please answer the following multiple choice

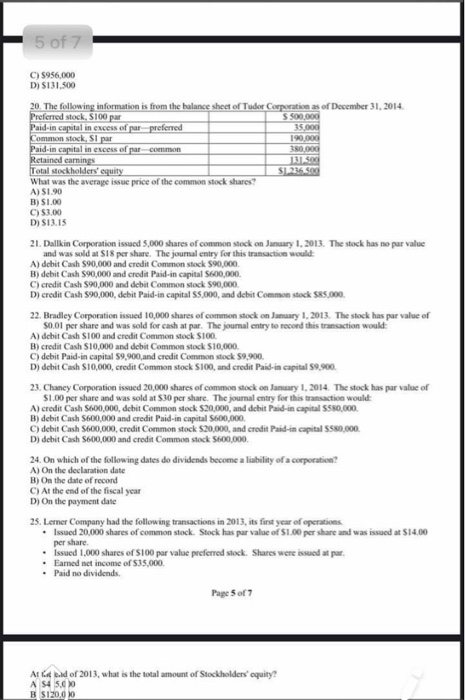

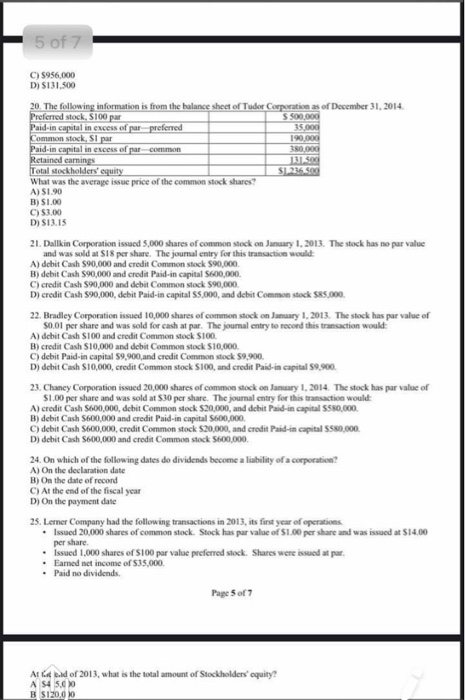

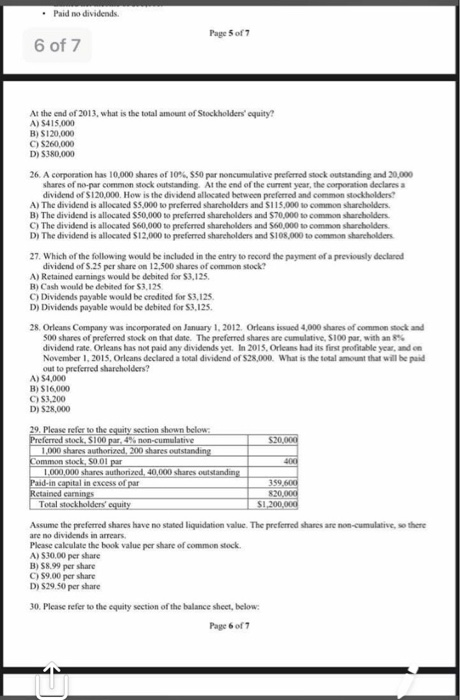

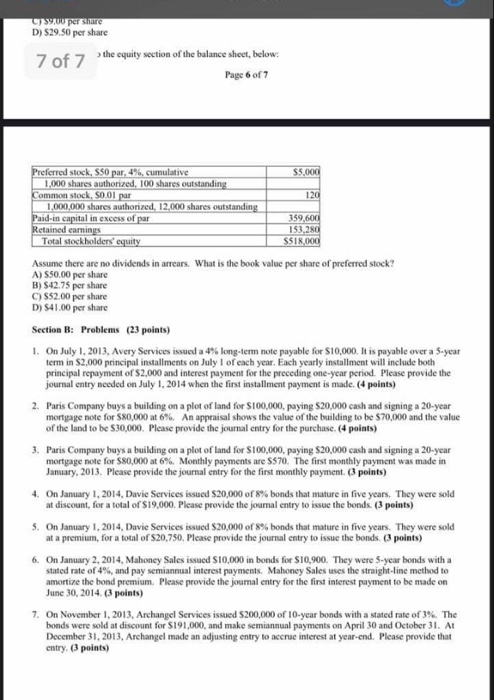

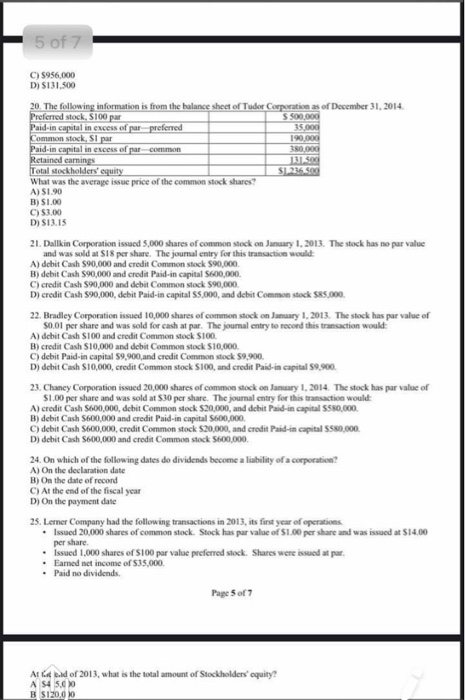

5 of 7 5956,000 D) $131.500 20. The following information is from the balance sheet of Teder Cage s of December 31, 2014 Preferred stock, S100 par $ 500.000 Paid-in capital in se preferred 35.000 Common stock, Spar Paid-in capital is re c omme Retained carings 131 S Total stockholders' equity S1236 What was the average issue price of the common stack has A) SI 90 B) $1.00 C) 51.00 DSILIS 21. Dallkin Corporation issued 5,000 shares of common stock on January 1, 2013. The stock has no par value and was sold at SIP share. The journal entry for this transaction would A) dcbit Cash $90,000 and credit Common stock $90,000 B) debit Cash 590.000 and credit Paid-in capital S00,000 C) credit Cash 50,000 and debit Common stack 590,000 D) credit Cash $90,000, debit Paid-in capital 55,000, and dehit Common stock $,000 22. Bradley Corporation issued 10,000 shares of common stock on January 1, 2013. The stock has par value of S0.01 per share and was sold for cash at par. The journal entry to record this transaction would Aldebit Cash SI00 and credit Common stock S100 B) Credit Cash S10,000 and debit Common stock $10,000 C) debit Paid-in capital 59,900 and credit Common stock $9.900 D) debit Cash S10,000, credit Common stock S100, and credit Paid-in capital 59.900 23. Chaney Corporation issued 20,000 shares of common stock on January 1, 2014. The stock has par value of S1.00 per share and was sold at $10 per share. The journal entry for this traction would A) credit Cash S600,000, dcbit Common stock $20,000, and dcbit Paid-in capital 5550.000 B) debit Cash S600.000 and credit Paid in capital 600.000 C) debit Cash S600,000, credit Common stock 520,000, and credit Paid-in capital 5580,000 Di dcbit Cash S600,000 and credit Common stock 600 000 24. On which of the following dates do dividends become a liability of a corporation A) On the declaration date B) On the date of record C) At the end of the fiscal year D) On the payment date 25. Lemer Company had the following transactions in 2013, its first year of operations Issued 20.000 shares of common stack. Stock has par value of S h are and was issued at $14.00 per share Issued 1,000 shares of S100 par value preferred stock. Shares were issued at par Earned net income of SO5.000 Paid no dividends Page 5 of 7 Alcad of 2013, what is the total amount of Stockholders' equity? A $45. BSI2000 Paid no dividends. Page 5 of 7 6 of 7 At the end of 2013, what is the total amount of Stockholders' equity! A) S415.000 B N 4 $260.000 D) $380.000 26. A corporation has 10,000 shares of 10% SS6 par noncumulative preferred stock outstanding and 20,000 shares of mo par common stock i ng At the end of the current year, the declares dividend of $120,000. How is the dividend allocated between preferred and common stockholders A) The dividend is allocated 55.000 pccred charcholders and SIIS 000 m a rched B) The dividend is allocated $50,000 to preferred shareholders and 570,000 common shareholders C) The dividend is allocated $60,000 te preferred shareholders and 60000 common shareholders D) The dividend is allocated $12,000 to preferred shareholders and S108,000 to common shareholders 27. Which of the following would be included in the entry to record the payment of a previously declared dividend of 5.25 per share on 12.500 shares of common stock? A) Retained carings would be debited for 53.125 Cach would the debited for $1126 C) Dividends payable would be credited for $3,125 D) Dividends payable would be debited for $3.125. 28 Orleans Company was incorporated on January 1, 2012. Orleans issued 4,000 shares of common stock and 500 shares of preferred stock on that date. The preferred shares are cumulative, SI00 par, with an 8% dividend rate. Orleans has not paid any dividends yet. In 2015, Orleans had its first profitable year, and on November 1, 2015, Orleans declared a total dividend of 28,000. What is the total amount that will be paid out to preferred shareholders? A) $4,000 H) S16000 CSI 200 D) $28.000 $200 29. Please refer to the equity section shown below Preferred stock, S100 par, 4% non-cumulative 1.000 shares authorized. 200 shares outstanding Common stock, sool par 1.000.000 shares authorized. 40,000 shares outstanding Paid-in capital in eness of par Retained carmings Totalckholders' equity 399 600 SI 200.000 Assume the preferred shares have no stated liquidation value. The preferred shares are on-Cumulative, so there are no dividends in areas Please calculate the book value per share of common stock A) 530.00 per share B) SS.99 per share $9.00 per share DS29. Seper share 30. Please refer to the equity section of the balance sheet, below. Page 6 of 7 CUTE D) $29.50 per share 7 of the equity section of the balance sheet, below: Page 6 of 7 $5,000 Preferred stock, Sopar 49cumulative 1.000 shares authorized, 100 shares outstanding Common stock, SO. 01 par 1.000.000 shares authorized, 12.000 shares outstanding Paid in capital in excess of par Retained earnings Total stockholders' equity 359.60 152 SSIR 000 Assume there are no dividends in arrears. What is the book value per share of preferred stock? A) 550,00 per share B) S42.75 per share C) 552.00 per share D) S41.00 per share Section B: Problems (23 points) 1. On July 1, 2013, Avery Services issued a 4% long-term note payable for $10,000. It is payable over a 5-year term in S2.000 principal installments on July 1 of each year. Each yearly installment will include both principal repayment of $2,000 and interest payment for the preceding one-year period. Please provide the journal entry needed on July 1, 2014 when the first installment payment is made. (4 points) 2. Paris Company buys a building on a plot of land for S100,000, paying $20,000 cash and signing a 20-year mortgage note for $80,000 at 6%. An appraisal shows the value of the building to be $70,000 and the value of the land to be $30,000. Please provide the journal entry for the purchase. (4 points) 3. Paris Company buys a building on a plot of land for S100,000, paying $20,000 cash and signing a 20-year mortgage note for $80,000 at 6%. Monthly payments are S570. The first monthly payment was made in January, 2013. Please provide the journal entry for the first monthly payment. (3 points) 4. On January 1, 2014, Duvie Services issued $20,000 of 8% bonds that mature in five years. They were sold at discount for a total of $19,000. Please provide the journal entry to issue the bonds (3 points) 5. On January 1, 2014, Davie Services issued $20,000 of 8% bonds that mature in five years. They were sold at a premium, for a total of $20,750. Please provide the journal entry to issue the bonds points) 6. On January 2, 2014, Mahoney Sales issued S10,000 in bonds for $10.900. They were 5-year bonds with a stated rate of 4%, and pay semiannual interest payments. Mahoney Sales uses the straight-line method to amortize the bond premium. Please provide the journal entry for the first interest payment to be made on June 30, 2014 points) 7. On November 1, 2013, Archangel Services issued $200,000 of 10-year bonds with a stated rate of 3%. The bonds were sold at discount for $191,000, and make semiannual payments on April 30 and October 31. At December 31, 2013. Archangel made an adjusting entry to accrue interest at year-end. Please provide that entry points)