Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the Exercise 2 more important if you can Exercise 1&3 also Thx Business Finance Chapter 10 Exercises ***Please show all computations to receive

Please answer the Exercise 2 more important if you can Exercise 1&3 also Thx

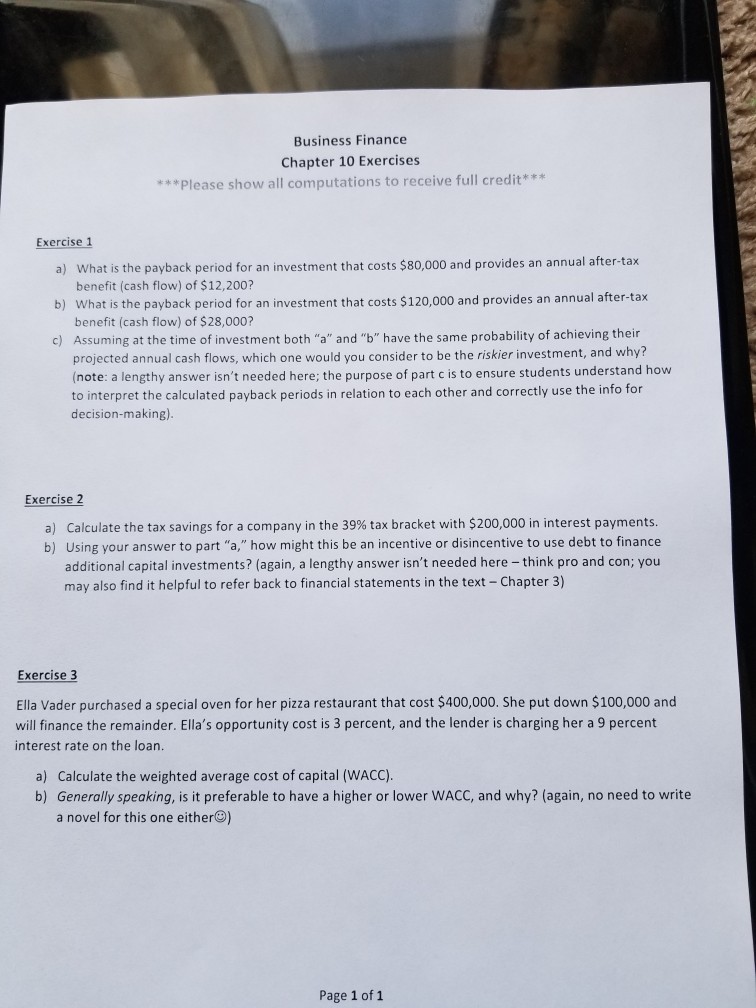

Business Finance Chapter 10 Exercises ***Please show all computations to receive full credit*** Exercise 1 a) What is the payback period for an investment that costs $80,000 and provides an annual after-tax b) What is the payback period for an investment that costs $120,000 and provides an annual after-tax c) Assuming at the time of investment both "a" and "b" have the same probability of achieving their benefit (cash flow) of $12,200? benefit (cash flow) of $28,000? projected annual cash flows, which one would you consider to be the riskier investment, and why? (note: a lengthy answer isn't needed here; the purpose of part c is to ensure students understand how to interpret the calculated payback periods in relation to each other and correctly use the info for decision-making) Exercise 2 a) Calculate the tax savings for a company in the 39% tax bracket with $200,000 in interest payments. b) Using your answer to part "a," how might this be an incentive or disincentive to use debt to finance additional capital investments? (again, a lengthy answer isn't needed here - think pro and con; you may also find it helpful to refer back to financial statements in the text - Chapter 3) Exercise 3 Ella Vader purchased a special oven for her pizza restaurant that cost $400,000. She put down $100,000 and will finance the remainder. Ella's opportunity cost is 3 percent, and the lender is charging her a 9 percent interest rate on the loan a) Calculate the weighted average cost of capital (WACC). b) Generally speaking, is it preferable to have a higher or lower WACC, and why? (again, no need to write a novel for this one either@) Page 1 of 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started