Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the incomplete question please write corrext answers in the BOXES. thank you The following data from the just completed year are taken from

please answer the incomplete question

please write corrext answers in the BOXES. thank you

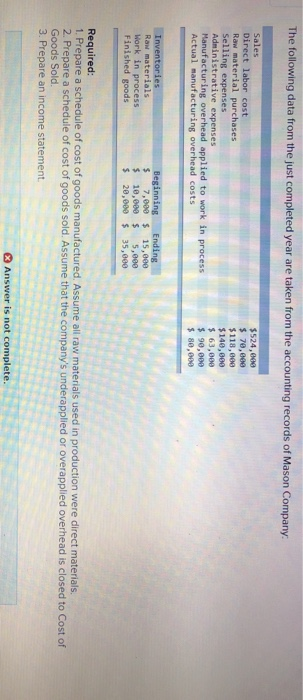

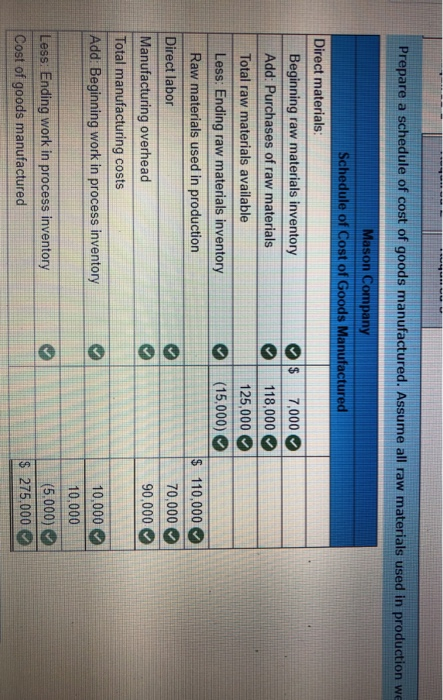

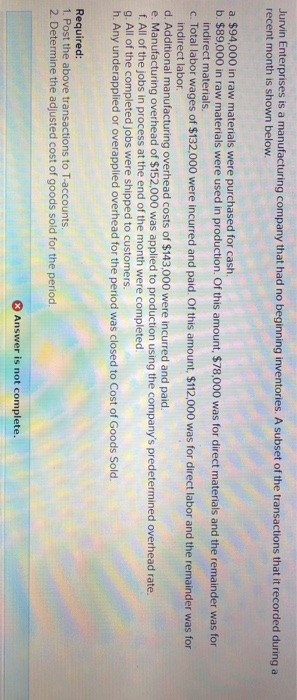

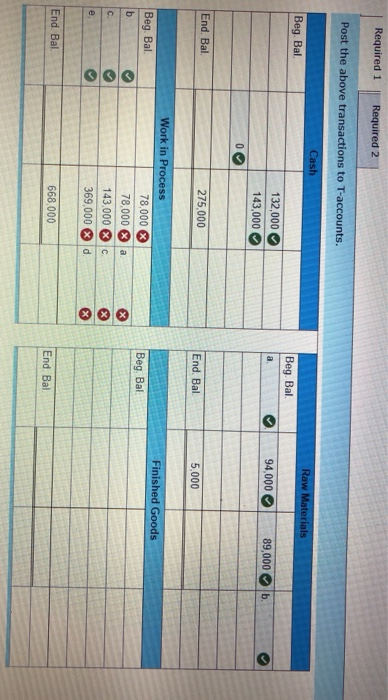

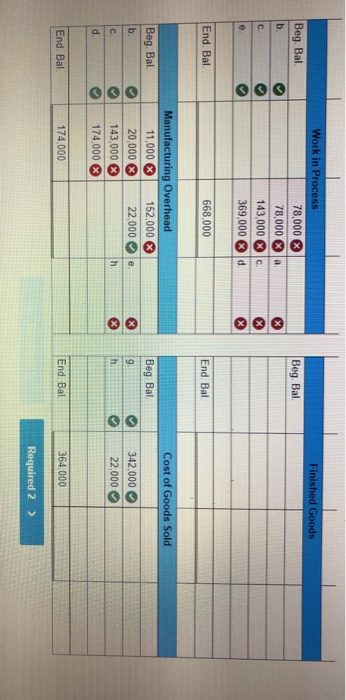

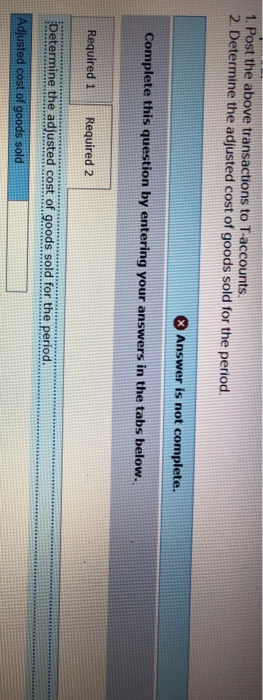

The following data from the just completed year are taken from the accounting records of Mason Company: Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs $524,000 $70,000 $118,888 $140,000 $ 63,000 $ 90,000 $ 80,000 Inventories Raw materials Work in process Finished goods Beginning Ending $ 7,000 $ 15,000 $ 10,000 $ 5,000 $ 20,000 $ 35,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. X Answer is not complete. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production we Mason Company Schedule of Cost of Goods Manufactured Direct materials: Beginning raw materials inventory $ 7,000 Add: Purchases of raw materials 118,000 Total raw materials available 125,000 Less: Ending raw materials inventory (15,000) Raw materials used in production Direct labor Manufacturing overhead Total manufacturing costs Add. Beginning work in process inventory $ 110,000 70,000 90,000 10.000 10,000 (5.000) $ 275.000 Less: Ending work in process inventory Cost of goods manufactured Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. a. $94,000 in raw materials were purchased for cash, b. $89,000 in raw materials were used in production of this amount, $78,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for indirect labor d. Additional manufacturing overhead costs of $143,000 were incurred and paid. e Manufacturing overhead of $152,000 was applied to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. 9. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead for the period was closed to cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Determine the adjusted cost of goods sold for the period. X Answer is not complete. Required 1 Required 2 Post the above transactions to T-accounts. Cash Raw Materials Beg Bal Beg Bal. 132,000 143,000 a. 94,000 89,000 b 0 End. Bal 275.000 End. Bal 5.000 Finished Goods Beg. Bal. b Beg Bal Work in Process 78,000 78,000 a 143.000 X C 369,000 d C. e End. Bal. 668,000 End Bal Finished Goods Beg. Bal Beg Bal b Work in Process 78,000 78,000 143,000 369,000 a X c e. d End. Bal 668,000 End. Bal Cost of Goods Sold Beg Bal Beg Bal b Manufacturing Overhead 11,000 X 152,000 X 20,000 22,000 143.000 174,000 e X 9 h SIS 342,000 22,000 h d. End. Bal 174,000 End. Bal 364.000 Required 2 > 1. Post the above transactions to T-accounts. 2. Determine the adjusted cost of goods sold for the period. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the adjusted cost of goods sold for the period. Adjusted cost of goods sold Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started