Answered step by step

Verified Expert Solution

Question

1 Approved Answer

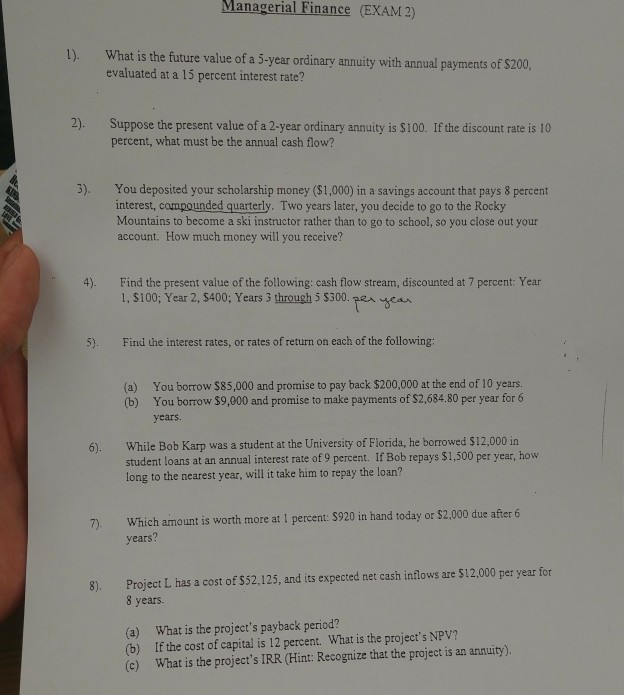

Please Answer the following Managerial Finance (EXAM 2) What is the future value of a 5-year ordinary annuity with anual payments of $200, evaluated at

Please Answer the following

Managerial Finance (EXAM 2) What is the future value of a 5-year ordinary annuity with anual payments of $200, evaluated at a 15 percent interest rate? 2) Suppose the present value of a 2-year ordinary annuity is $100. If the discount rate is 10 percent, what must be the annual cash flow? 3). You deposited your scholarship money ($1,000) in a savings account that pays 8 percent interest, compounded quarterly. Two years later, you decide to go to the Rocky Mountains to become a ski instructor rather than to go to school, so you close out your account. How much money will you receive? 4). Find the present value of the following: cash flow stream, discounted at 7 percent: Year 1, S100; Year 2, $400; Years 3 through 5 $300. 5). Find the interest rates, or rates of return on each of the following: You borrow $85,000 and promise to pay back $200,000 at the end of 10 years. (a) (b) You borrow $9,000 and promise to make payments of $2,684.80 per year for 6 years. 6). While Bob Karp was a student at the University of Fiorida, he borrowed $12,000 in student loans at an annual interest rate of 9 percent. If Bob repays $1,500 per year, how long to the nearest year, will it take him to repay the loan? 7) Which amount is worth more at I percent: $920 in hand today or $2,000 due after 6 years? 8). Project L has a cost of $52,125, and its expected net cash inflows are $12,000 per year for 8 years. (a) What is the project's payback period? (b) If the cost of capital is 12 percent. What is the project's NPV? (c) What is the project's IRR (Hint: Recognize that the project is an annuity)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started