Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the first question A proposed project is expected to generate annual revenues of $70,000 a year, the first year's revenue is expected to

please answer the first question

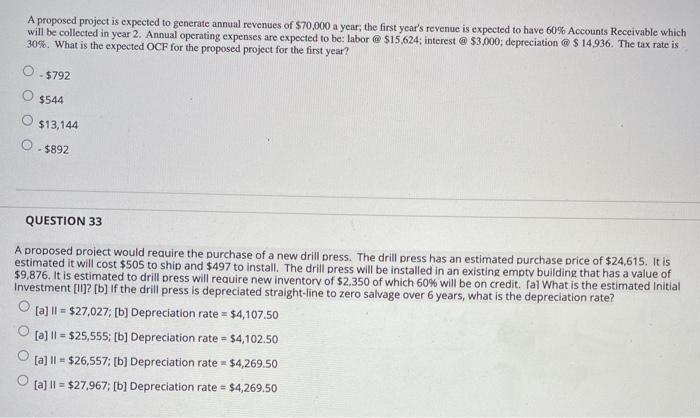

A proposed project is expected to generate annual revenues of $70,000 a year, the first year's revenue is expected to have 60% Accounts Receivable which will be collected in year 2. Annual operating expenses are expected to be: labor @ $15,624interest @ $3.000; depreciation $ 14,936. The tax rate is 30%. What is the expected OCF for the proposed project for the first year? - $792 $544 $13,144 - $892 QUESTION 33 A proposed project would require the purchase of a new drill press. The drill press has an estimated purchase price of $24,615. It is estimated it will cost $505 to ship and $497 to install. The drill press will be installed in an existing empty building that has a value of $9.876. It is estimated to drill press will require new inventory of $2.350 of which 60% will be on credit. fal What is the estimated Initial Investment (U? [b] If the drill press is depreciated straight-line to zero salvage over 6 years, what is the depreciation rate? [a] || = $27,027; [b] Depreciation rate = $4,107.50 [a] || = $25,555; [b] Depreciation rate = $4,102.50 [a] II - $26,557; (b) Depreciation rate = $4,269.50 [a] Il = $27,967; (b) Depreciation rate = $4,269.50 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started