Please answer the following questions below. I need the Correct data put into a table with the same labels as the ones in the questions. again, please label them the same so i know where to input the data. I only need questions E through G to be answered. Hand written is fine so long as it's legible and labeled correctly. Please don't bother commenting on this post unless you actually intend to answer the questions. i've had too many people asking me to pay for their own service to get the answers i need or marking it as completed with only a comment saying that they'll post the answers "eventually". if the answers provided are in the correct formatting and are labeled correctly i will be sure to thumbs up. thanks in advance.

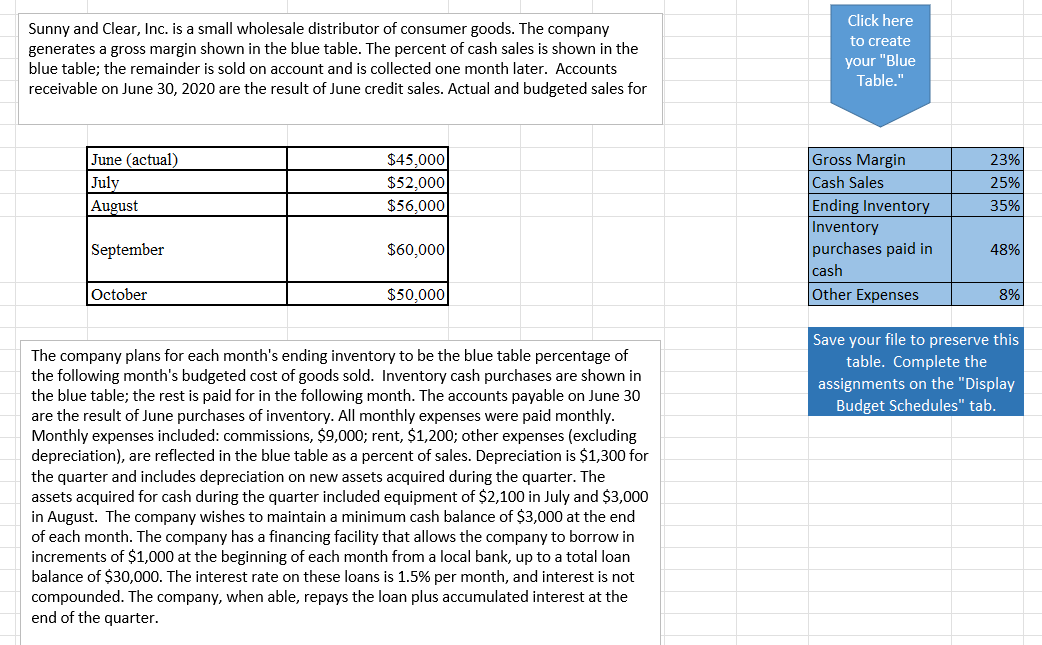

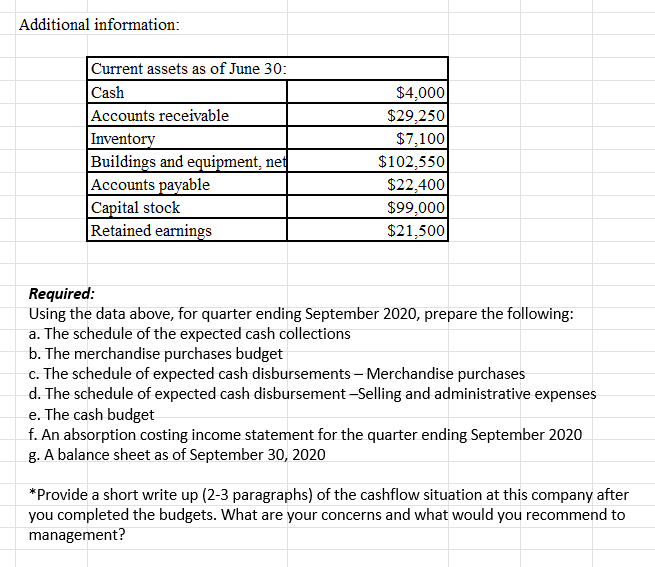

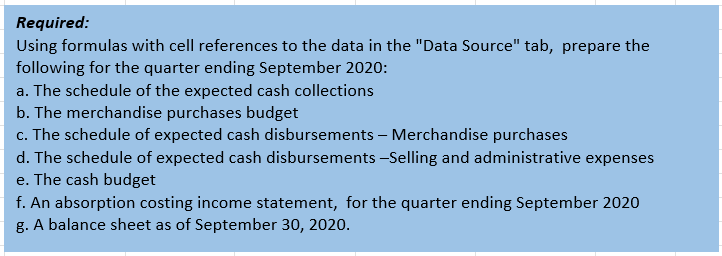

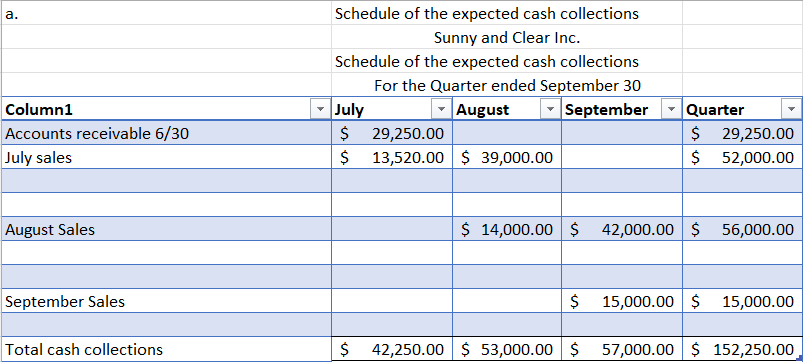

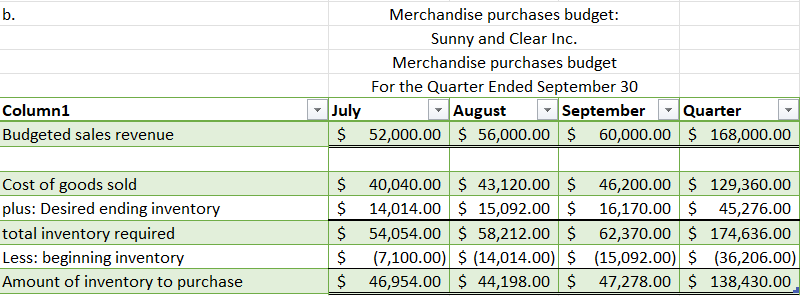

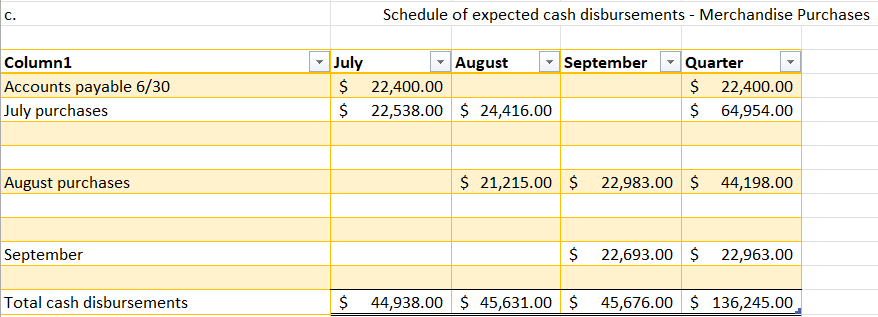

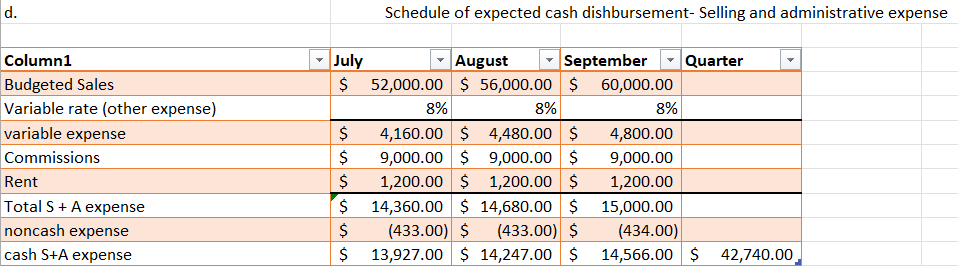

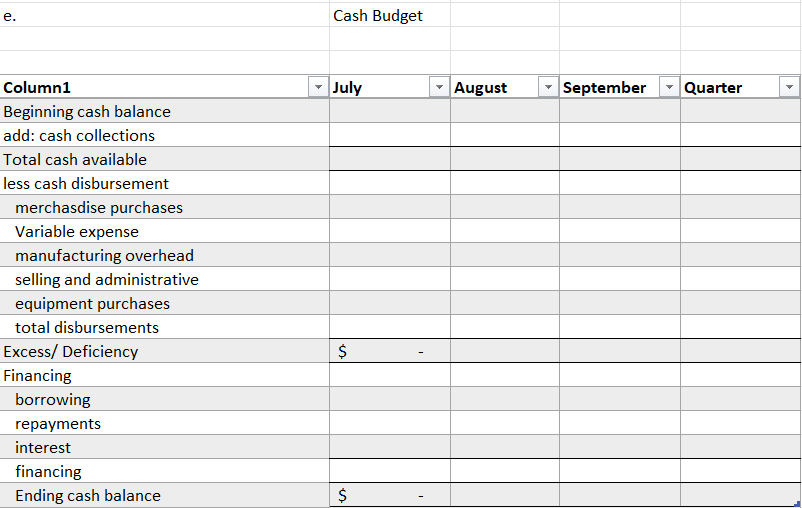

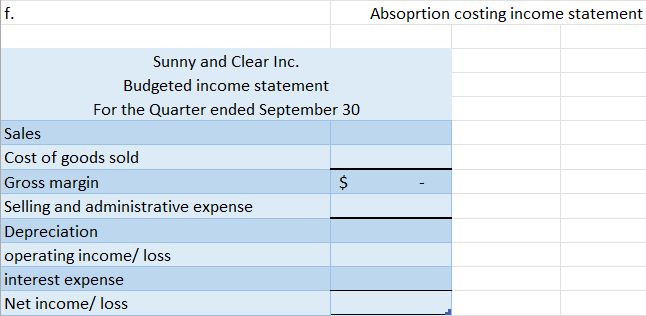

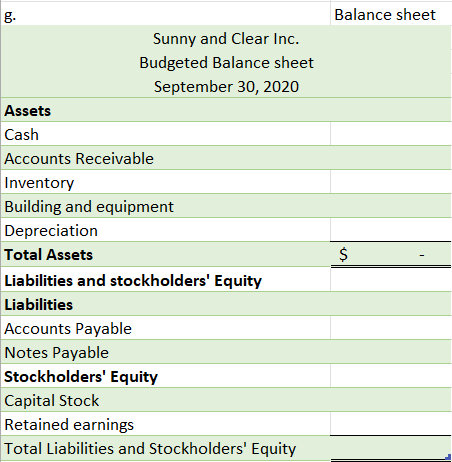

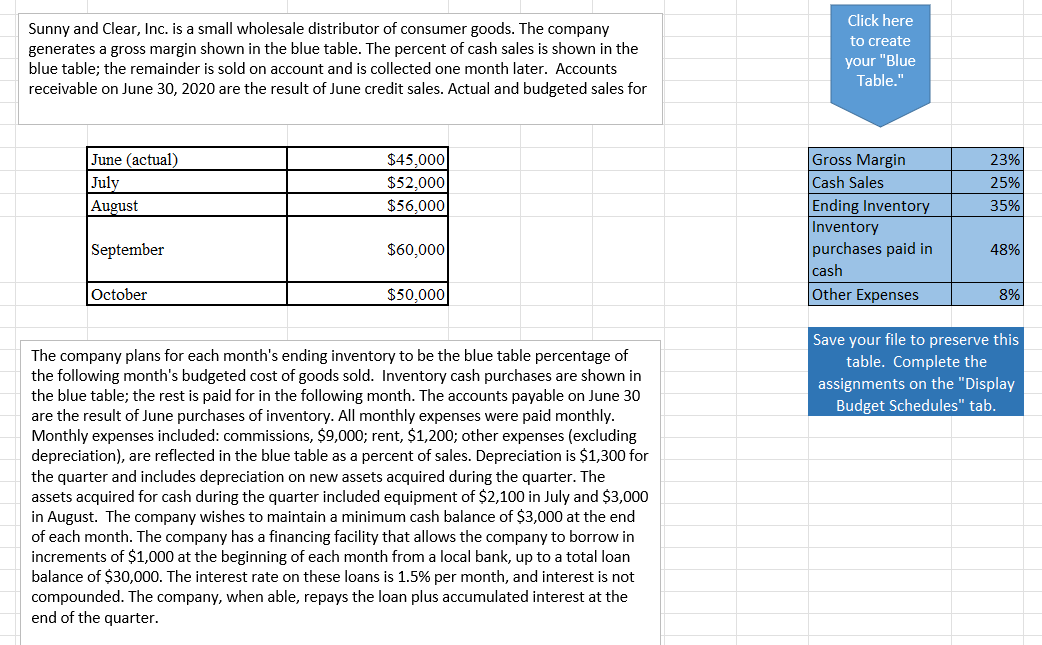

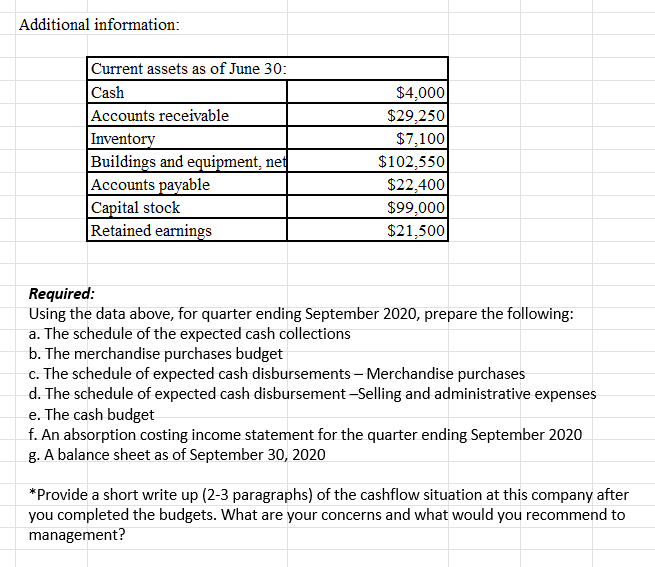

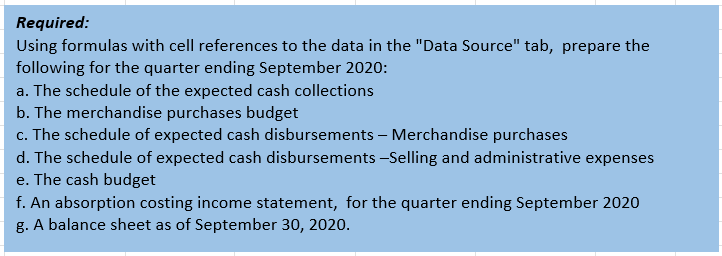

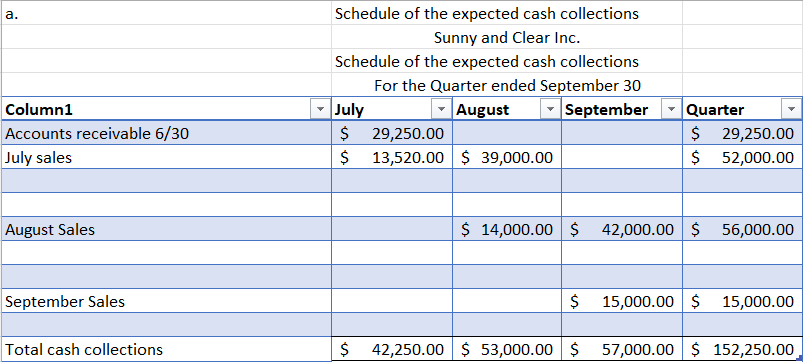

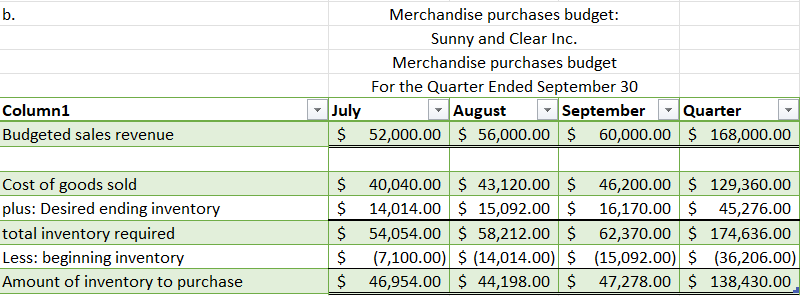

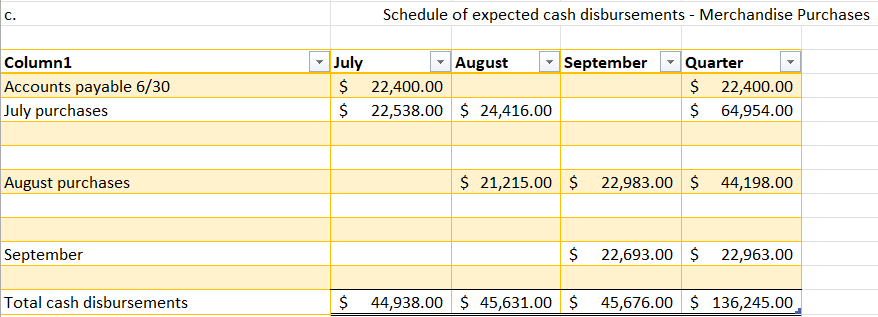

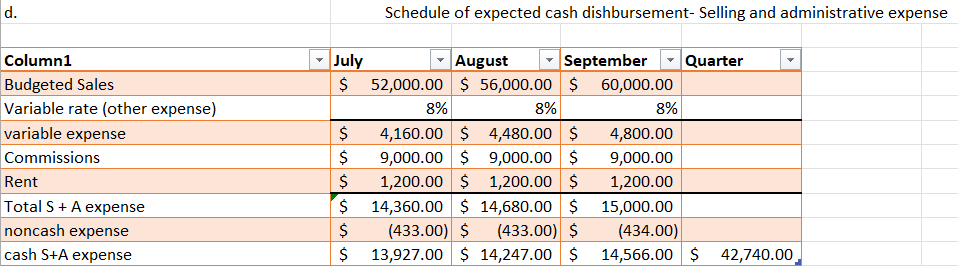

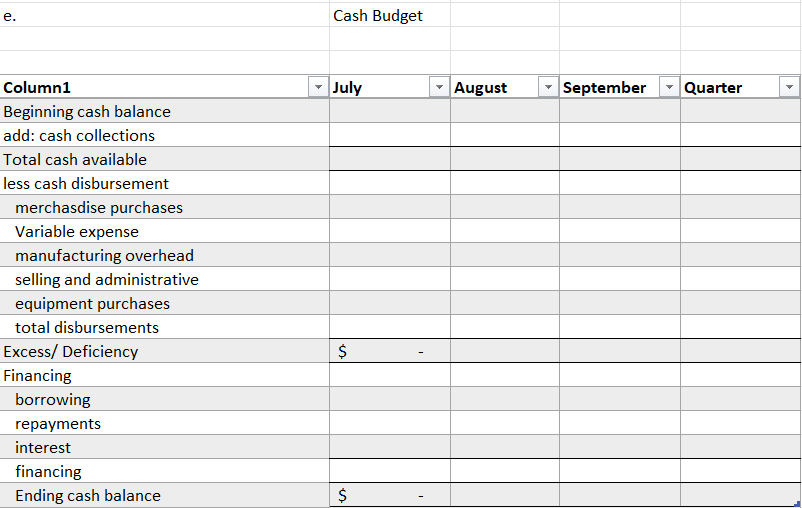

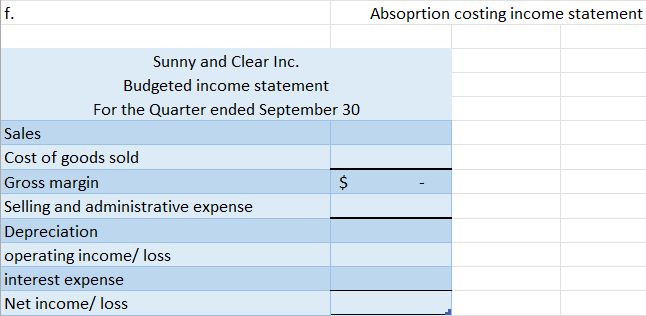

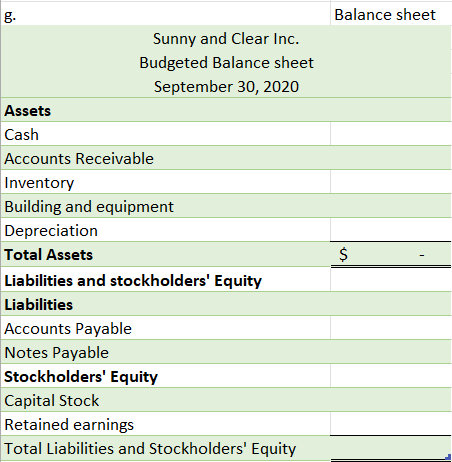

Sunny and Clear, Inc. is a small wholesale distributor of consumer goods. The company generates a gross margin shown in the blue table. The percent of cash sales is shown in the blue table; the remainder is sold on account and is collected one month later. Accounts receivable on June 30, 2020 are the result of June credit sales. Actual and budgeted sales for Click here to create your "Blue Table." June (actual) July August $45,000 $52.000 $56,000 23% 25% 35% Gross Margin Cash Sales Ending Inventory Inventory purchases paid in cash Other Expenses September $60,000 48% October $50,000 8% Save your file to preserve this table. Complete the assignments on the "Display Budget Schedules" tab. The company plans for each month's ending inventory to be the blue table percentage of the following month's budgeted cost of goods sold. Inventory cash purchases are shown in the blue table; the rest is paid for in the following month. The accounts payable on June 30 are the result of June purchases of inventory. All monthly expenses were paid monthly. Monthly expenses included: commissions, $9,000; rent, $1,200; other expenses (excluding depreciation), are reflected in the blue table as a percent of sales. Depreciation is $1,300 for the quarter and includes depreciation on new assets acquired during the quarter. The assets acquired for cash during the quarter included equipment of $2,100 in July and $3,000 in August. The company wishes to maintain a minimum cash balance of $3,000 at the end of each month. The company has a financing facility that allows the company to borrow in increments of $1,000 at the beginning of each month from a local bank, up to a total loan balance of $30,000. The interest rate on these loans is 1.5% per month, and interest is not compounded. The company, when able, repays the loan plus accumulated interest at the end of the quarter. Additional information: Current assets as of June 30: Cash Accounts receivable Inventory Buildings and equipment, net Accounts payable Capital stock Retained earnings $4,000 $29,250 $7.100 $102,550 $22,400 $99,000 $21,500 Required: Using the data above, for quarter ending September 2020, prepare the following: a. The schedule of the expected cash collections b. The merchandise purchases budget c. The schedule of expected cash disbursements - Merchandise purchases d. The schedule of expected cash disbursement-Selling and administrative expenses e. The cash budget f. An absorption costing income statement for the quarter ending September 2020 8. A balance sheet as of September 30, 2020 *Provide a short write up (2-3 paragraphs) of the cashflow situation at this company after you completed the budgets. What are your concerns and what would you recommend to management? Required: Using formulas with cell references to the data in the "Data Source" tab, prepare the following for the quarter ending September 2020: a. The schedule of the expected cash collections b. The merchandise purchases budget c. The schedule of expected cash disbursements - Merchandise purchases d. The schedule of expected cash disbursements -Selling and administrative expenses e. The cash budget f. An absorption costing income statement, for the quarter ending September 2020 g. A balance sheet as of September 30, 2020. a. Schedule of the expected cash collections Sunny and Clear Inc. Schedule of the expected cash collections For the Quarter ended September 30 July August September $ 29,250.00 $ 13,520.00 $ 39,000.00 Column1 Accounts receivable 6/30 July sales Quarter $ 29,250.00 $ 52,000.00 August Sales $ 14,000.00 $ 42,000.00 $ 56,000.00 September Sales $ 15,000.00 $ 15,000.00 Total cash collections $ 42,250.00 $ 53,000.00 $ 57,000.00 $ 152,250.00 b. O Merchandise purchases budget: Sunny and Clear Inc. Merchandise purchases budget For the Quarter Ended September 30 July August September Quarter $ 52,000.00 $ 56,000.00 $ 60,000.00 $ 168,000.00 Columni Budgeted sales revenue Cost of goods sold plus: Desired ending inventory total inventory required Less: beginning inventory Amount of inventory to purchase $ 40,040.00 $ 43,120.00 $ 46,200.00 $ 129,360.00 $ 14,014.00 $ 15,092.00 $ 16,170.00 $ 45,276.00 $ 54,054.00 $ 58,212.00 $ 62,370.00 $ 174,636.00 $ (7,100.00) $ (14,014.00) $ (15,092.00) $ (36,206.00) $ 46,954.00 $ 44,198.00 $ 47,278.00 $ 138,430.00 c. Schedule of expected cash disbursements - Merchandise Purchases September Column1 Accounts payable 6/30 July purchases July August $ 22,400.00 $ 22,538.00 $ 24,416.00 Quarter $ 22,400.00 $ 64,954.00 August purchases $ 21,215.00 $ 22,983.00 $ 44,198.00 September $ 22,693.00 $ 22,963.00 Total cash disbursements $ 44,938.00 $ 45,631.00 $ 45,676.00 $ 136,245.00 d. Schedule of expected cash dishbursement-Selling and administrative expense 8% Column1 Budgeted Sales Variable rate (other expense) variable expense Commissions Rent Total S+A expense noncash expense cash S+A expense July August September Quarter $ 52,000.00 $ 56,000.00 $ 60,000.00 8% 8% $ 4,160.00 $ 4,480.00 $ 4,800.00 $ 9,000.00 $ 9,000.00 $ 9,000.00 $ 1,200.00 $ 1,200.00 $ 1,200.00 $ 14,360.00 $ 14,680.00 $ 15,000.00 $ (433.00) $ (433.00) $ (434.00) $ 13,927.00 $ 14,247.00 $ 14,566.00 $ 42,740.00 e. . Cash Budget July August September Quarter Column1 Beginning cash balance add: cash collections Total cash available less cash disbursement merchasdise purchases Variable expense manufacturing overhead selling and administrative equipment purchases total disbursements Excess/ Deficiency Financing borrowing repayments interest financing Ending cash balance $ $ f. Absoprtion costing income statement Sunny and Clear Inc. Budgeted income statement For the Quarter ended September 30 Sales Cost of goods sold Gross margin $ Selling and administrative expense Depreciation operating income, loss interest expense Net income/ loss Balance sheet g. Sunny and Clear Inc. Budgeted Balance sheet September 30, 2020 Assets Cash Accounts Receivable Inventory Building and equipment Depreciation Total Assets Liabilities and stockholders' Equity Liabilities Accounts Payable Notes Payable Stockholders' Equity Capital Stock Retained earnings Total Liabilities and Stockholders' Equity $