Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the following: Benefits of borrowing. Wilson Motors is looking to expand its operations by adding a second manufacturing location. If it is successful,

please answer the following:

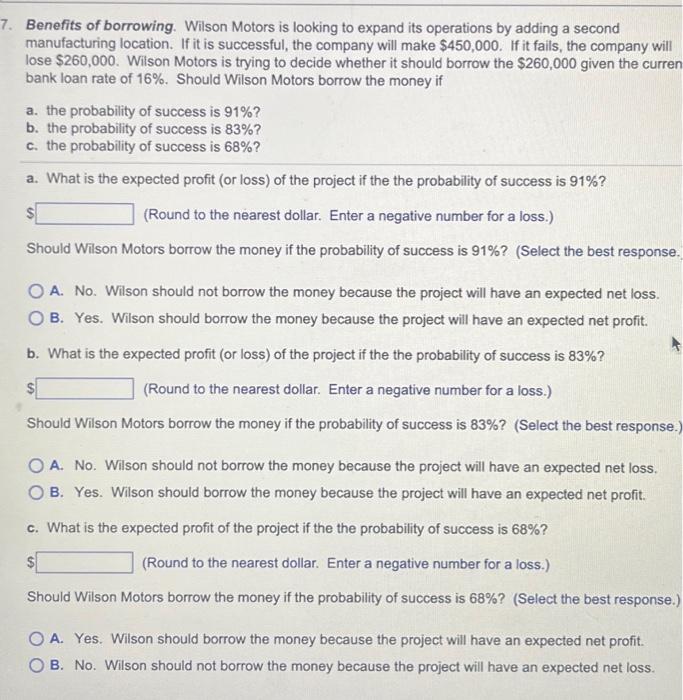

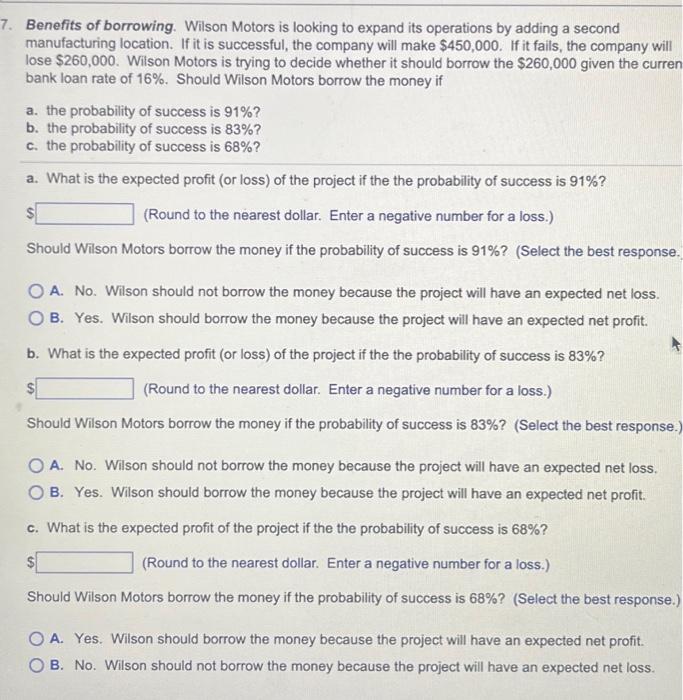

Benefits of borrowing. Wilson Motors is looking to expand its operations by adding a second manufacturing location. If it is successful, the company will make $450,000. If it fails, the company will lose $260,000. Wilson Motors is trying to decide whether it should borrow the $260,000 given the curren bank loan rate of 16%. Should Wilson Motors borrow the money if a. the probability of success is 91% ? b. the probability of success is 83% ? c. the probability of success is 68% ? a. What is the expected profit (or loss) of the project if the the probability of success is 91% ? (Round to the nearest dollar. Enter a negative number for a loss.) Should Wilson Motors borrow the money if the probability of success is 91%? (Select the best response. A. No. Wilson should not borrow the money because the project will have an expected net loss. B. Yes. Wilson should borrow the money because the project will have an expected net profit. b. What is the expected profit (or loss) of the project if the the probability of success is 83% ? (Round to the nearest dollar. Enter a negative number for a loss.) Should Wilson Motors borrow the money if the probability of success is 83% ? (Select the best response.) A. No. Wilson should not borrow the money because the project will have an expected net loss. B. Yes. Wilson should borrow the money because the project will have an expected net profit. c. What is the expected profit of the project if the the probability of success is 68% ? (Round to the nearest dollar. Enter a negative number for a loss.) Should Wilson Motors borrow the money if the probability of success is 68% ? (Select the best response.) A. Yes. Wilson should borrow the money because the project will have an expected net profit. B. No. Wilson should not borrow the money because the project will have an expected net loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started