Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the first three bullet points of both question 2 and 3 2. (15 points) Stock brokers assign probabilities to stock prices. Suppose that

Please answer the first three bullet points of both question 2 and 3

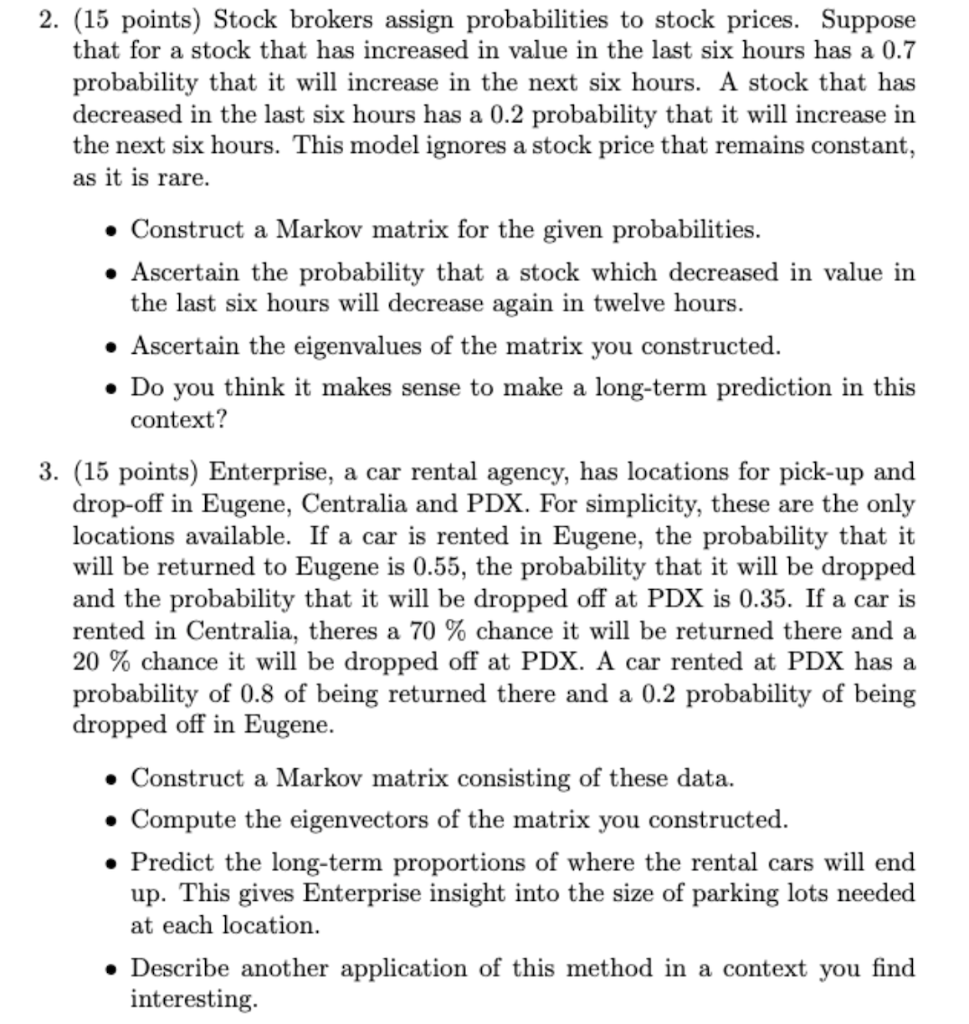

2. (15 points) Stock brokers assign probabilities to stock prices. Suppose that for a stock that has increased in value in the last six hours has a 0.7 probability that it will increase in the next six hours. A stock that has decreased in the last six hours has a 0.2 probability that it will increase in the next six hours. This model ignores a stock price that remains constant, as it is rare. Construct a Markov matrix for the given probabilities. Ascertain the probability that a stock which decreased in value in the last six hours will decrease again in twelve hours. Ascertain the eigenvalues of the matrix you constructed. Do you think it makes sense to make a long-term prediction in this context? 3. (15 points) Enterprise, a car rental agency, has locations for pick-up and drop-off in Eugene, Centralia and PDX. For simplicity, these are the only locations available. If a car is rented in Eugene, the probability that it will be returned to Eugene is 0.55, the probability that it will be dropped and the probability that it will be dropped off at PDX is 0.35. If a car is rented in Centralia, theres a 70 % chance it will be returned there and a 20 % chance it will be dropped off at PDX. A car rented at PDX has a probability of 0.8 of being returned there and a 0.2 probability of being dropped off in Eugene. Construct a Markov matrix consisting of these data. Compute the eigenvectors of the matrix you constructed. Predict the long-term proportions of where the rental cars will end up. This gives Enterprise insight into the size of parking lots needed at each location. Describe another application of this method in a context you find interesting. 2. (15 points) Stock brokers assign probabilities to stock prices. Suppose that for a stock that has increased in value in the last six hours has a 0.7 probability that it will increase in the next six hours. A stock that has decreased in the last six hours has a 0.2 probability that it will increase in the next six hours. This model ignores a stock price that remains constant, as it is rare. Construct a Markov matrix for the given probabilities. Ascertain the probability that a stock which decreased in value in the last six hours will decrease again in twelve hours. Ascertain the eigenvalues of the matrix you constructed. Do you think it makes sense to make a long-term prediction in this context? 3. (15 points) Enterprise, a car rental agency, has locations for pick-up and drop-off in Eugene, Centralia and PDX. For simplicity, these are the only locations available. If a car is rented in Eugene, the probability that it will be returned to Eugene is 0.55, the probability that it will be dropped and the probability that it will be dropped off at PDX is 0.35. If a car is rented in Centralia, theres a 70 % chance it will be returned there and a 20 % chance it will be dropped off at PDX. A car rented at PDX has a probability of 0.8 of being returned there and a 0.2 probability of being dropped off in Eugene. Construct a Markov matrix consisting of these data. Compute the eigenvectors of the matrix you constructed. Predict the long-term proportions of where the rental cars will end up. This gives Enterprise insight into the size of parking lots needed at each location. Describe another application of this method in a context you find interestingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started