Question: please answer the followign question right, Chris Pike is divorced and has full custody of his two children: 1 9 year old Hemmer and 1

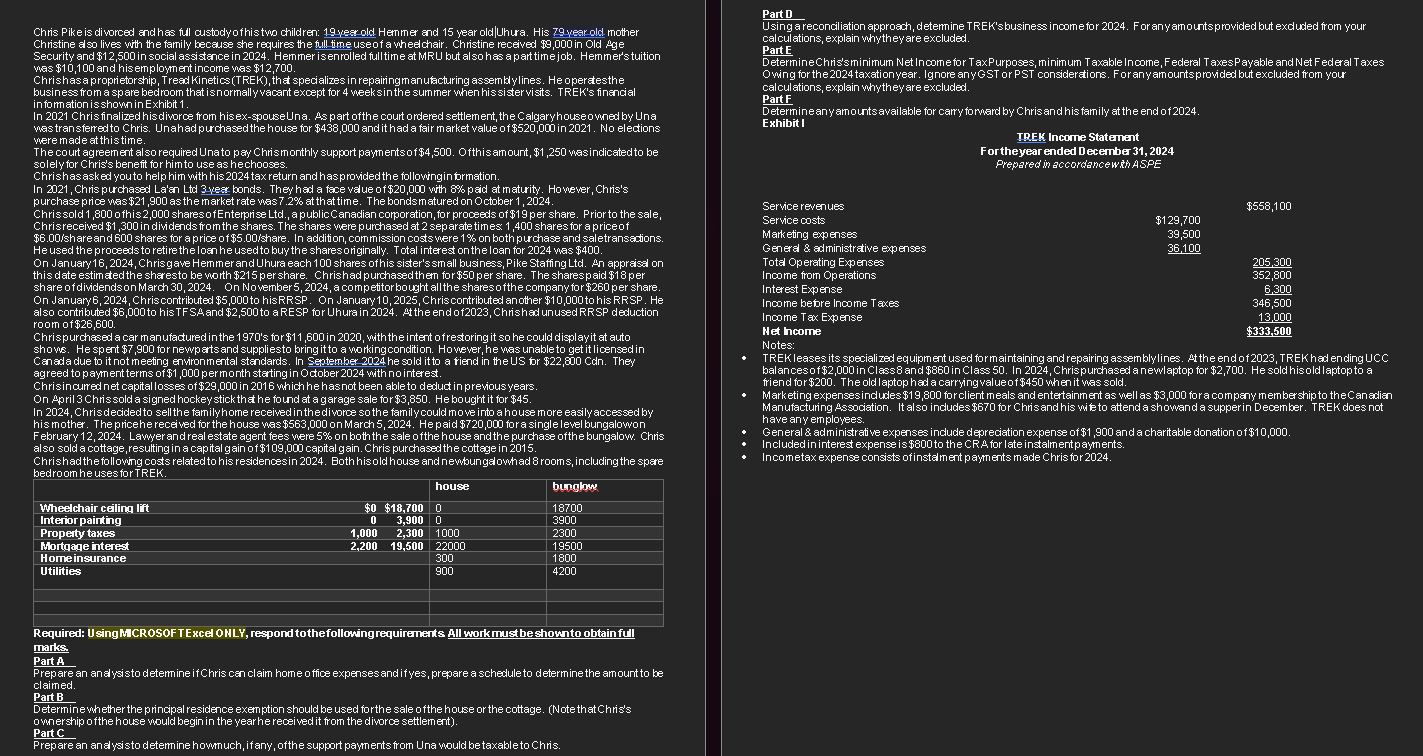

please answer the followign question right, Chris Pike is divorced and has full custody of his two children: year old Hemmer and year old Uhura. His year old mother Christine also lives with the family because she requires the full time use of a wheelchair. Christine received $ in Old Age Security and $ in social assistance in Hemmer is enrolled full time at MRU but also has a part time job. Hemmers tuition was $ and his employment income was $ Chris has a proprietorship, Tread Kinetics TREK that specializes in repairing manufacturing assembly lines. He operates the business from a spare bedroom that is normally vacant except for weeks in the summer when his sister visits. TREKs financial information is shown in Exhibit In Chris finalized his divorce from his exspouse Una. As part of the court ordered settlement, the Calgary house owned by Una was transferred to Chris. Una had purchased the house for $ and it had a fair market value of $ in No elections were made at this time. The court agreement also required Una to pay Chris monthly support payments of $ Of this amount, $ was indicated to be solely for Chriss benefit for him to use as he chooses. Chris has asked you to help him with his tax return and has provided the following information. In Chris purchased Laan Ltd year bonds. They had a face value of $ with paid at maturity. However, Chriss purchase price was $ as the market rate was at that time. The bonds matured on October Chris sold of his shares of Enterprise Ltd a public Canadian corporation, for proceeds of $ per share. Prior to the sale, Chris received $ in dividends from the shares. The shares were purchased at separate times: shares for a price of $share and shares for a price of $share In addition, commission costs were on both purchase and sale transactions. He used the proceeds to retire the loan he used to buy the shares originally. Total interest on the loan for was $ On January Chris gave Hemmer and Uhura each shares of his sisters small business, Pike Staffing Ltd An appraisal on this date estimated the shares to be worth $ per share. Chris had purchased them for $ per share. The shares paid $ per share of dividends on March On November a competitor bought all the shares of the company for $ per share. On January Chris contributed $ to his RRSP On January Chris contributed another $ to his RRSP He also contributed $ to his TFSA and $ to a RESP for Uhura in At the end of Chris had unused RRSP deduction room of $ Chris purchased a car manufactured in the s for $ in with the intent of restoring it so he could display it at auto shows. He spent $ for new parts and supplies to bring it to a working condition. However, he was unable to get it licensed in Canada due to it not meeting environmental standards. In September he sold it to a friend in the US for $ Cdn They agreed to payment terms of $ per month starting in October with no interest. Chris incurred net capital losses of $ in which he has not been able to deduct in previous years. On April Chris sold a signed hockey stick that he found at a garage sale for $ He bought it for $ In Chris decided to sell the family home received in the divorce so the family could move into a house more easily accessed by his mother. The price he received for the house was $ on March He paid $ for a single level bungalow on February Lawyer and real estate agent fees were on both the sale of the house and the purchase of the bungalow. Chris also sold a cottage resulting in a capital gain of $ capital gain. Chris purchased the cottage in Chris had the following costs related to his residences in Both his old house and new bungalow had rooms, including the spare bedroom he uses for TREK. house bunglow Wheelchair ceiling lift $ $ Interior painting Property taxes Mortgage interest Home insurance Utilities see scrreshooot

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock