Answered step by step

Verified Expert Solution

Question

1 Approved Answer

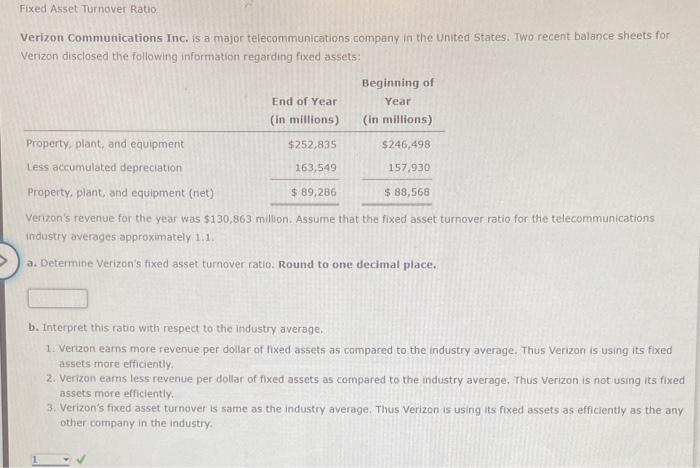

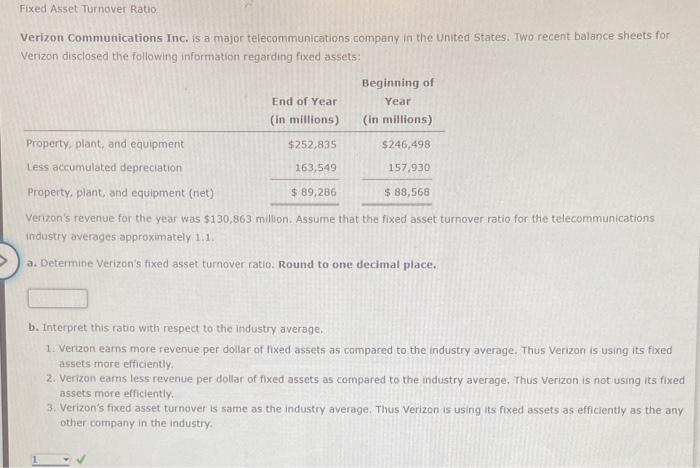

please answer the following question Fixed Asset Turnover Ratio Verizon Communications Inc. is a major telecommunications company in the United States. Two recent balance sheets

please answer the following question

Fixed Asset Turnover Ratio Verizon Communications Inc. is a major telecommunications company in the United States. Two recent balance sheets for Verizon disclosed the following information regarding fixed assets: Beginning of End of Year Year (in millions) (in millions) Property, plant, and equipment $252,835 $246,498 Less accumulated depreciation 163,549 157,930 Property, plant, and equipment (net) $ 89,286 $ 88,568 Venzon's revenue for the year was $130,863 million. Assume that the fixed asset turnover ratio for the telecommunications industry averages approximately 1.1. a. Determine Verizon's fixed asset turnover ratio. Round to one decimal place. b. Interpret this ratio with respect to the industry average. 1. Verizon earns more revenue per dollar of fixed assets as compared to the industry average. Thus Verizon is using its fixed assets more efficiently, 2. Verizon earns less revenue per dollar of fixed assets as compared to the industry average. Thus Verizon is not using its fixed assets more efficiently 3. Verizon's fixed asset turnover is same as the industry average. Thus Verizon is using its fixed assets as efficiently as the any other company in the industry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started