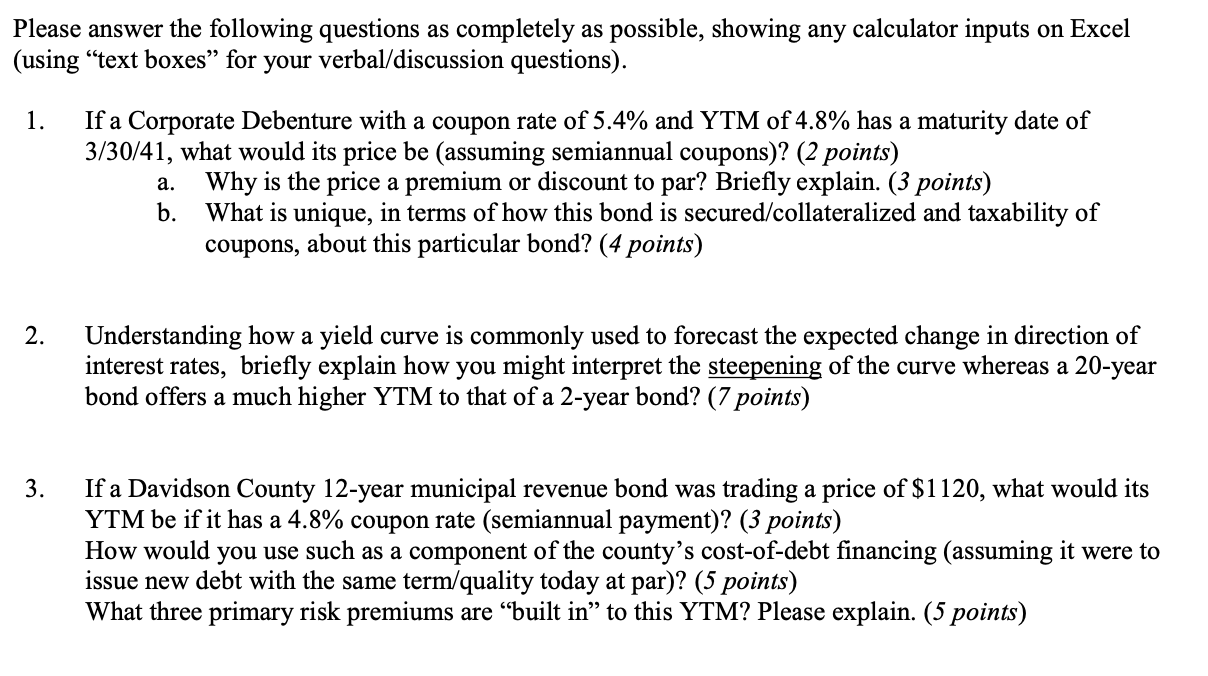

Please answer the following questions as completely as possible, showing any calculator inputs on Excel (using text boxes for your verbal/discussion questions). 1. If a Corporate Debenture with a coupon rate of 5.4% and YTM of 4.8% has a maturity date of 3/30/41, what would its price be (assuming semiannual coupons)? (2 points) a. Why is the price a premium or discount to par? Briefly explain. (3 points) b. What is unique, in terms of how this bond is secured/collateralized and taxability of coupons, about this particular bond? (4 points) 2. Understanding how a yield curve is commonly used to forecast the expected change in direction of interest rates, briefly explain how you might interpret the steepening of the curve whereas a 20-year bond offers a much higher YTM to that of a 2-year bond? (7 points) 3. If a Davidson County 12-year municipal revenue bond was trading a price of $1120, what would its YTM be if it has a 4.8% coupon rate (semiannual payment)? (3 points) How would you use such as a component of the county's cost-of-debt financing (assuming it were to issue new debt with the same term quality today at par)? (5 points) What three primary risk premiums are "built in to this YTM? Please explain. (5 points) Please answer the following questions as completely as possible, showing any calculator inputs on Excel (using text boxes for your verbal/discussion questions). 1. If a Corporate Debenture with a coupon rate of 5.4% and YTM of 4.8% has a maturity date of 3/30/41, what would its price be (assuming semiannual coupons)? (2 points) a. Why is the price a premium or discount to par? Briefly explain. (3 points) b. What is unique, in terms of how this bond is secured/collateralized and taxability of coupons, about this particular bond? (4 points) 2. Understanding how a yield curve is commonly used to forecast the expected change in direction of interest rates, briefly explain how you might interpret the steepening of the curve whereas a 20-year bond offers a much higher YTM to that of a 2-year bond? (7 points) 3. If a Davidson County 12-year municipal revenue bond was trading a price of $1120, what would its YTM be if it has a 4.8% coupon rate (semiannual payment)? (3 points) How would you use such as a component of the county's cost-of-debt financing (assuming it were to issue new debt with the same term quality today at par)? (5 points) What three primary risk premiums are "built in to this YTM? Please explain. (5 points)