Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions that go along with the data provided The CFO of an emerging technology firm wants to evaluate a competitor that

Please answer the following questions that go along with the data provided

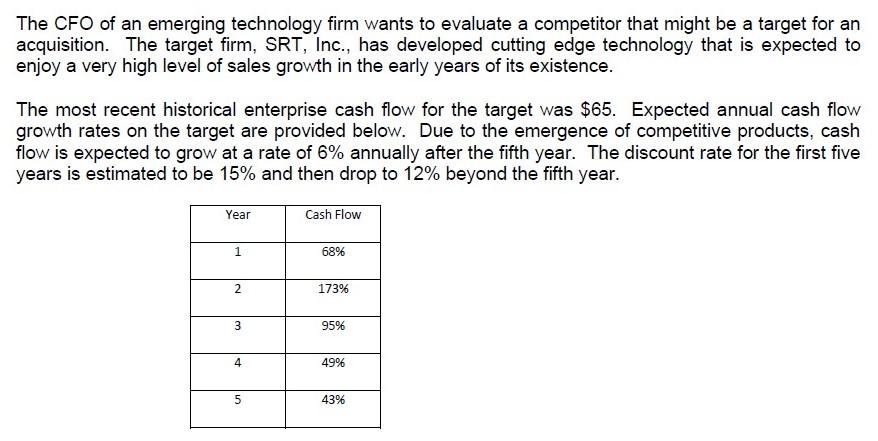

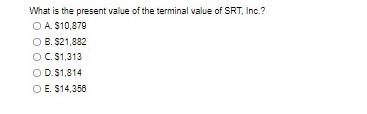

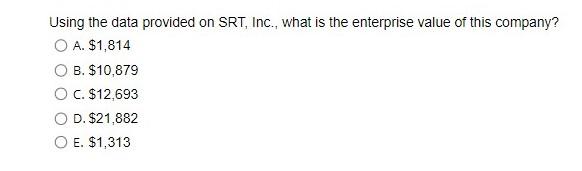

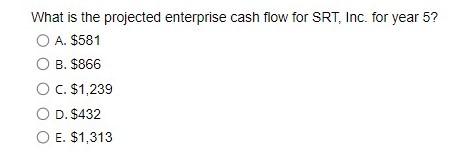

The CFO of an emerging technology firm wants to evaluate a competitor that might be a target for an acquisition. The target firm, SRT, Inc., has developed cutting edge technology that is expected to enjoy a very high level of sales growth in the early years of its existence. The most recent historical enterprise cash flow for the target was $65. Expected annual cash flow growth rates on the target are provided below. Due to the emergence of competitive products, cash flow is expected to grow at a rate of 6% annually after the fifth year. The discount rate for the first five years is estimated to be 15% and then drop to 12% beyond the fifth year. Year Cash Flow 1 68% 2 173% 3 95% 4 49% 5 5 43% What is the present value of the terminal value of SRT, Inc.? O A $10,879 O B. $21,882 OC. $1,313 OD. $1,814 O E. $14,358 Using the data provided on SRT, Inc., what is the enterprise value of this company? O A. $1,814 B. $10,879 O C. $12,693 O D. $21,882 O E. $1,313 What is the projected enterprise cash flow for SRT, Inc. for year 5? O A. $581 B. $866 O C. $1,239 D. $432 O E. $1,313Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started