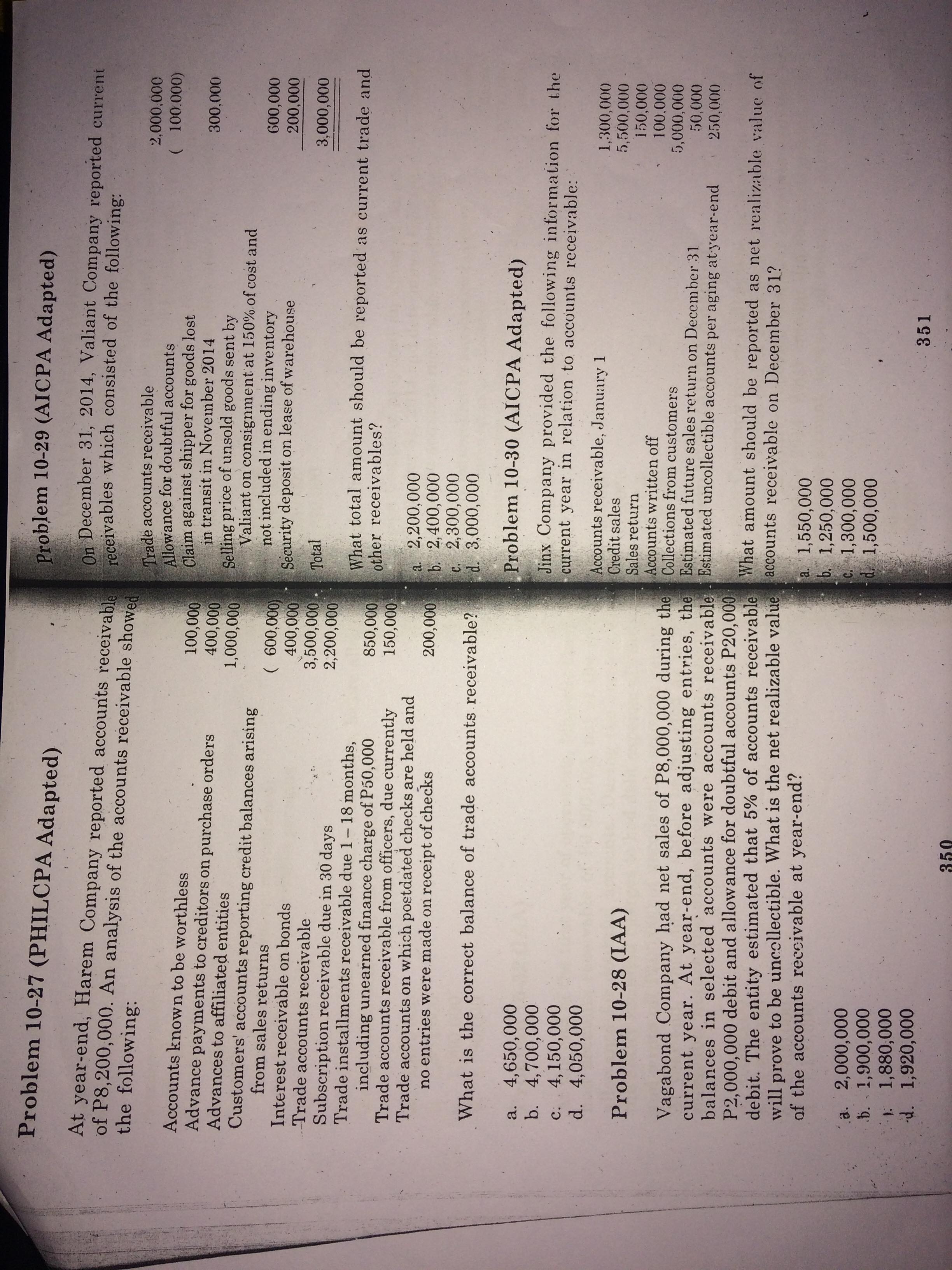

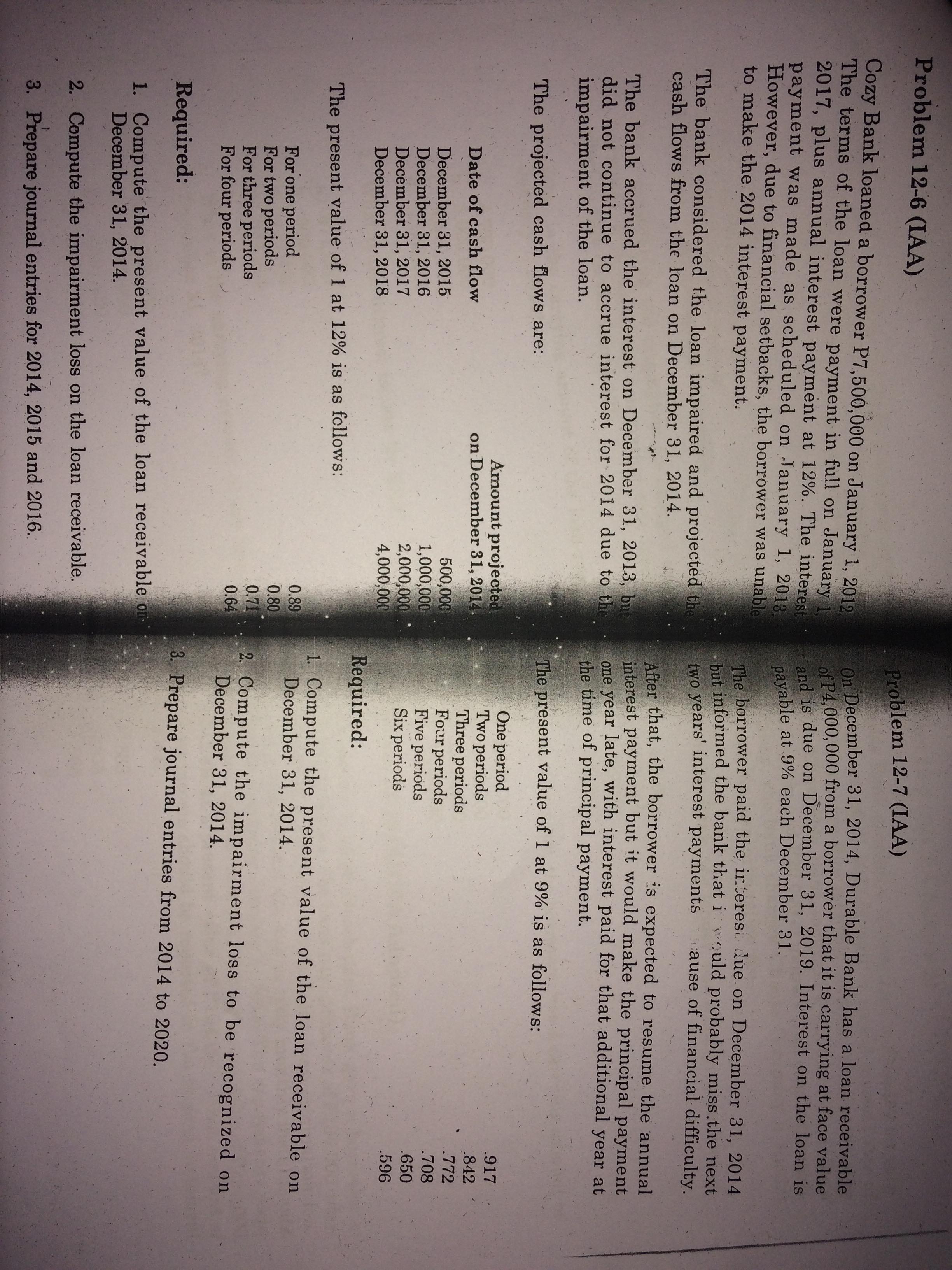

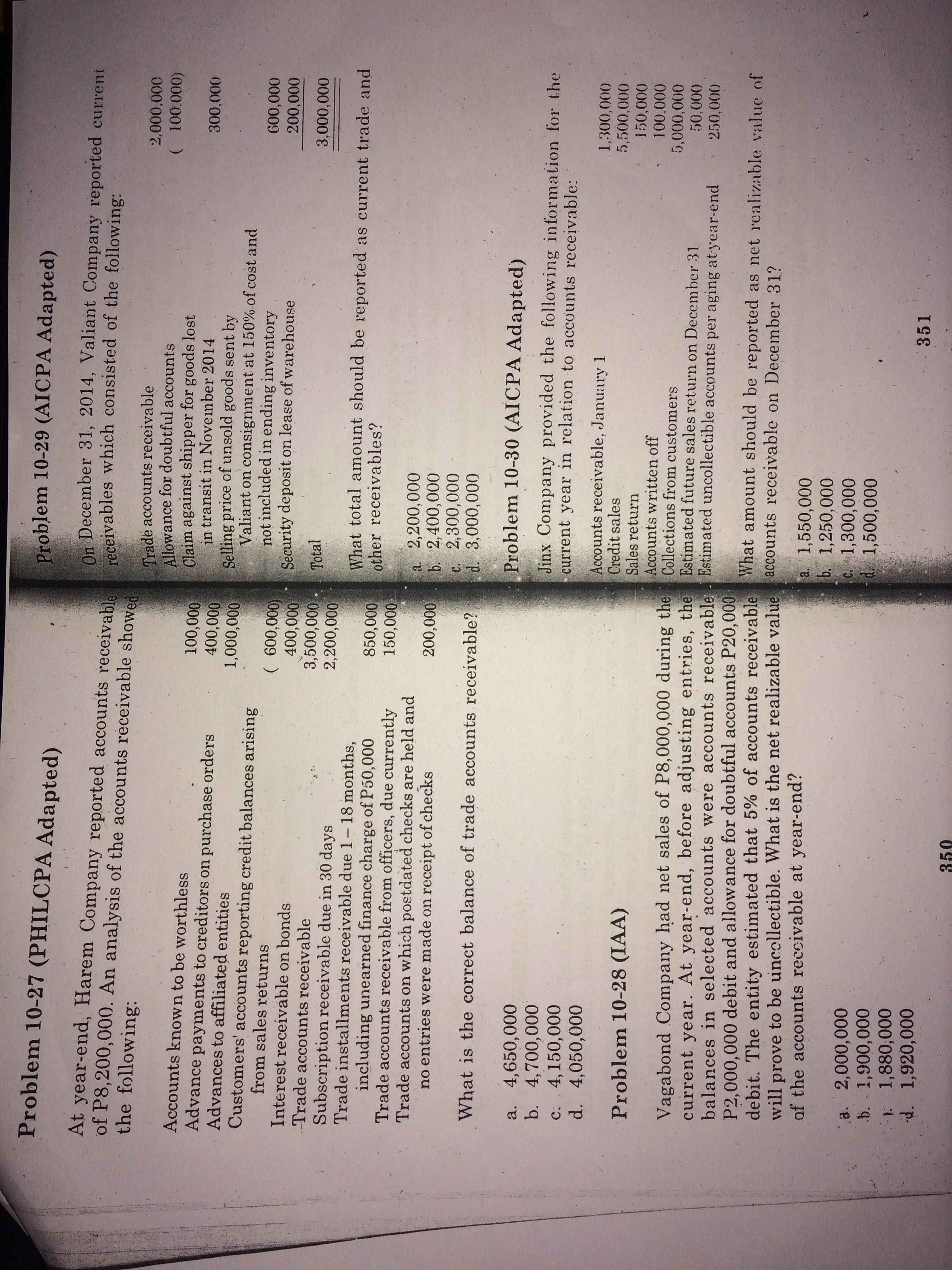

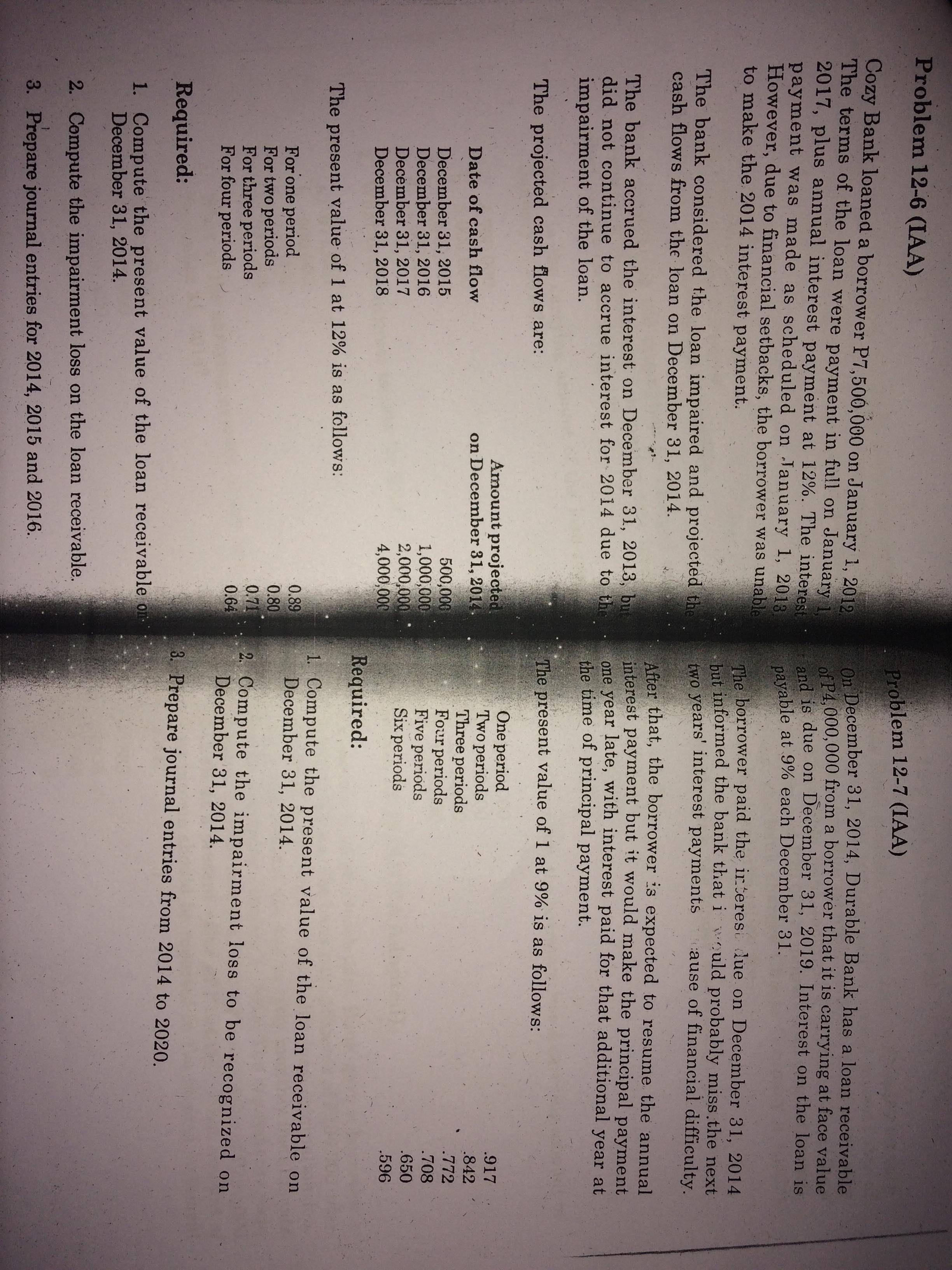

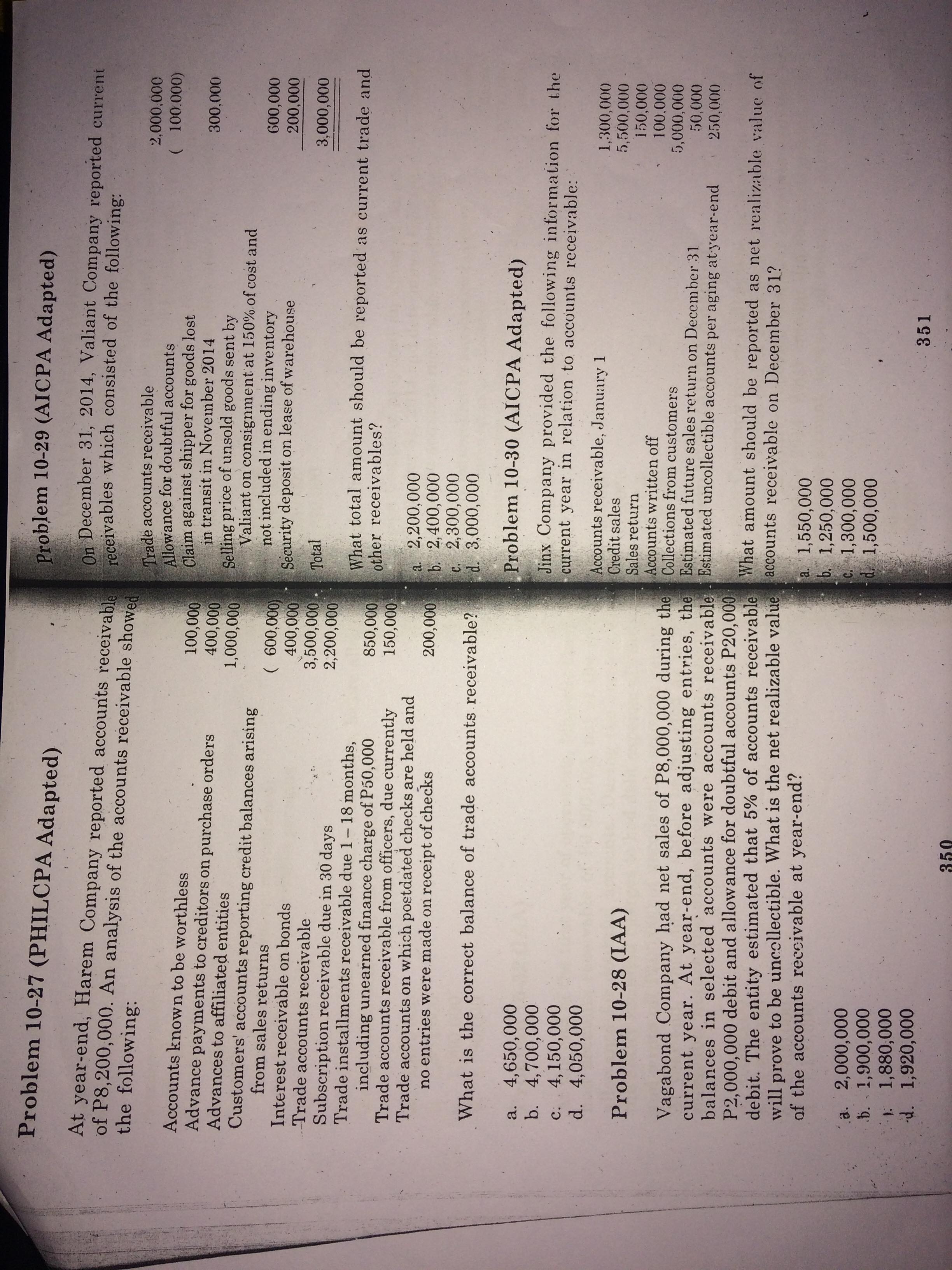

Hi Required: Problem 12-6 (IAA) impairment of the loan. December 31, 2014. For one period For two periods For four periods For three periods The projected cash flows are: December 31, 2016 December 31, 2015 December 31, 2017 December 31, 2018 Date of cash flow to make the 2014 interest payment. The present value of 1 at 12% is as follows: cash flows from the loan on December 31, 2014. 3. Prepare journal entries for 2014, 2015 and 2016. 2. Compute the impairment loss on the loan receivable. The terms of the loan were payment in full on January 1. Cozy Bank loaned a borrower P7,500,000 on January 1, 2012 However, due to financial setbacks, the borrower was unable payment was made as scheduled on January 1, 2013 2017, plus annual interest payment at 12%. The interest The bank considered the loan impaired and projected the The bank accrued the interest on December 31, 2013, but did not continue to accrue interest for 2014 due to the Compute the present value of the loan receivable on. on December 31, 2014 Amount projected 4,000,000 2,000,000 1,000,000 500,000 0.89 0.80 0.71 Required: Six periods One period Two periods Five periods Four periods Problem 12-7 (IAA) Three periods December 31, 2014. December 31, 2014. the time of principal payment. two years' interest payments payable at 9% each December 31. The present value of 1 at 9% is as follows: 3. Prepare journal entries from 2014 to 2020. 0 .2. Compute the impairment loss to be recognized on and is due on December 31, 2019. Interest on the loan is 1. Compute the present value of the loan receivable on but informed the bank that i would probably miss.the next After that, the borrower is expected to resume the annual The borrower paid the interes due on December 31, 2014 interest payment but it would make the principal payment one year late, with interest paid for that additional year at On December 31, 2014, Durable Bank has a loan receivable of P4, 000,000 from a borrower that it is carrying at face value ause of financial difficulty. .596 .772 .842 650 708300, 000 GO0 , 000 200, 000 50.000 150, 00 0 $2, 000. 00 0 250, 0.0 0 3,000, 000 100.000 ( 100: 000) $3 , 00.0, 0010 1 , : 300, 000 5 , 500, 000 On December 31 , 2014 , Valiant Company reported current What total amount should be reported as current trade and Jinx Company provided the following information for the What amount should be reported as net realizable value of "35 1 current year in relation to accounts receivable :` receivables which consisted of the following : { Estimated uncollectible accounts per aging at- year-end Valiant on consignment . at 150% of cost and Problem 10 - 29 ( AICPA Adapted ) Estimated future sales return on December 3 1 Problem 10 - 30 ( AICPA Adapted ) \\accounts receivable on December 31 ?` not included in ending inventory Security deposit on lease of warehouse Claim against shipper for goods lost Selling price of unsold goods sent by in transit in November 2014 Allowance for doubtful accounts Accounts receivable , January ] Trade accounts receivable _Collections from customers other receivables ? Account's written off 2 , 200, 000 2 , 400 , 000 3.000 , 000 \\2, 300 , 000 1 , 550 , 000 1 , 250 , 000 C .` 1 , 300, 000 |2 . 1 , 500 , 000 Credit sales Sales return \\Total \\6. C .` \\2 .` 100, 000 3, 500 , 000* - 850, 000* 150 , 000 400 , 000 600 , 000 400 , 000 200 , 000 1 , 000 , 000 2 , 200 , 000 balances in selected accounts were accounts receivable . Vagabond Company had net sales of $8, 000, 000 during the current year . At year-end , before adjusting entries , the* debit . The entity estimated that 5% of accounts receivable* will prove to be uncollectible . What is the net realizable value P 2 , 000, 000 debit and allowance for doubtful accounts P 20 , 000 At year -end , Harem Company reported accounts receivable* of P8 , 200, 000 . An analysis of the accounts receivable showed What is the correct balance of trade accounts receivable ? Trade accounts on which postdated checks are held and Trade accounts receivable from officers , due currently Customers' accounts reporting credit balances arising including unearned finance charge of $50 , 000 Advance payments to creditors on purchase orders no entries were made on receipt of checks Trade installments receivable due 1 - 18 months , Problem 10 - 27 ( PHIL CPA Adapted ) of the accounts receivable at year -end ?` Subscription receivable due in 30 days Accounts known to be worthless Advances to affiliated entities Problem 10 - 28 ( IAA ) Interest receivable on bonds from sales returns Trade accounts receivable* 4, 650, 000 1 , 920 , 000 4 , 700 , 000 1 , 880, 000 4 , 150 , 000 2 , 000 , 000 1 , 900 , 000 d. 4, 050 , 000 the following : C . a . $D . `