please answer the exercises and be very specific please. thank you

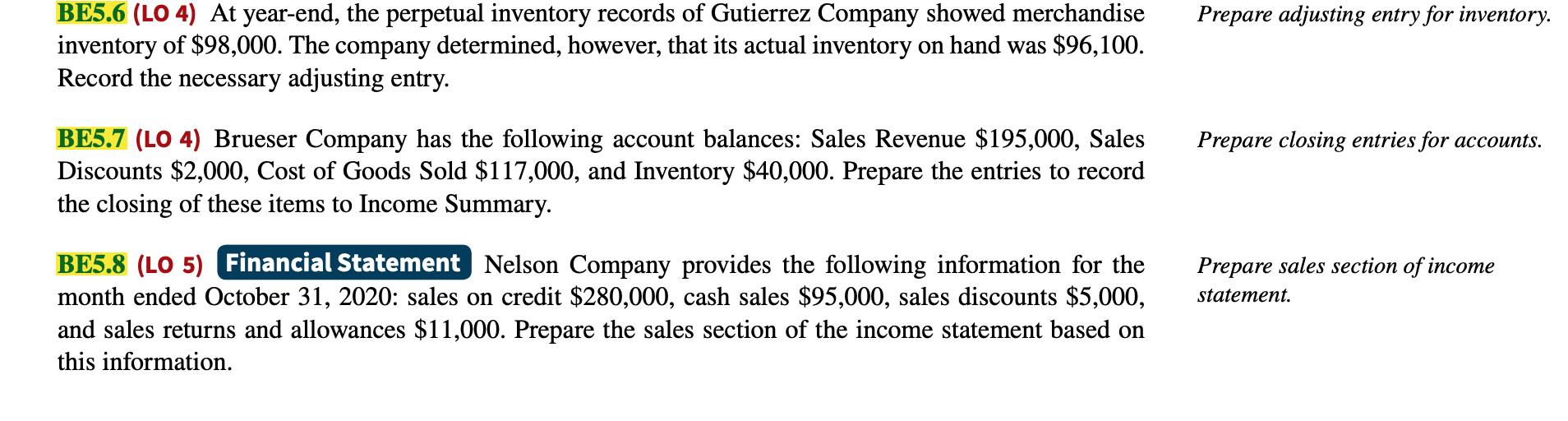

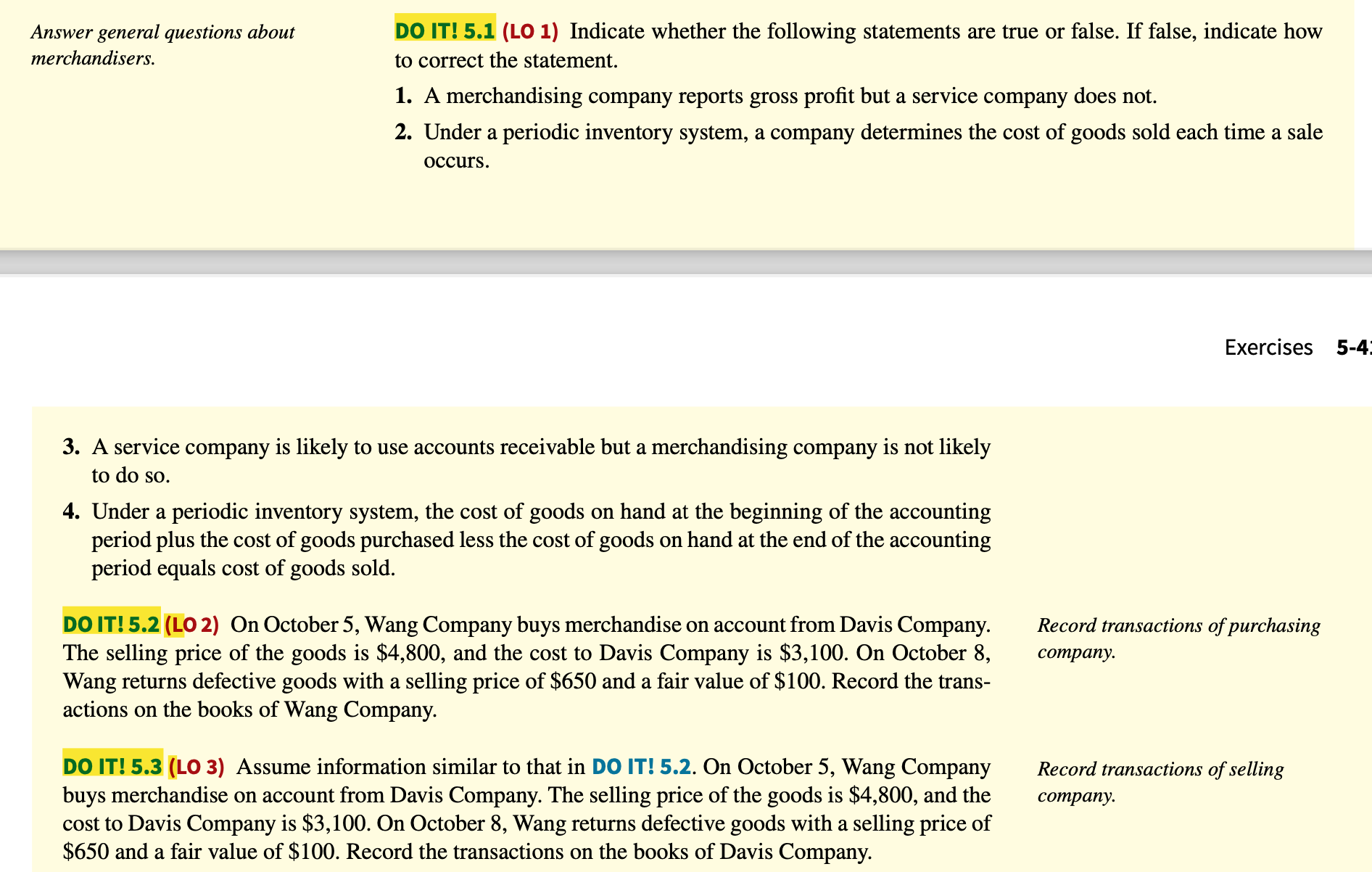

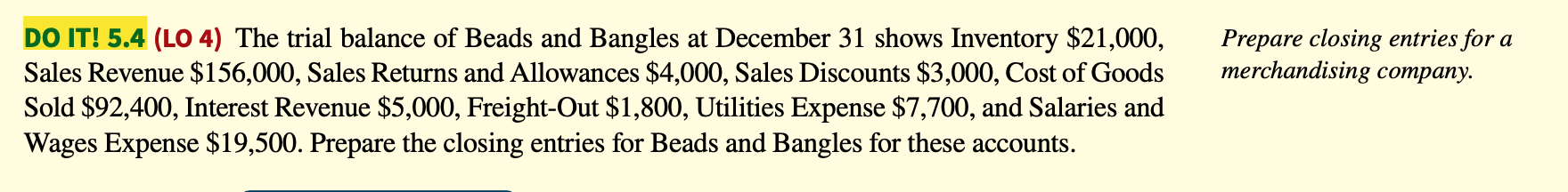

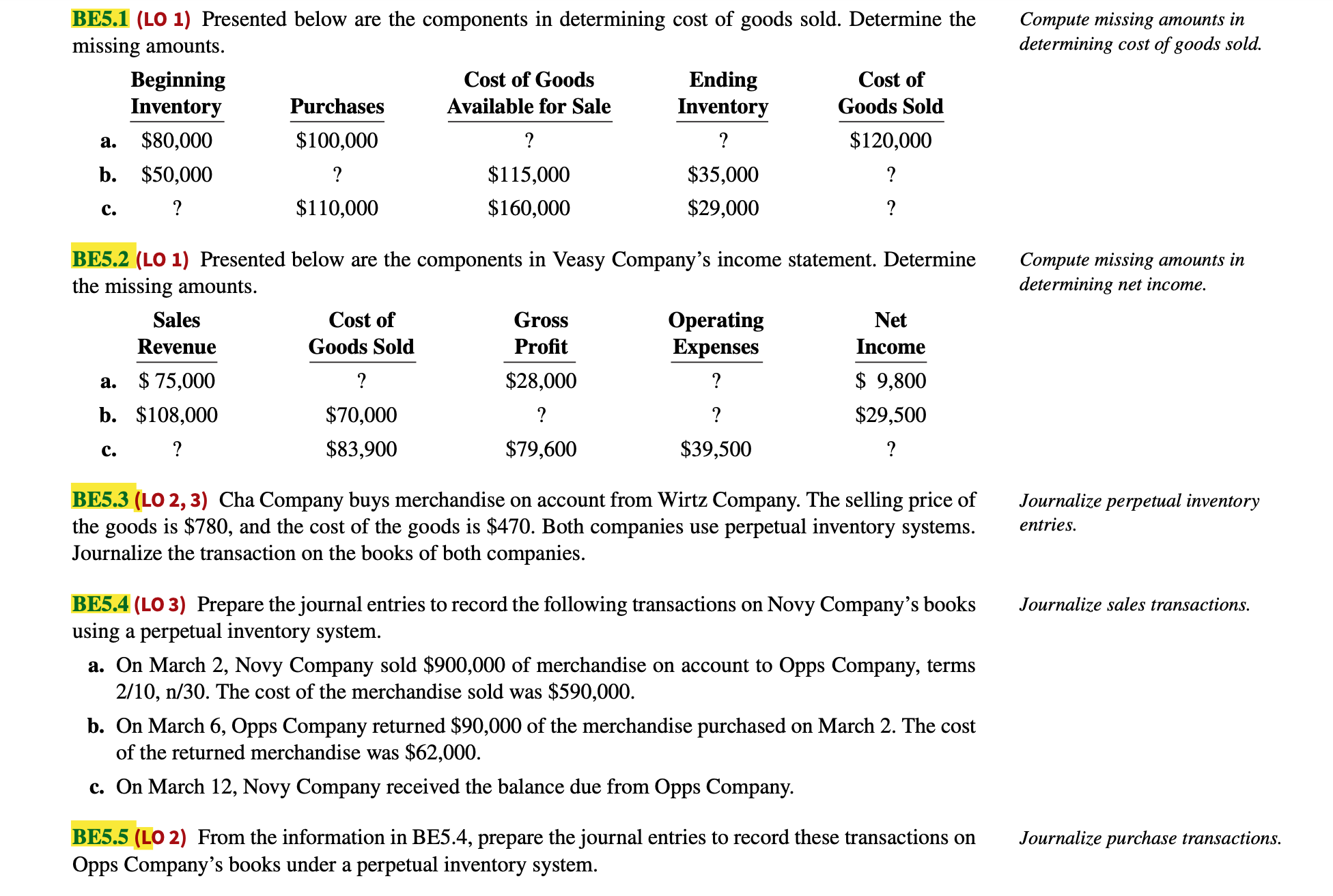

BE5.1 (LO 1) Presented below are the components in determining cost of goods sold. Determine the missing amounts. Beginning Cost of Goods Ending Cost of Inventory Purchases Available for Sale Inventory Goods Sold a. $80,000 $100,000 ? ? $120,000 b. $50,000 7 $115,000 $35,000 ? c. ? $110,000 $160,000 $29,000 ? BE5.2 (LO 1) Presented below are the components in Veasy Company's income statement. Determine the missing amounts. Sales Cost of Gross Operating Net Revenue Goods Sold Prot Expenses Income a. $75,000 ? $28,000 ? $ 9,800 b. $108,000 $70,000 ? ? $29,500 c. ? $83,900 $79,600 $39,500 ? BESS (LO 2, 3) Cha Company buys merchandise on account from Wirtz Company. The selling price of the goods is $780, and the cost of the goods is $470. Both companies use perpetual inventory systems. Journalize the transaction on the books of both companies. BESA (L0 3) Prepare the journal entries to record the following transactions on Novy Company's books using a perpetual inventory system. a. On March 2, Novy Company sold $900,000 of merchandise on account to Opps Company, terms 2/10, n/30. The cost of the merchandise sold was $590,000. b. On March 6, Opps Company returned $90,000 of the merchandise purchased on March 2. The cost of the returned merchandise was $62,000. c. On March 12, Novy Company received the balance due from Opps Company. BE5.5 (LO 2) From the information in BE5.4, prepare the journal entries to record these transactions on Opps Company's books under a perpetual inventory system. Compute missing amounts in determining cost of goods sold. Compute missing amounts in determining net income. Journalize perpetual inventory entries. Journalize sales transactions. Journalize purchase transactions. BE5.6 (LO 4) At year-end, the perpetual inventory records of Gutierrez Company showed merchandise inventory of $98,000, The company determined, however, that its actual inventory on hand was $96,100. Record the necessary adjusting entry. BE5.7 (L0 4) Brueser Company has the following account balances: Sales Revenue $195,000, Sales Discounts $2,000, Cost of Goods Sold $117,000, and Inventory $40,000. Prepare the entries to record the closing of these items to Income Summary. BE5.8 (LO 5) Nelson Company provides the following information for the month ended October 31, 2020: sales on credit $280,000, cash sales $95,000, sales discounts $5,000, and sales returns and allowances $11,000. Prepare the sales section of the income statement based on this information. Prepare adjusting entry for inventory. Prepare closing entries for accounts. Prepare sales section of income statement. Answer general questions about DO IT! 5.1 (L0 1) Indicate whether the following statements are true or false. If false, indicate how merchandisers. to correct the statement. 1. A merchandising company reports gross prot but a service company does not. 2. Under a periodic inventory system, a company determines the cost of goods sold each time a sale OCCUIS . 3. A service company is likely to use accounts receivable but a merchandising company is not likely to do so. 4. Under a periodic inventory system, the cost of goods on hand at the beginning of the accounting period plus the cost of goods purchased less the cost of goods on hand at the end of the accounting period equals cost of goods sold. DO IT! 5.2 (L0 2) On October 5, Wang Company buys merchandise on account from Davis Company. The selling price of the goods is $4,800, and the cost to Davis Company is $3,100. On October 8, Wang returns defective goods with a selling price of $650 and a fair value of $100. Record the trans- actions on the books of Wang Company. DO IT! 5.3 (L0 3) Assume information similar to that in DO IT! 5.2. On October 5, Wang Company buys merchandise on account from Davis Company. The selling price of the goods is $4,800, and the cost to Davis Company is $3,100. On October 8, Wang returns defective goods with a selling price of $650 and a fair value of $100. Record the transactions on the books of Davis Company. Exercises 5-4: Record transactions of purchasing company. Record transactions of selling company. DO IT! 5.4 (LO 4) The trial balance of Beads and Bangles at December 31 shows Inventory $21,000, Prepare closing entries for a Sales Revenue $156,000, Sales Returns and Allowances $4,000, Sales Discounts $3,000, Cost of Goods merchandising company. Sold $92,400, Interest Revenue $5,000, Freight-Out $1,800, Utilities Expense $7,700, and Salaries and Wages Expense $19,500. Prepare the closing entries for Beads and Bangles for these accounts