Answered step by step

Verified Expert Solution

Question

1 Approved Answer

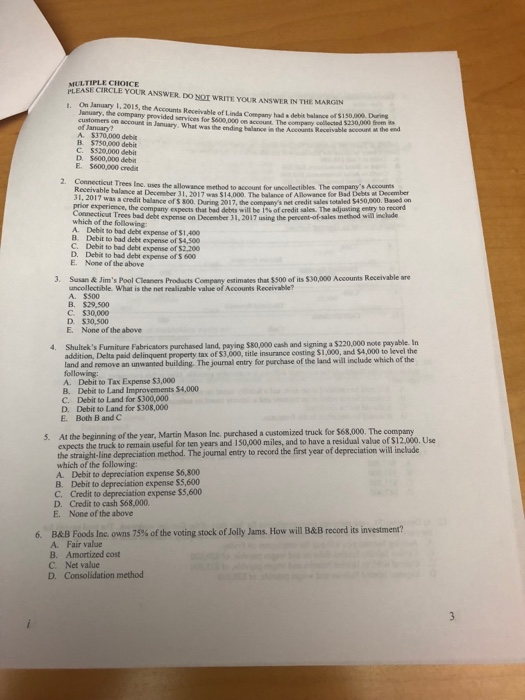

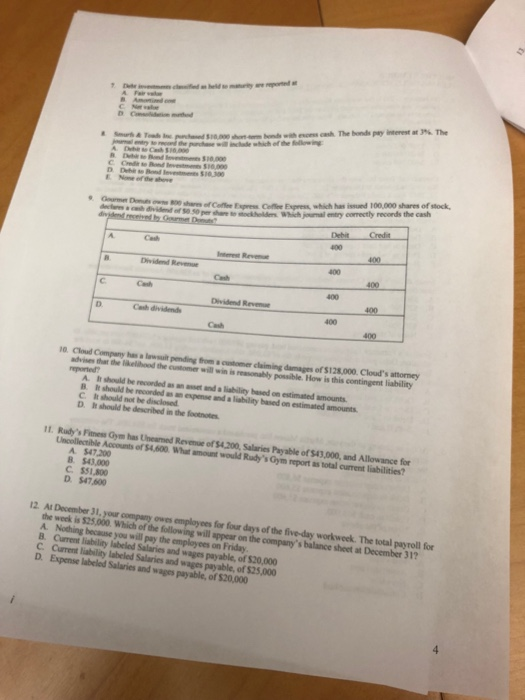

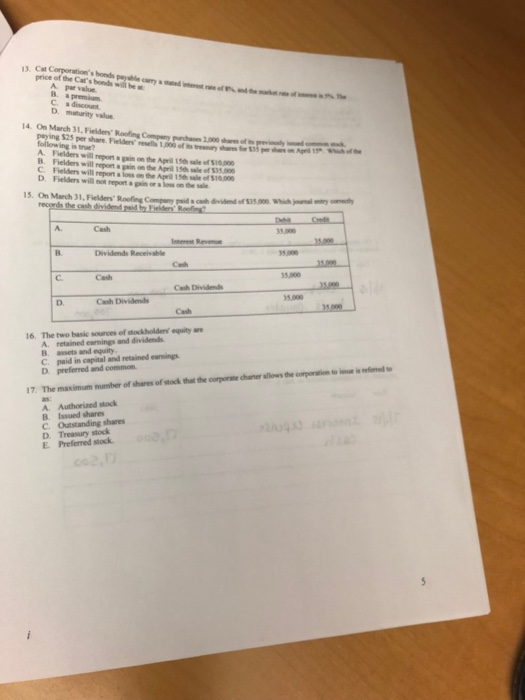

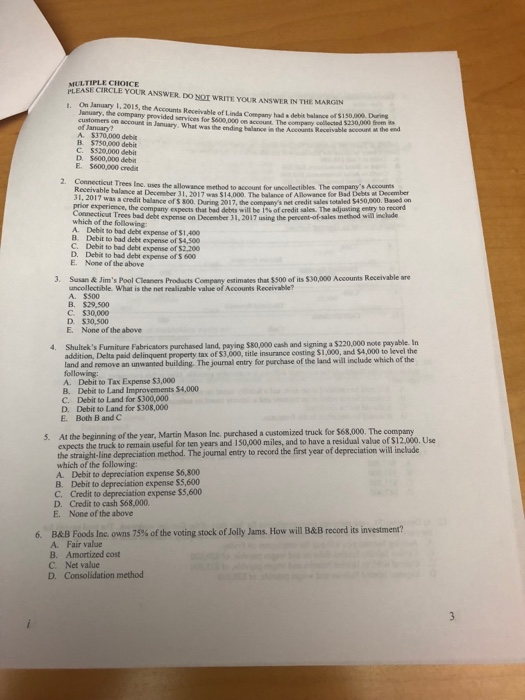

Please answer the multiple choice questions, no work needed MULTIPLE CHOICE PLEASE CIRCLE YOUR ANSWER DONor wRITE YOUR ANSWER IN THE MARGIN On January 1,2015,

Please answer the multiple choice questions, no work needed

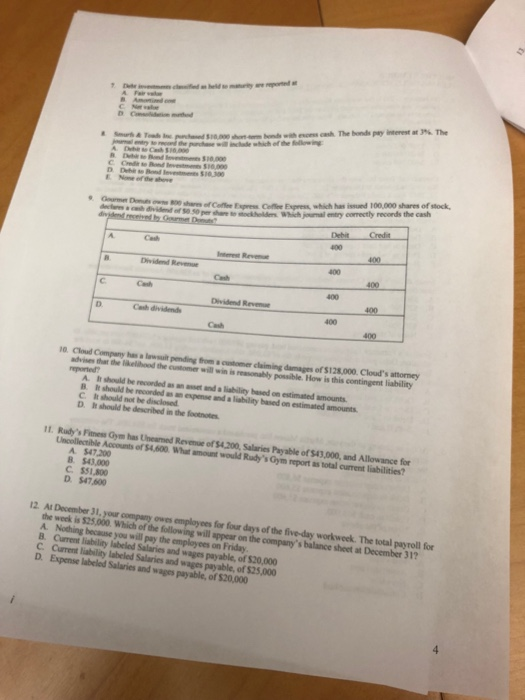

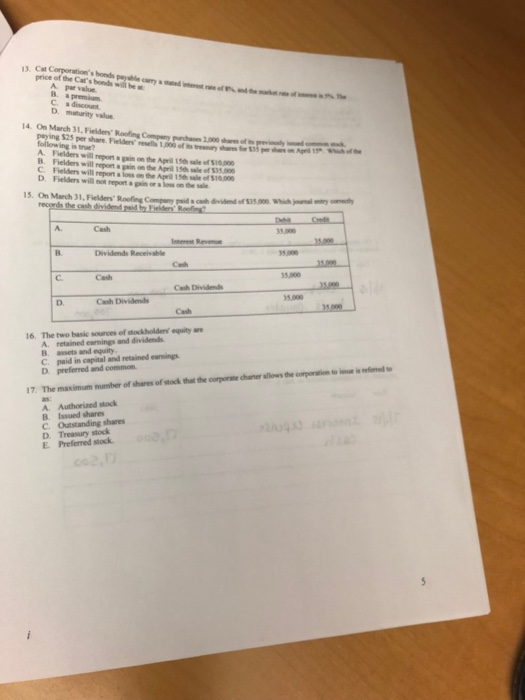

MULTIPLE CHOICE PLEASE CIRCLE YOUR ANSWER DONor wRITE YOUR ANSWER IN THE MARGIN On January 1,2015, the Accounts Receivable of Linda Company had a debit balance of 51 January, the company provided services for $600,.000 on account. The company collected $230,000 tr t. $150.000 Daring customers on account in January. What was the ending balance in the Accounts Receivable of January?o A. $370,000 debit B $7,000 debit C. $520,000 debit D. 5600,000 debit E. $600,000 credit 2. Connecticut Tirees Ine. uses the allowance method to account for uncellectibles The company's Accounts ae blance at December 31, 2017 was 514,000. The balance of Allowance for Bad Debts at December 31, 2017 prior experience, t Connectiout Trees bad debt expense on December 31, 2017 using the percent-of-sales which of the folowing A. Debit so bad debt expense of $1.400 B. Debit to bad debt expense of $4,500 C. Debit to bad debt expense of $2,200 D. Debit to bad debt expense of s 600 E. None of the above balance of S 800. During 2017, the company's net credit sales totaled $450,000. Based on he company expects that bad debts will be 1% of credit sales. The entry to record will inchade 3. Susan & Jim's Pool Cleaners Prodacts Compay estimates that $500 of its $30,000 Accounts Receivable are uncollectible. What is the net realizable value of Accounts Receivable? A. $500 B. $29,s00 C. $30,000 D. $30,500 E. None of the above 4. Shultek's Furniture Fabricators purchased land, paying $80,000 cash and signing a $220,000 note payable In addition, Delta paid delinquent property tax of $3,000, title insurance costing $1,000, and $4,000 to level the land and remove an unwanted building. The journal entry for parchase of the land wil A. Debit to Tax Expense $3,000 B. Debit to Land Improvements $4,000 C. Debit to Land for $300,000 D. Debit so Land for $308,000 E. Both B and C S. At the beginning of the year, Martin Mason Inc. purchased a custoemized truck for $68,000. The compamy s the truck to remain useful for ten years and 150,000 miles, and to have a residual value of $12,000. Use the straight-line depreciation method. The journal entry to record the first year of depreciation will inclade which of the following: A. Debit to depreciation expense $6,800 B. Debit to depreciation expense $5,600 C. Credit to depreciation expense $5,600 D. Credit to cash $68,000. E. None of the above 6. B&BFoods Inc. owns 75% ofthe voting stock ofJolly Jars. How wil B&B record its investment? A. Fair value B. Amortized cost C. Net value D. Consolidation method c bends with encess cash The bonds pay interest at 3% The h Goumer Dnuts 800 s of Coffee Express joumal entry crrectly reconds the cash ahdoCfe xpss Coffie Express, which has issued 100,000 shares of sock C. 400 400 Cloud Company has a lewsuit pending from a customer claiming damages of $128,000. Cloud's atorney advises thar the ielthood the cuntomer will win is reasonably possible. How is this contingent liability A. It should be recorded as an asset and a liability hased on estimated amounts B. IR should be recorded as an expense and a liability based on estimated amounts C It should not be disclosed D. R should be described in the footnotes .Rudy's Fitmess Gym has Uneamed Revenue of $4,200, Salaries Payable of $43,000, and Allowance for incollectible Accounts of $4,600 What amount would Rudy's Gym neport as total current liabilities? A $47.200 $43,000 $51,800 D $47.600 12 At December 31, A December 31, your compary owes omployes for four days of the five-day workweek. The total payroll for the week is 525,000. Which of the A. Nothing because you will pay the employees on Friday B. Current liability labeled Salaries and wages payable, of $20,000 C. Current liability labeled Salaries and wages payable, of $25,000 D. Expense labeled Salaries and wages payable, of $20,000 will 13 Cat Corporation's bonds payable price of the Cat's bonds will be A. par value C. a discount 14 On March 31,Fielders Roofing Company parchases 2,000ha ofp ping $25 per share. Fielden resells 1,000 oftry shre follow ing is se? A. Fielders will repont a gain on the Aprill 15t sle of $0 B. Fielders will C. Fielders will report a loss on the April 15th sale of $10.00 D. Fielders will not report a gain or a los on the sale repoet a gain on the April 15th sale of $35,000 15. On March 31, Fielders Roofing Compeny paid s cah dviden of $3se wich Company paid s casth dividend of $35.Wo A. Cash 35.000 5.000 C. 35.000 D. Cash 16. The two basic sources of stokholdens equity we d earnings and dividends in capital and retained earnings B. assets and equity D. preferred and common in e 17. The maximum number of shares of stock that the corporate charter allows the corporation to i A. Authorized stock B. Issued shares C. Outstanding shares D. Treasury stock E Prefered stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started