Answered step by step

Verified Expert Solution

Question

1 Approved Answer

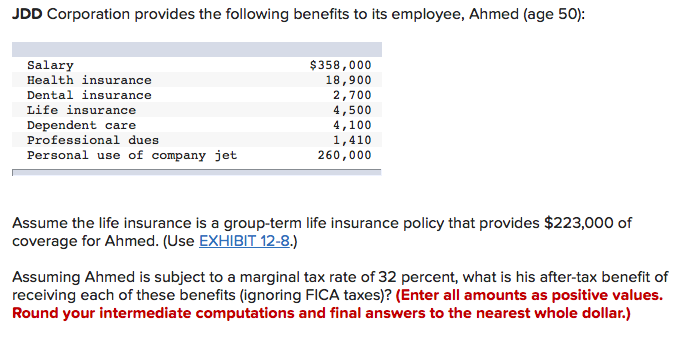

Please answer the missing numbers. JDD Corporation provides the following benefits to its employee, Ahmed (age 50): Salary Health insurance Dental insurance Life insurance Dependent

Please answer the missing numbers.

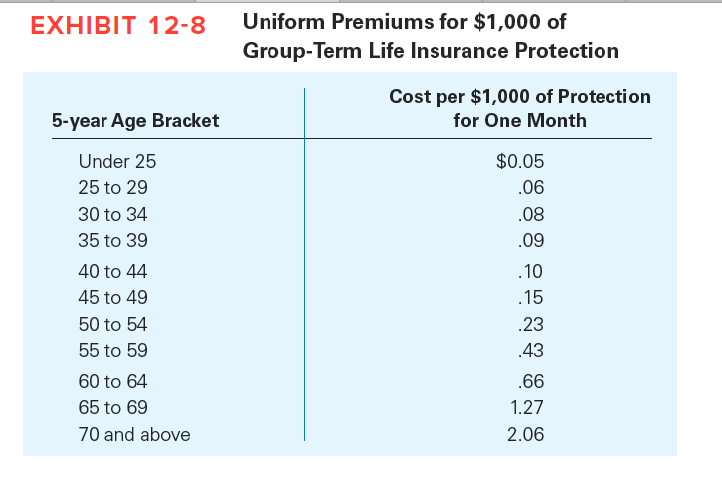

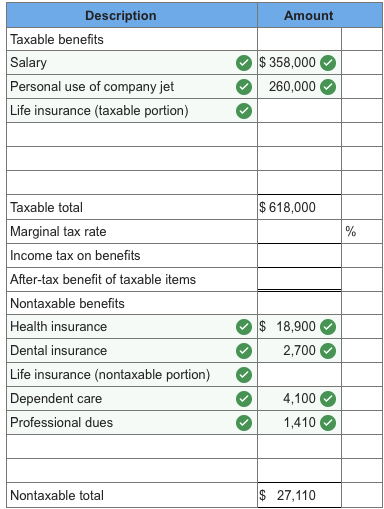

JDD Corporation provides the following benefits to its employee, Ahmed (age 50): Salary Health insurance Dental insurance Life insurance Dependent care Professional dues Personal use of company jet $ 358,000 18,900 2,700 4,500 4,100 1,410 260,000 Assume the life insurance is a group-term life insurance policy that provides $223,000 of coverage for Ahmed. (Use EXHIBIT 12-8.) Assuming Ahmed is subject to a marginal tax rate of 32 percent, what is his after-tax benefit of receiving each of these benefits (ignoring FICA taxes)? (Enter all amounts as positive values. Round your intermediate computations and final answers to the nearest whole dollar.) Uniform Premiums for $1,000 of Group-Term Life Insurance Protection Cost per $1,000 of Protection for One Month 5-year Age Bracket $0.05 Under 25 25 to 29 30 to 34 35 to 39 40 to 44 45 to 49 50 to 54 55 to 59 60 to 64 65 to 69 70 and above 2.06 Amount Description Taxable benefits Salary Personal use of company jet Life insurance (taxable portion) $ 358,000 260,000 $ 618,000 Taxable total Marginal tax rate Income tax on benefits After-tax benefit of taxable items Nontaxable benefits Health insurance Dental insurance Life insurance (nontaxable portion) Dependent care Professional dues $ 18,900 2,700 4,100 1,410 Nontaxable total $ 27,110

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started