Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the following as soon as possible because I have exam ACCOUNTING INFORMATION SYSTEM Mr. Amjad is a retail merchandiser. The business sells different

please answer the following as soon as possible because I have exam

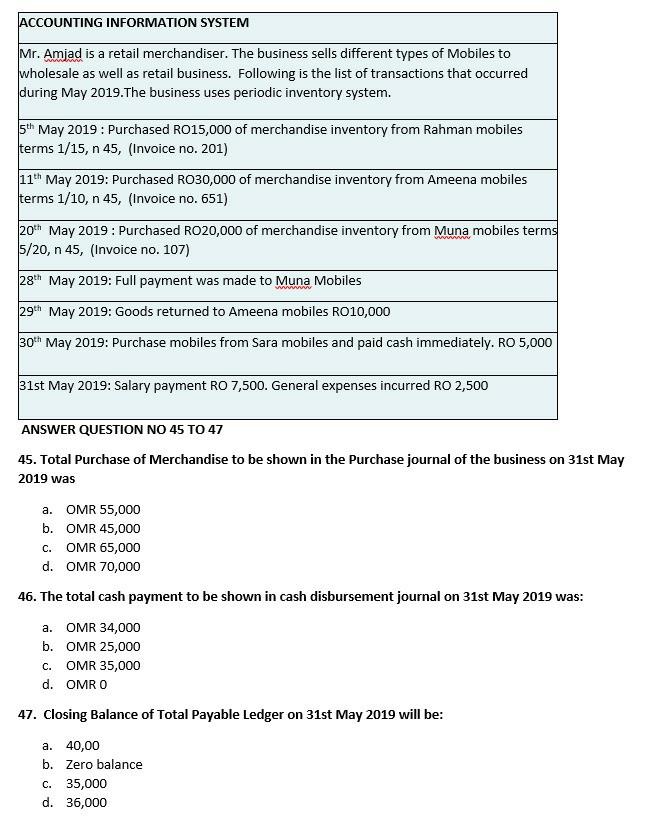

ACCOUNTING INFORMATION SYSTEM Mr. Amjad is a retail merchandiser. The business sells different types of Mobiles to wholesale as well as retail business. Following is the list of transactions that occurred during May 2019.The business uses periodic inventory system. 5th May 2019: Purchased RO15,000 of merchandise inventory from Rahman mobiles terms 1/15, n 45, (Invoice no. 201) 11th May 2019: Purchased RO30,000 of merchandise inventory from Ameena mobiles terms 1/10, n 45, (Invoice no. 651) 20th May 2019: Purchased RO20,000 of merchandise inventory from Muna mobiles terms 5/20, n 45, (Invoice no. 107) 28th May 2019: Full payment was made to Muna Mobiles 29th May 2019: Goods returned to Ameena mobiles RO10,000 30h May 2019: Purchase mobiles from Sara mobiles and paid cash immediately. RO 5,000 31st May 2019: Salary payment RO 7,500. General expenses incurred RO 2,500 ANSWER QUESTION NO 45 TO 47 45. Total Purchase of Merchandise to be shown in the Purchase journal of the business on 31st May 2019 was a. OMR 55,000 b. OMR 45,000 C. OMR 65,000 d. OMR 70,000 46. The total cash payment to be shown in cash disbursement journal on 31st May 2019 was: a. OMR 34,000 b. OMR 25,000 C. OMR 35,000 d. OMRO 47. Closing Balance of Total Payable Ledger on 31st May 2019 will be: a. 40,00 b. Zero balance c. 35,000 d. 36,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started