Question

Answer the following question based on the following financial statements (Statement of Financial Position and Income Statement) for Company A and Company B. 1. Perform

Answer the following question based on the following financial statements (Statement of Financial Position and Income Statement) for Company A and Company B.

1. Perform ratio analysis for the two companies for the year ended 31 March 2019.

( Note: The scope of analysis should include liquidity, profitability, and solvency. )

Please show the workings of the accounting ratios.

________________________________________________________________

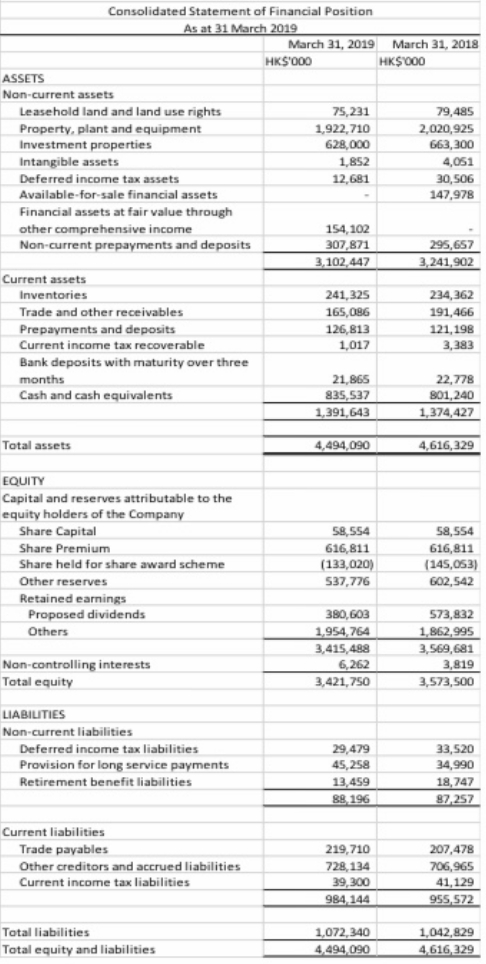

Company A: Statement of Financial Position

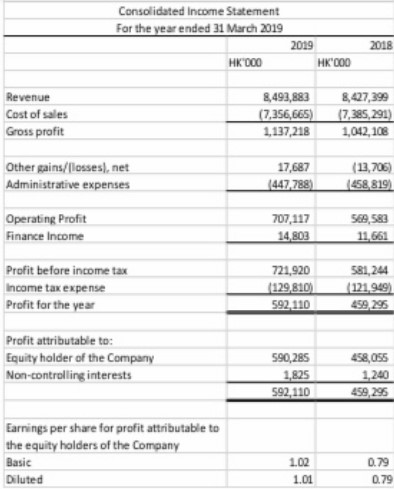

Company A : Income Statement

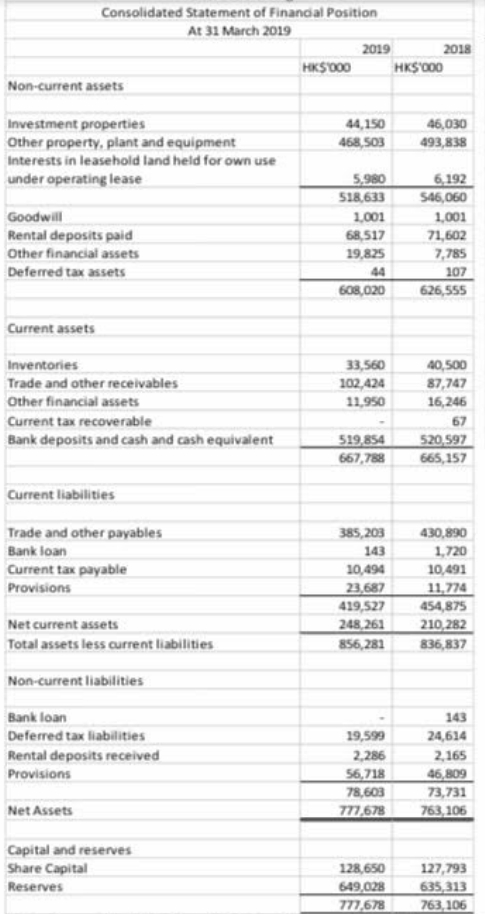

Company B: Statement of Financial Position

Company B : Income Statement

Note: Average Total Equity = (Beginning balance of shareholders' equity + Ending balance of shareholders' equity) / 2

Consolidated Statement of Financial Position As at 31 March 2019 ASSETS Non-current assets Leasehold land and land use rights Property, plant and equipment Investment properties Intangible assets Deferred income tax assets Available-for-sale financial assets Financial assets at fair value through other comprehensive income Non-current prepayments and deposits Current assets Inventories Trade and other receivables Prepayments and deposits Current income tax recoverable Bank deposits with maturity over three months Cash and cash equivalents Total assets EQUITY Capital and reserves attributable to the equity holders of the Company Share Capital Share Premium Share held for share award scheme Other reserves Retained earnings Proposed dividends Others Non-controlling interests Total equity LIABILITIES Non-current liabilities Deferred income tax liabilities Provision for long service payments Retirement benefit liabilities Current liabilities Trade payables Other creditors and accrued liabilities Current income tax liabilities Total liabilities Total equity and liabilities March 31, 2019 March 31, 2018 HK$ 000 HK$'000 75,231 1,922,710 628,000 1,852 12,681 154,102 307,871 3,102,447 241,325 165,086 126,813 1,017 21,865 835,537 1,391,643 4,494,090 58,554 616,811 (133,020) 537,776 380,603 1,954,764 3,415,488 6,262 3,421,750 29,479 45,258 13,459 88,196 219,710 728,134 39,300 984,144 1,072,340 4,494,090 79,485 2,020,925 663,300 4,051 30,506 147,978 295,657 3,241,902 234,362 191,466 121,198 3,383 22,778 801,240 1,374,427 4,616,329 58,554 616,811 (145,053) 602,542 573,832 1,862,995 3,569,681 3,819 3,573,500 33,520 34,990 18,747 87,257 207,478 706,965 41,129 955,572 1,042,829 4,616,329

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Liquidity Ratio Quick Ratio Current Assets Inventory Cur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started