Please answer the following questions:

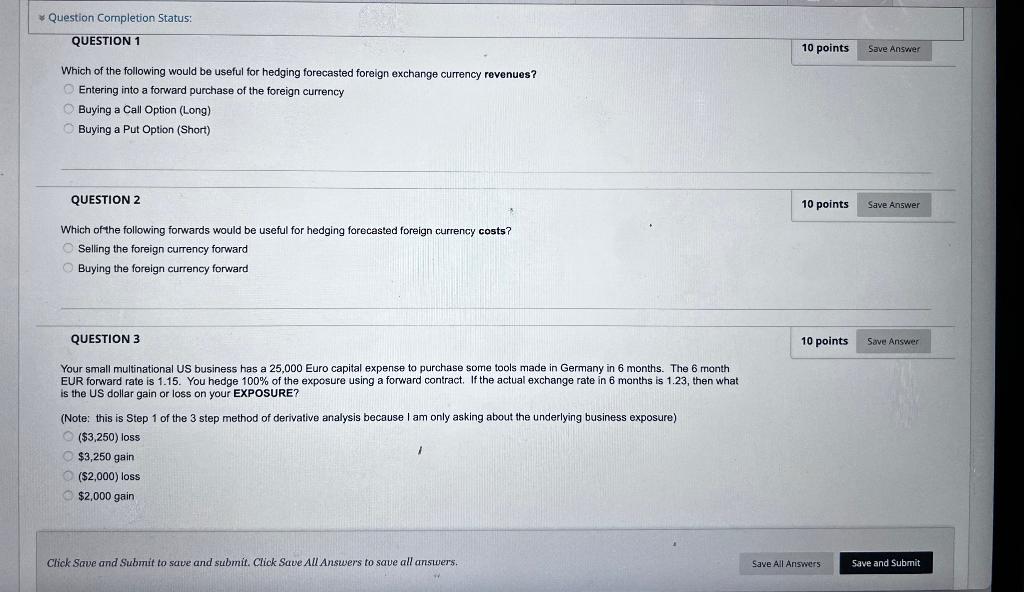

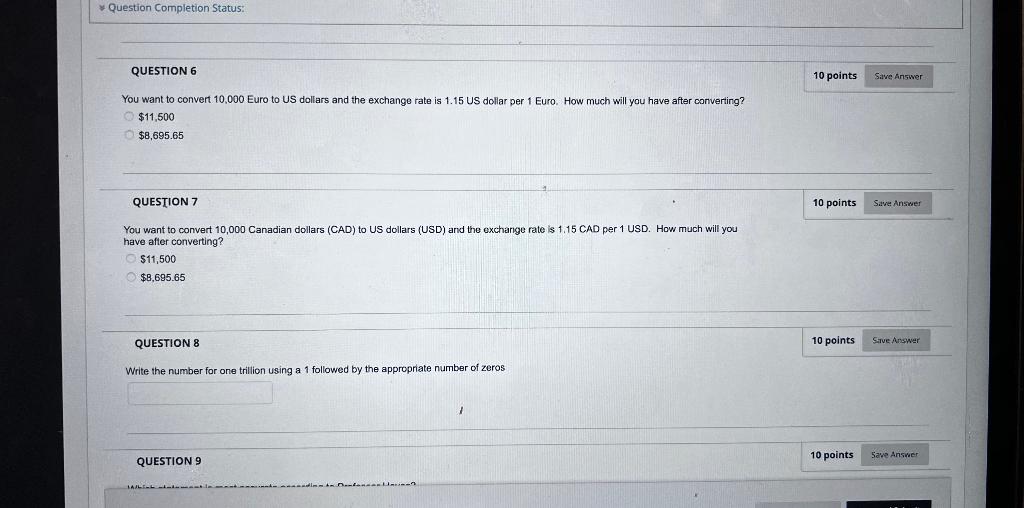

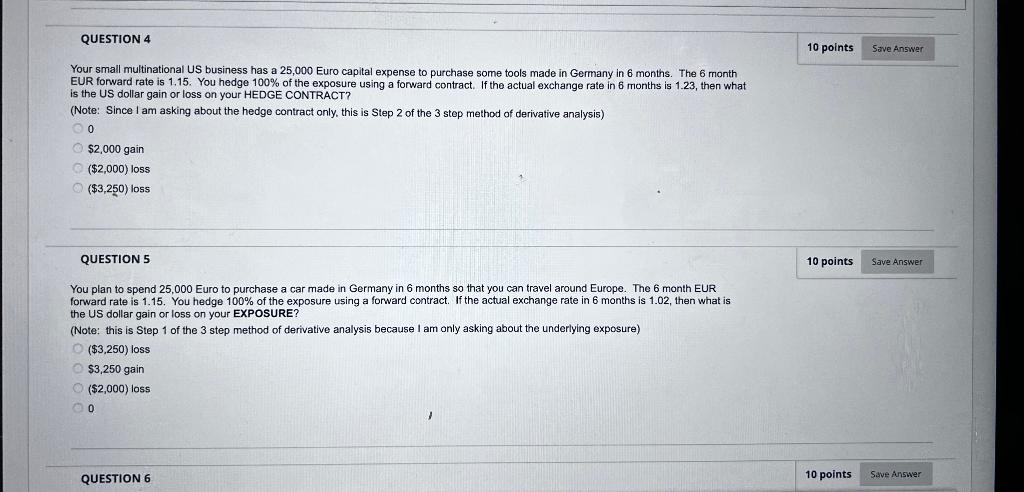

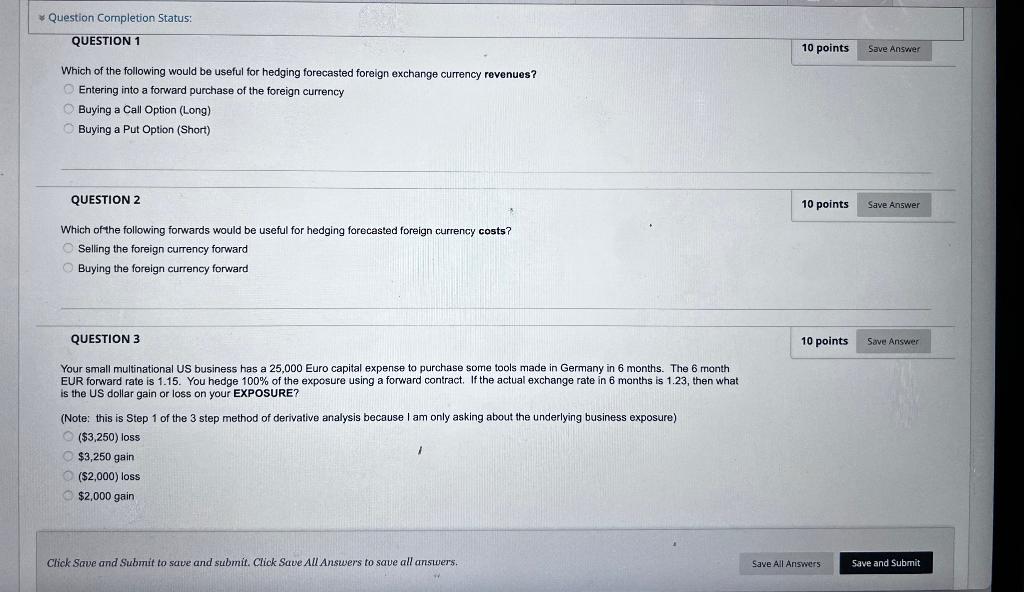

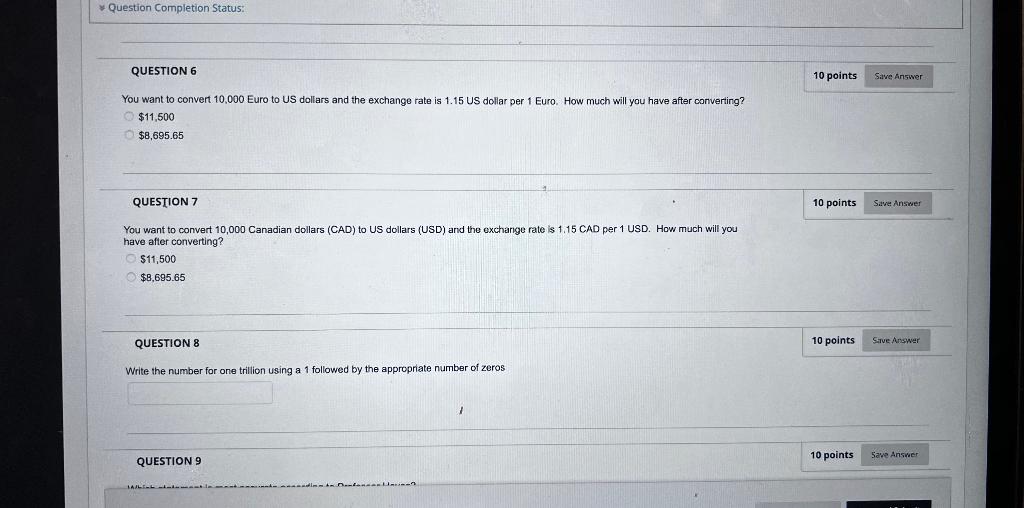

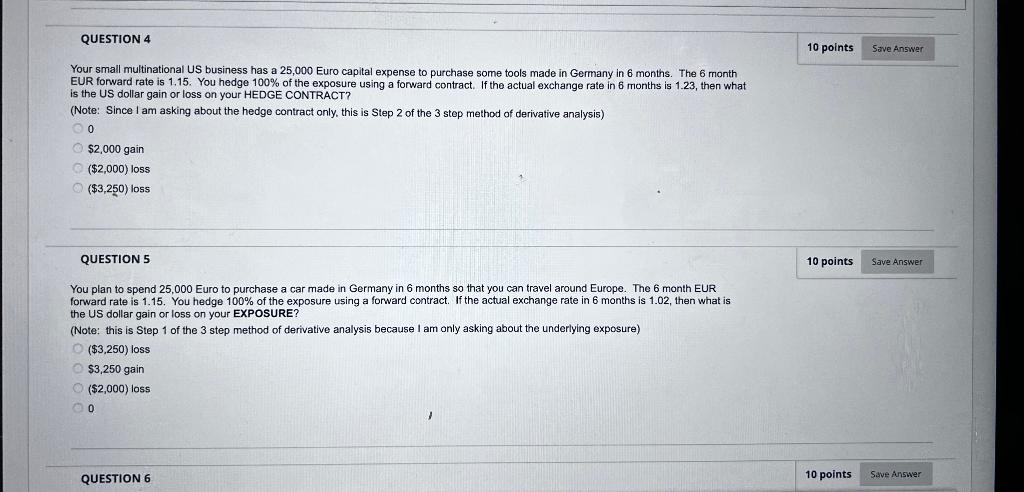

Which of the following would be useful for hedging forecasted foreign exchange currency revenues? Entering into a forward purchase of the foreign currency Buying a Call Option (Long) Buying a Put Option (Short) QUESTION 2 Which of the following forwards would be useful for hedging forecasted foreign currency costs? Selling the foreign currency forward Buying the foreign currency forward QUESTION 3 Your small multinational US business has a 25,000 Euro capital expense to purchase some tools made in Germany in 6 months. The 6 month EUR forward rate is 1.15. You hedge 100% of the exposure using a forward contract. If the actual exchange rate in 6 months is 1.23 , then what is the US dollar gain or loss on your EXPOSURE? (Note: this is Step 1 of the 3 step method of derivative analysis because I am only asking about the underlying business exposure) ($3,250) loss $3,250 gain ($2,000) loss $2,000 gain Click Save and Submit to save and submit. Click Save All Answers to save all answers. You want to convert 10,000 Euro to US dollars and the exchange rate is 1.15 US dollar per 1 Euro. How much will you have after converting? $11,500 $8,695.65 QUESTION 7 You want to convert 10,000 Canadian dollars (CAD) to US dollars (USD) and the exchange rate is 1.15 CAD per 1 USD. How much will you have after converting? $11,500$8,695.65 QUESTION 8 Write the number for one trillion using a 1 followed by the appropriate number of zeros Your small multinational US business has a 25,000 Euro capital expense to purchase some tools made in Germany in 6 months. The 6 month EUR forward rate is 1.15. You hedge 100% of the exposure using a forward contract. If the actual exchange rate in 6 months is 1.23 , then what is the US dollar gain or loss on your HEDGE CONTRACT? (Note: Since I am asking about the hedge contract only, this is Step 2 of the 3 step method of derivative analysis) $2,000 gain ($2,000) loss ($3,250) loss QUESTION 5 You plan to spend 25,000 Euro to purchase a car made in Germany in 6 months so that you can travel around Europe. The 6 month EUR forward rate is 1.15 . You hedge 100% of the exposure using a forward contract. If the actual exchange rate in 6 months is 1.02 , then what is the US dollar gain or loss on your EXPOSURE? (Note: this is Step 1 of the 3 step method of derivative analysis because I am only asking about the underlying exposure) ($3,250) loss $3,250 gain ($2,000) loss 0 Which of the following would be useful for hedging forecasted foreign exchange currency revenues? Entering into a forward purchase of the foreign currency Buying a Call Option (Long) Buying a Put Option (Short) QUESTION 2 Which of the following forwards would be useful for hedging forecasted foreign currency costs? Selling the foreign currency forward Buying the foreign currency forward QUESTION 3 Your small multinational US business has a 25,000 Euro capital expense to purchase some tools made in Germany in 6 months. The 6 month EUR forward rate is 1.15. You hedge 100% of the exposure using a forward contract. If the actual exchange rate in 6 months is 1.23 , then what is the US dollar gain or loss on your EXPOSURE? (Note: this is Step 1 of the 3 step method of derivative analysis because I am only asking about the underlying business exposure) ($3,250) loss $3,250 gain ($2,000) loss $2,000 gain Click Save and Submit to save and submit. Click Save All Answers to save all answers. You want to convert 10,000 Euro to US dollars and the exchange rate is 1.15 US dollar per 1 Euro. How much will you have after converting? $11,500 $8,695.65 QUESTION 7 You want to convert 10,000 Canadian dollars (CAD) to US dollars (USD) and the exchange rate is 1.15 CAD per 1 USD. How much will you have after converting? $11,500$8,695.65 QUESTION 8 Write the number for one trillion using a 1 followed by the appropriate number of zeros Your small multinational US business has a 25,000 Euro capital expense to purchase some tools made in Germany in 6 months. The 6 month EUR forward rate is 1.15. You hedge 100% of the exposure using a forward contract. If the actual exchange rate in 6 months is 1.23 , then what is the US dollar gain or loss on your HEDGE CONTRACT? (Note: Since I am asking about the hedge contract only, this is Step 2 of the 3 step method of derivative analysis) $2,000 gain ($2,000) loss ($3,250) loss QUESTION 5 You plan to spend 25,000 Euro to purchase a car made in Germany in 6 months so that you can travel around Europe. The 6 month EUR forward rate is 1.15 . You hedge 100% of the exposure using a forward contract. If the actual exchange rate in 6 months is 1.02 , then what is the US dollar gain or loss on your EXPOSURE? (Note: this is Step 1 of the 3 step method of derivative analysis because I am only asking about the underlying exposure) ($3,250) loss $3,250 gain ($2,000) loss 0