Question

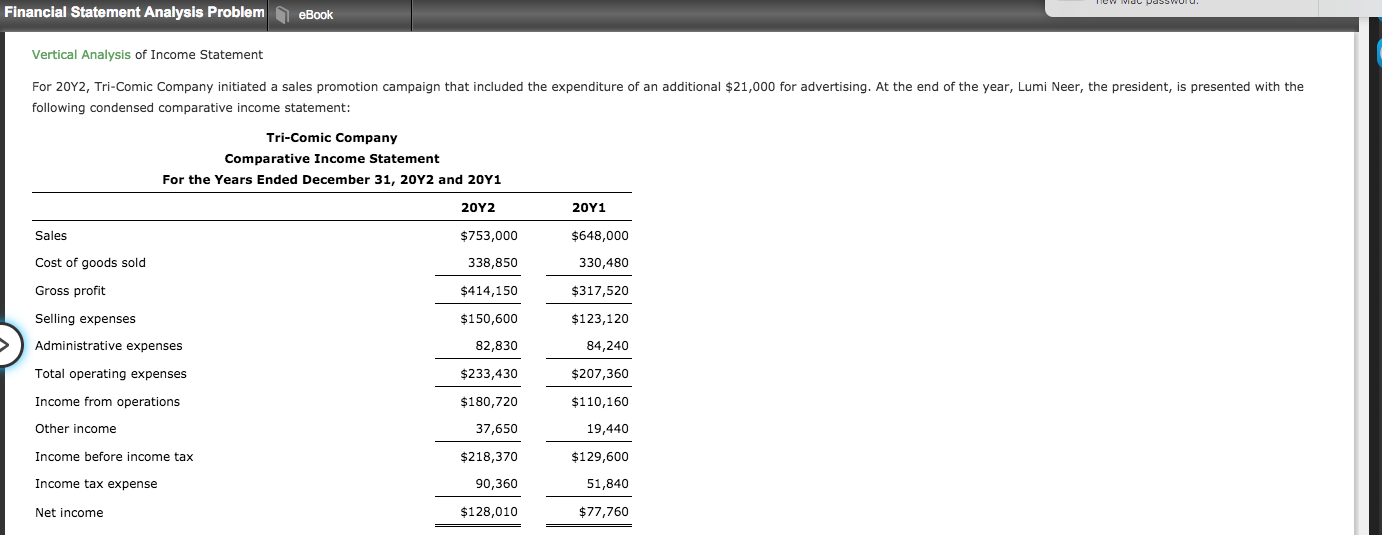

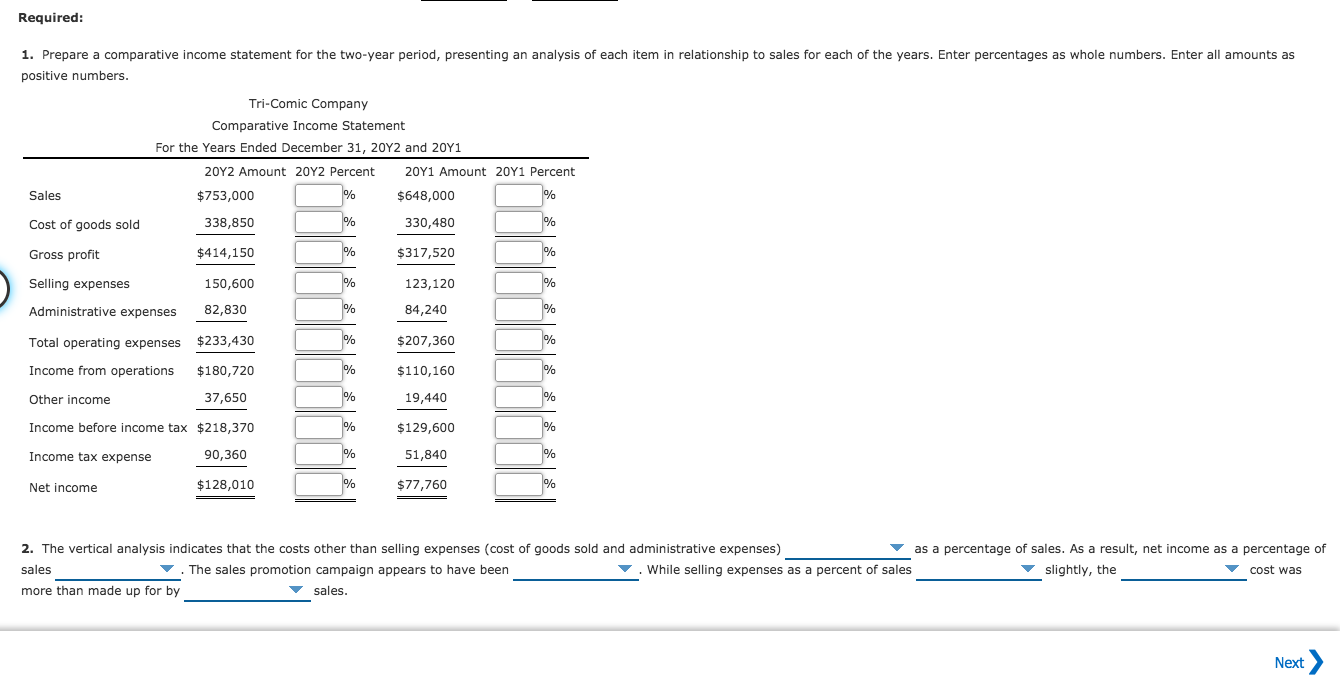

Please answer the following question Question 2: The vertical analysis indicates that the costs other than selling expenses (cost of goods sold and administrative expenses)___improved/deteriorated________

Please answer the following question

Question 2:

The vertical analysis indicates that the costs other than selling expenses (cost of goods sold and administrative expenses)___improved/deteriorated________ as a percentage of sales.

As a result, net income as a percentage of sales _____increased/decreased______.

The sales promotion campaign appears to have been_____successful/unsuccessful____

While selling expenses as a percent of sales _____increased/deceased____slightly, the____increased/decreased_____ cost was more than made up for by ____increased/decreased____ sales.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started