Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions and all its parts. Failure to do so will result in negative rating. Try answering on a piece of paper

Please answer the following questions and all its parts. Failure to do so will result in negative rating. Try answering on a piece of paper if possible and scan it please and i will give good rating. Thanks!

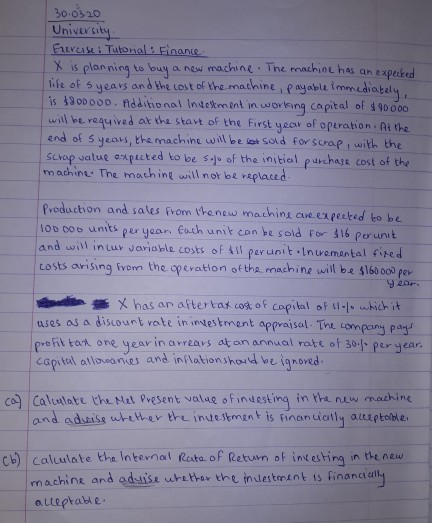

30.0320 University Fireise: Tutorial: Finance X is planning to buy a new machine. The machine has an expected life of years and the cost of the machine, payable immediately is 4800000. Additional Interment in working capital of $ 900.00 will be required at the start of the first year of operation. At the end of years, the machine will be sat sold for scrap, with the Scrop value expected to be 5. of the initial purchase cost of the machine. The machine will not be replaced Production and sales from the new machine are expected to be 100ooo units per year Each unit can be sold for $16 perunit and will incur variable costs of $11 perunit incremental fired costs arising from the operation of the machine will be $16000 per dan X has an after tax cost of capital of 11% which it uses as a discount rate in investment appraisal. The company pays profil for one year in arrears at an annual rate of 30 per year. capital allowanies and inflation should be ignored. ca) Calculate the Mel Present value of investing in the new machine and advise whether the investment is financially acceptable. calculate the Internal Rate of Return of investing in the new machine and advise whether the in lestment is financially aceptableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started