Question: Please answer the following: 14-29 Behavioral Considerations and Continuous-Improvement Standards At a recent seminar you attended, the invited speaker was discussing some of the advantages

Please answer the following:

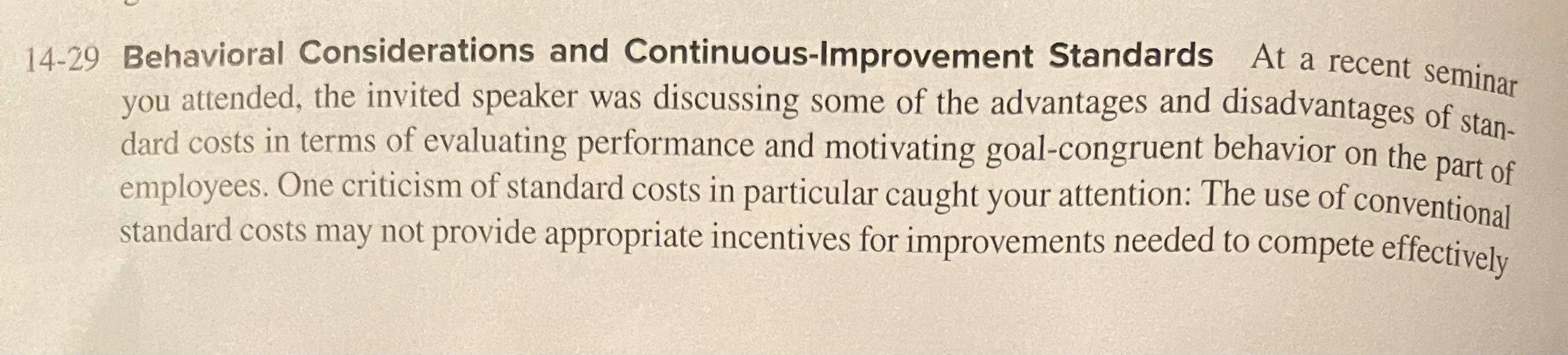

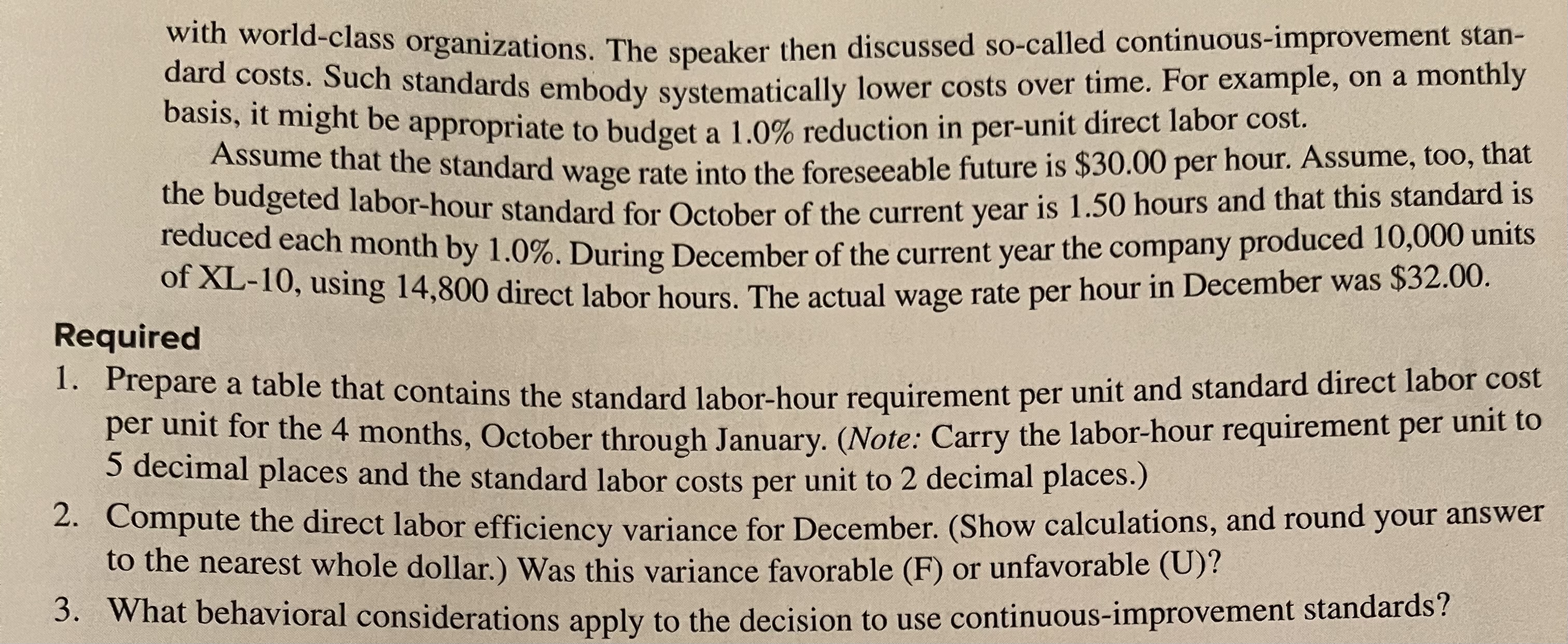

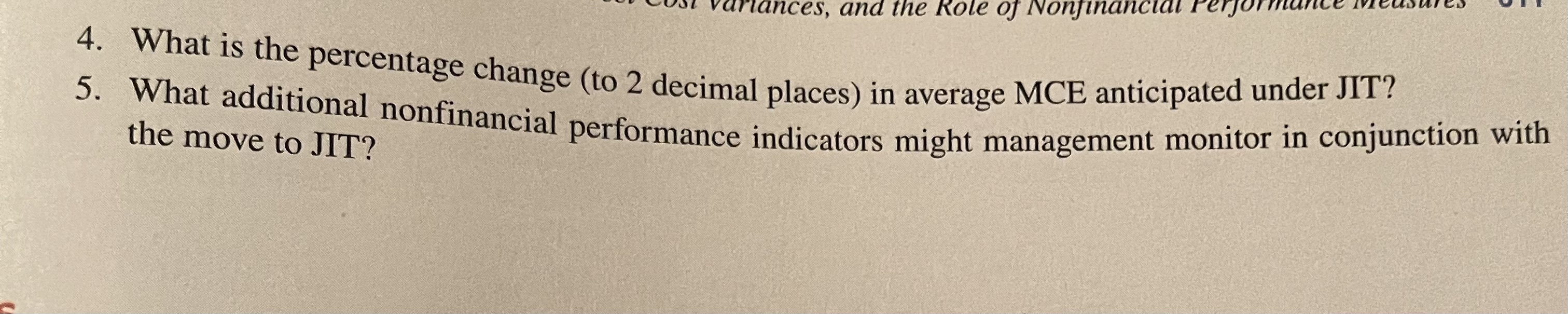

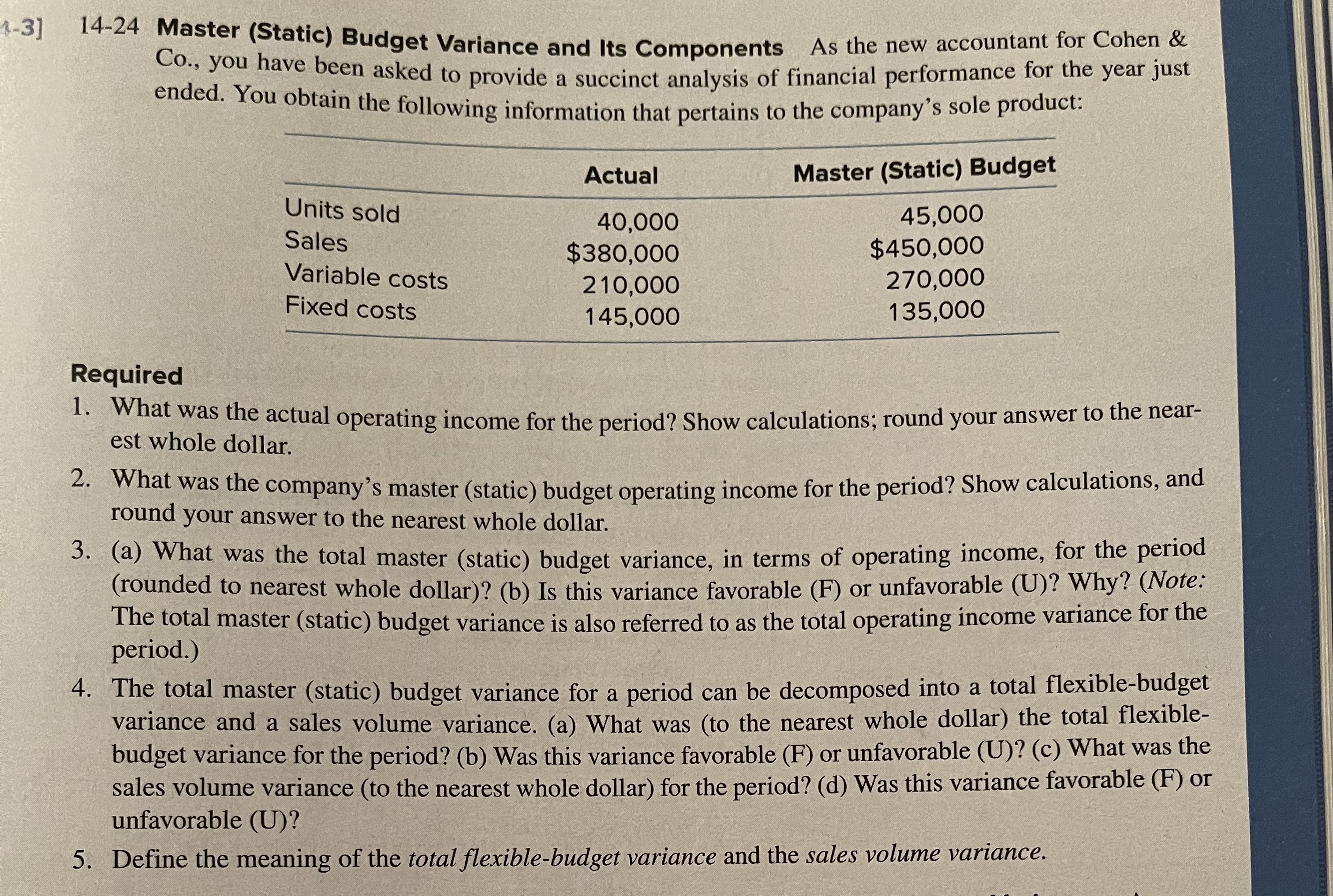

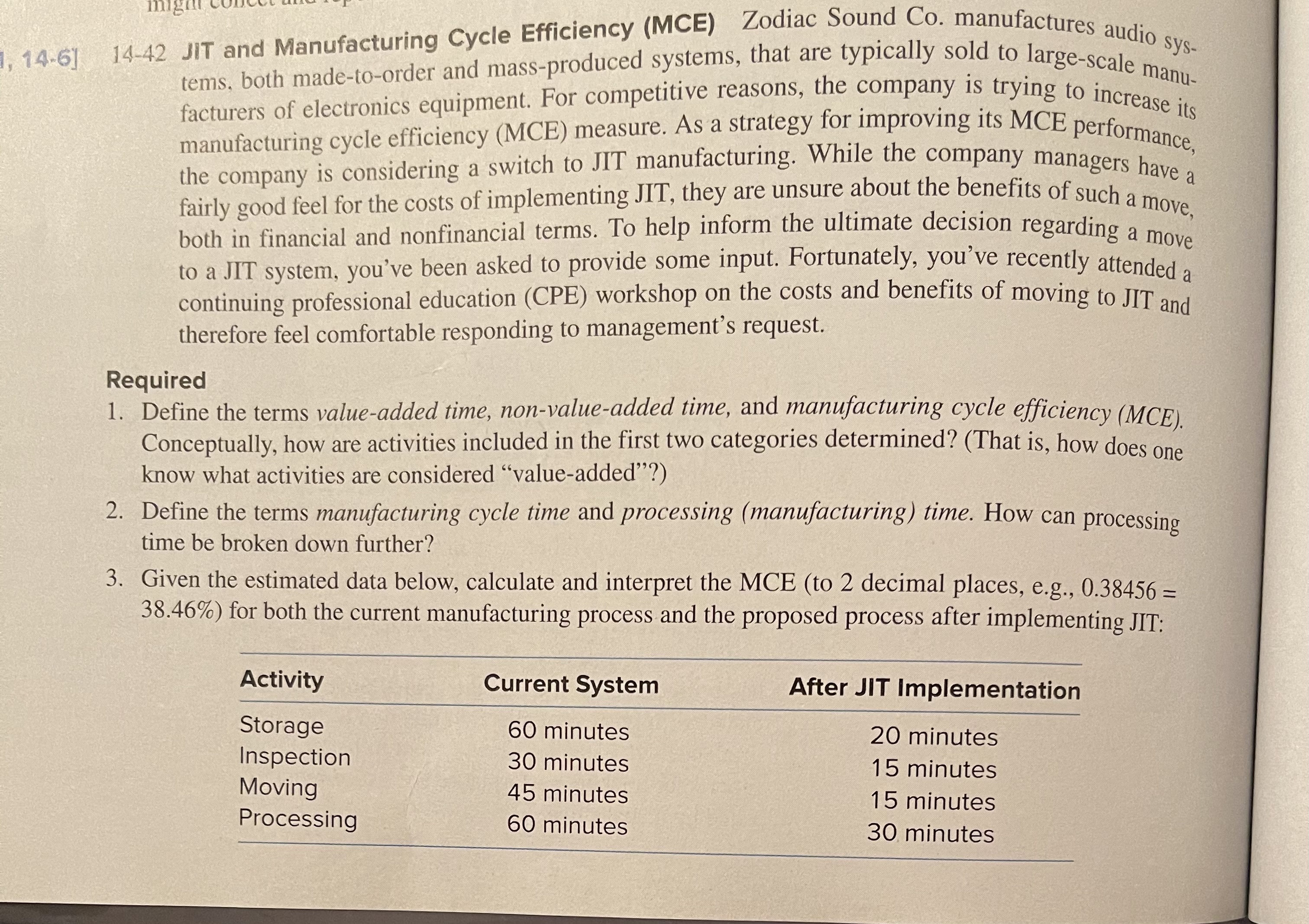

14-29 Behavioral Considerations and Continuous-Improvement Standards At a recent seminar you attended, the invited speaker was discussing some of the advantages and disadvantages of stan- dard costs in terms of evaluating performance and motivating goal-congruent behavior on the part of employees. One criticism of standard costs in particular caught your attention: The use of conventional standard costs may not provide appropriate incentives for improvements needed to compete effectivelywith world-class organizations. The speaker then discussed so-called continuous-improvement stan- dard costs. Such standards embody systematically lower costs over time. For example, on a monthly basis, it might be appropriate to budget a 1.0% reduction in per-unit direct labor cost. Assume that the standard wage rate into the foreseeable future is $30.00 per hour. Assume, too, that the budgeted labor-hour standard for October of the current year is 1.50 hours and that this standard is reduced each month by 1.0%. During December of the current year the company produced 10,000 units of XL-10, using 14,800 direct labor hours. The actual wage rate per hour in December was $32.00. Required 1. Prepare a table that contains the standard labor-hour requirement per unit and standard direct labor cost per unit for the 4 months, October through January. (Note: Carry the labor-hour requirement per unit to 5 decimal places and the standard labor costs per unit to 2 decimal places.) 2. Compute the direct labor efficiency variance for December. (Show calculations, and round your answer to the nearest whole dollar.) Was this variance favorable (F) or unfavorable (U)? 3. What behavioral considerations apply to the decision to use continuous-improvement standards?ariances, and the Role of Nonfinancial Perjo 4. What is the percentage change (to 2 decimal places) in average MCE anticipated under JIT? 5. What additional nonfinancial performance indicators might management monitor in conjunction with the move to JIT?1-3] 14-24 Master (Static) Budget Variance and Its Components As the new accountant for Cohen & Co., you have been asked to provide a succinct analysis of financial performance for the year just ended. You obtain the following information that pertains to the company's sole product: Actual Master (Static) Budget Units sold 40,000 45,000 Sales $380,000 $450,000 Variable costs 210,000 270,000 Fixed costs 145,000 135,000 Required 1. What was the actual operating income for the period? Show calculations; round your answer to the near- est whole dollar. 2. What was the company's master (static) budget operating income for the period? Show calculations, and round your answer to the nearest whole dollar. 3. (a) What was the total master (static) budget variance, in terms of operating income, for the period (rounded to nearest whole dollar)? (b) Is this variance favorable (F) or unfavorable (U)? Why? (Note: The total master (static) budget variance is also referred to as the total operating income variance for the period.) 4. The total master (static) budget variance for a period can be decomposed into a total flexible-budget variance and a sales volume variance. (a) What was (to the nearest whole dollar) the total flexible- budget variance for the period? (b) Was this variance favorable (F) or unfavorable (U)? (c) What was the sales volume variance (to the nearest whole dollar) for the period? (d) Was this variance favorable (F) or unfavorable (U)? 5. Define the meaning of the total flexible-budget variance and the sales volume variance.14-61 14-42 JIT and Manufacturing Cycle Efficiency (MCE) Zodiac Sound Co. manufactures audio sys tems, both made-to-order and mass-produced systems, that are typically sold to large-scale many- facturers of electronics equipment. For competitive reasons, the company is trying to increase its manufacturing cycle efficiency (MCE) measure. As a strategy for improving its MCE performance, the company is considering a switch to JIT manufacturing. While the company managers have a fairly good feel for the costs of implementing JIT, they are unsure about the benefits of such a move, both in financial and nonfinancial terms. To help inform the ultimate decision regarding a move to a JIT system, you've been asked to provide some input. Fortunately, you've recently attended a continuing professional education (CPE) workshop on the costs and benefits of moving to JIT and therefore feel comfortable responding to management's request. Required 1. Define the terms value-added time, non-value-added time, and manufacturing cycle efficiency (MCE). Conceptually, how are activities included in the first two categories determined? (That is, how does one know what activities are considered "value-added"?) 2. Define the terms manufacturing cycle time and processing (manufacturing) time. How can processing time be broken down further? 3. Given the estimated data below, calculate and interpret the MCE (to 2 decimal places, e.g., 0.38456 = 38.46%) for both the current manufacturing process and the proposed process after implementing JIT: Activity Current System After JIT Implementation Storage 60 minutes 20 minutes Inspection 30 minutes 15 minutes Moving 45 minutes 15 minutes Processing 60 minutes 30 minutes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts