Please answer the following questions and explain

1 and 2

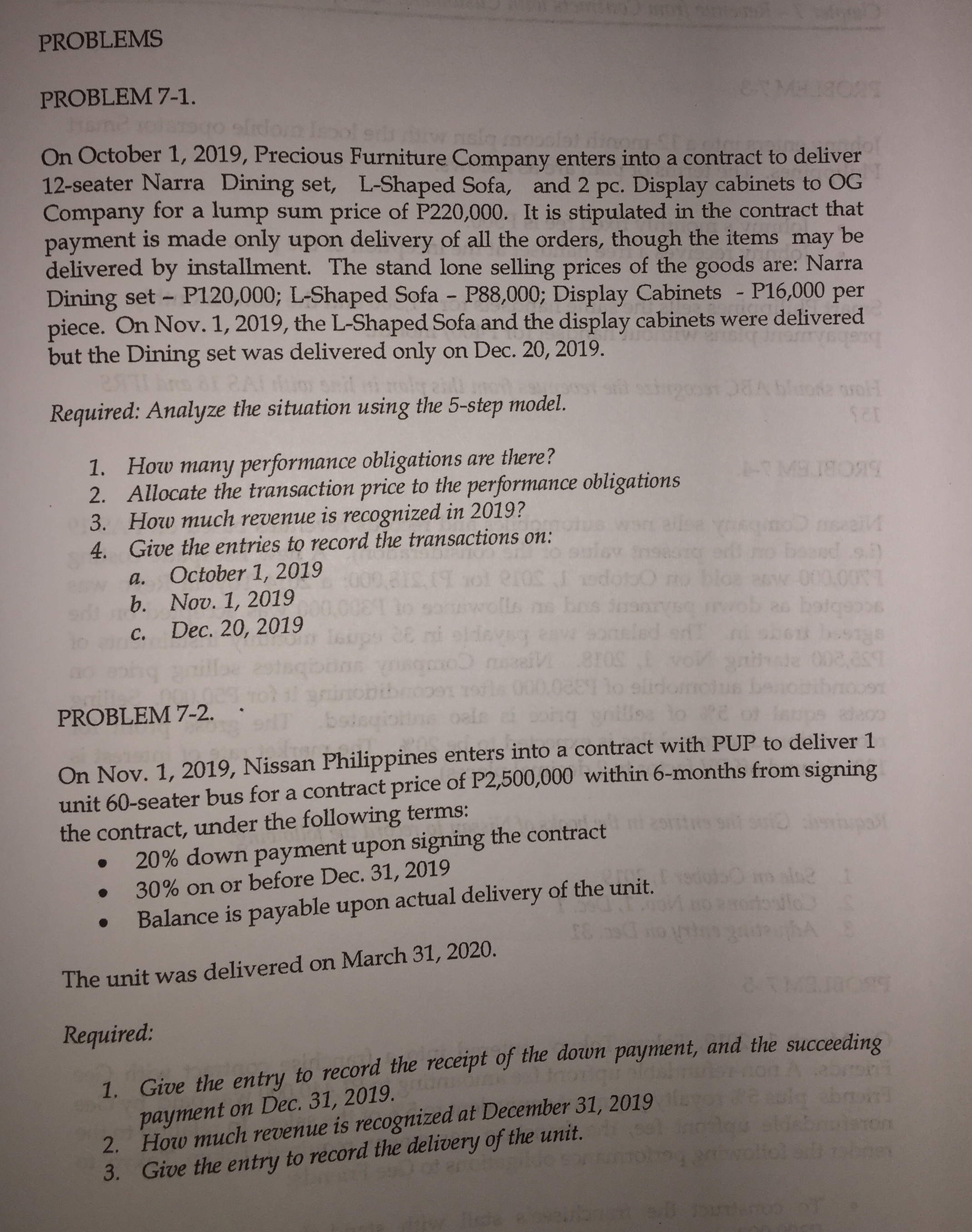

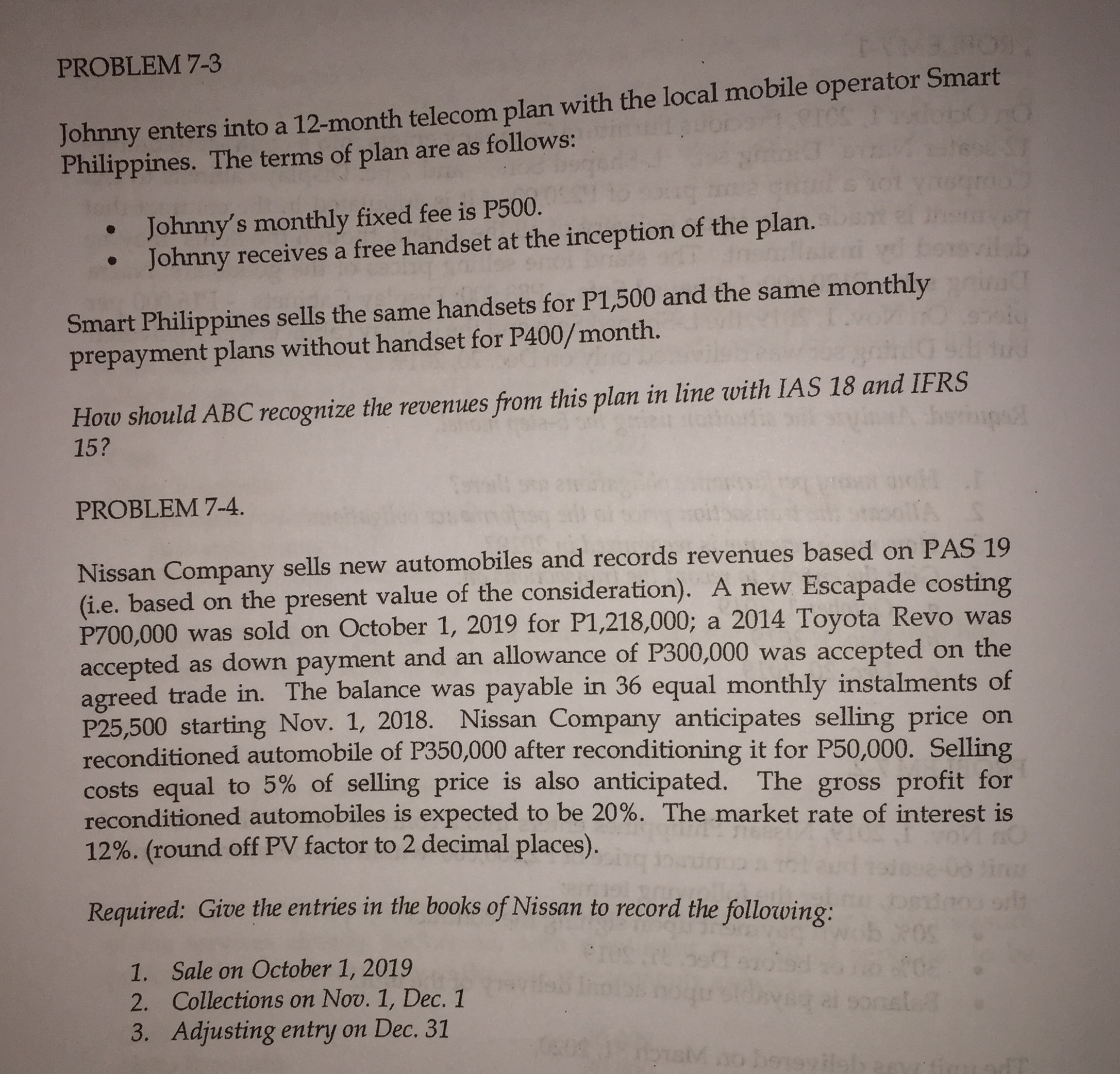

PROBLEMS PROBLEM 7-1. to sirdoin On October 1, 2019, Precious Furniture Company enters into a contract to deliver 12-seater Narra Dining set, L-Shaped Sofa, and 2 pc. Display cabinets to OG Company for a lump sum price of P220,000. It is stipulated in the contract that payment is made only upon delivery of all the orders, though the items may be delivered by installment. The stand lone selling prices of the goods are: Narra Dining set - P120,000; L-Shaped Sofa - P88,000; Display Cabinets - P16,000 per piece. On Nov. 1, 2019, the L-Shaped Sofa and the display cabinets were delivered but the Dining set was delivered only on Dec. 20, 2019. Required: Analyze the situation using the 5-step model. 5t sill sthatgoost DeLA blurone orold 1. How many performance obligations are there? 2. Allocate the transaction price to the performance obligations Ma.18079 3. How much revenue is recognized in 2019? 4. Give the entries to record the transactions on: pipe wort ailee vegmod meall a. October 1, 2019 sulev moosic ord no based s.) b. Nov. 1, 2019 :600 818. (1 101 2108 ,I asdoto() no bloa eow 000.C0% c. Dec. 20, 2019 90.0081 to sonwolls me bris inanysey nwob es hodgepos s Loops 26 ni sideveg enwe sonsled off and seeis bestgs grillbe estagioBos (good again .8108 [ vov gabvale one,as PROBLEM 7-2. rot il grinonibncost 1976 000.068I lo slidomodus benotiboost beingtotine bale of bong grillse On Nov. 1, 2019, Nissan Philippines enters into a contract with PUP to deliver 1 unit 60-seater bus for a contract price of P2,500,000 within 6-months from signing the contract, under the following terms: 20% down payment upon signing the contracts said thepast 30% on or before Dec. 31, 2019 . . Balance is payable upon actual delivery of the unit. The unit was delivered on March 31, 2020. & i Maddogs Required: 1. Give the entry to record the receipt of the down payment, and the succeeding payment on Dec. 31, 2019. How much revenue is recognized at December 31, 2019 2. 3. Give the entry to record the delivery of the unit. going antwolfof all robertPROBLEM 7-3 Johnny enters into a 12-month telecom plan with the local mobile operator Smart Philippines. The terms of plan are as follows: Johnny's monthly fixed fee is P500. Johnny receives a free handset at the inception of the plan. Smart Philippines sells the same handsets for P1,500 and the same monthlypri prepayment plans without handset for P400/month. How should ABC recognize the revenues from this plan in line with IAS 18 and IFRS 15? PROBLEM 7-4. Nissan Company sells new automobiles and records revenues based on PAS 19 (i.e. based on the present value of the consideration). A new Escapade costing P700,000 was sold on October 1, 2019 for P1,218,000; a 2014 Toyota Revo was accepted as down payment and an allowance of P300,000 was accepted on the agreed trade in. The balance was payable in 36 equal monthly instalments of P25,500 starting Nov. 1, 2018. Nissan Company anticipates selling price on reconditioned automobile of P350,000 after reconditioning it for P50,000. Selling costs equal to 5% of selling price is also anticipated. The gross profit for reconditioned automobiles is expected to be 20%. The market rate of interest is 12%. (round off PV factor to 2 decimal places). eud islove-06 Jira Required: Give the entries in the books of Nissan to record the following: vob POS 1. Sale on October 1, 2019 2. Collections on Nov. 1, Dec. 1 psyifso Inpist nogu sidhveg al sonsled 3. Adjusting entry on Dec. 31