Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the exercises in the following answer format . please follow the exact answer format EXERCISE: Beginning Inventory 817 units 66% complete in Materials

please answer the exercises in the following answer format . please follow the exact answer format

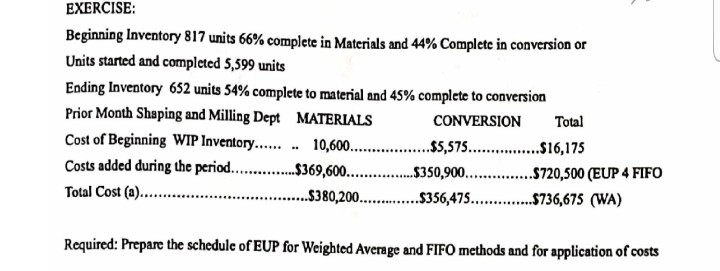

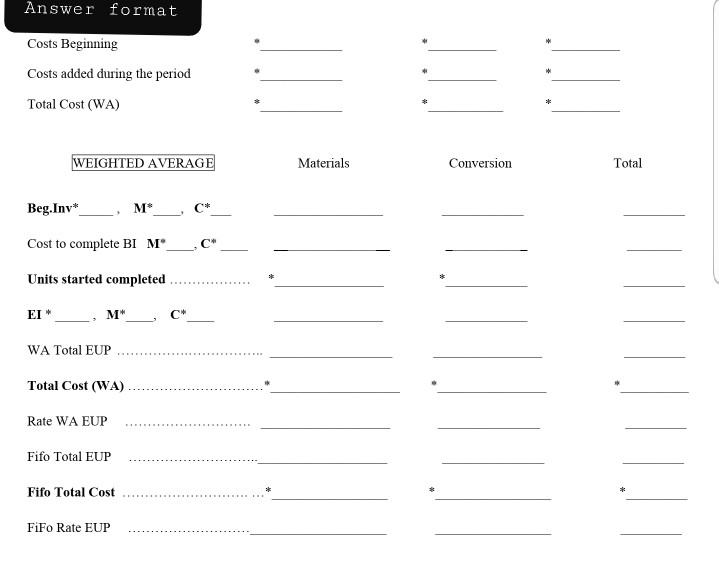

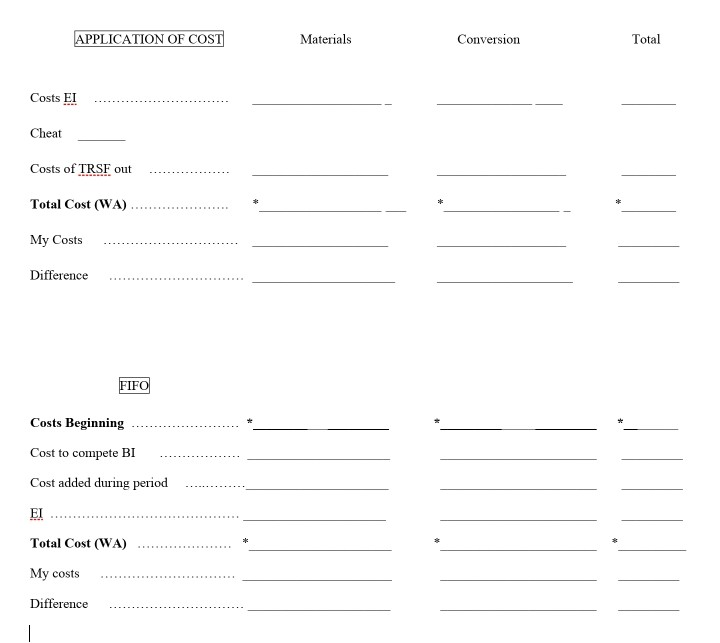

EXERCISE: Beginning Inventory 817 units 66% complete in Materials and 44% Complete in conversion or Units started and completed 5,599 units Ending Inventory 652 units 54% complete to material and 45% complete to conversion Prior Month Shaping and Milling Dept MATERIALS CONVERSION Total Cost of Beginning WIP Inventory.... 10,600...............$5,575..............916,175 Costs added during the period...... ...$369,600...............$350,900..............S720,500 (EUP 4 FIFO Total Cost (a)..... ..$380,200.............5356,475...............736,675 (WA) Required: Prepare the schedule of EUP for Weighted Average and FIFO methods and for application of costs Answer format Costs Beginning Costs added during the period Total Cost (WA) WEIGHTED AVERAGE Materials Conversion Total Beg.Iny* M C* Cost to complete BI M" Units started completed EI M" WA Total EUP Total Cost (WA) Rate WA EUP Fifo Total EUP Fifo Total Cost FiFo Rate EUP APPLICATION OF COST Materials Conversion Total Costs EI Cheat Costs of TRSF out Total Cost (WA) My Costs Difference FIFO Costs Beginning Cost to compete BI Cost added during period EI Total Cost (WA) My costs Difference

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started