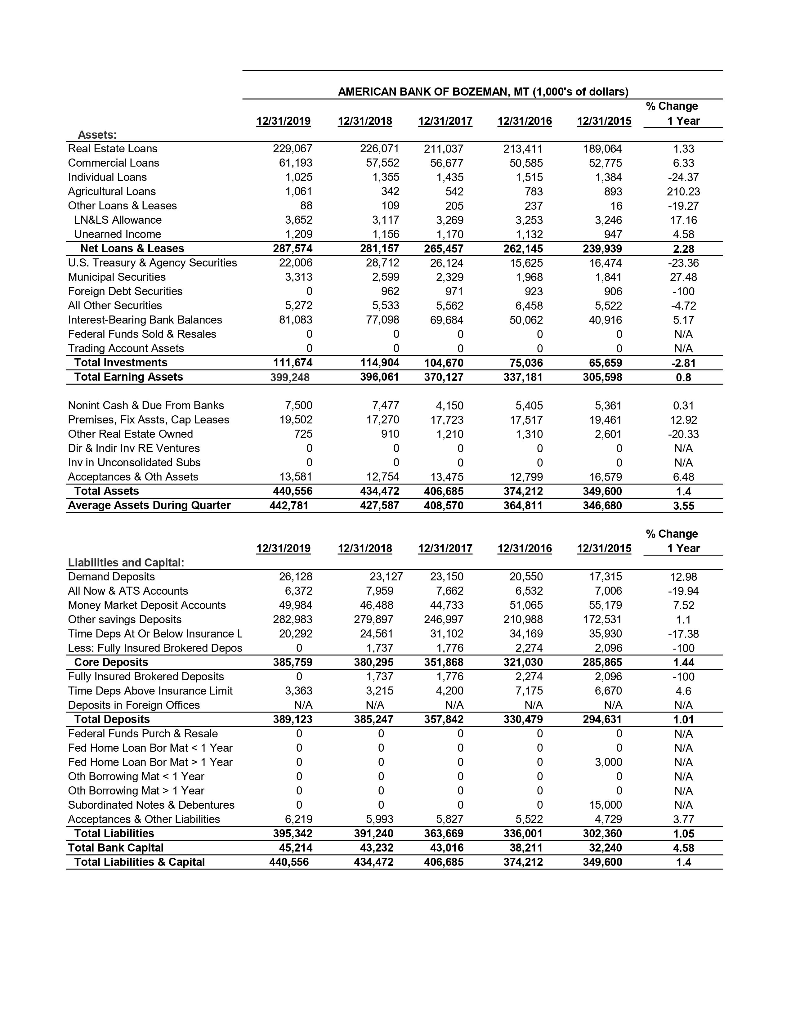

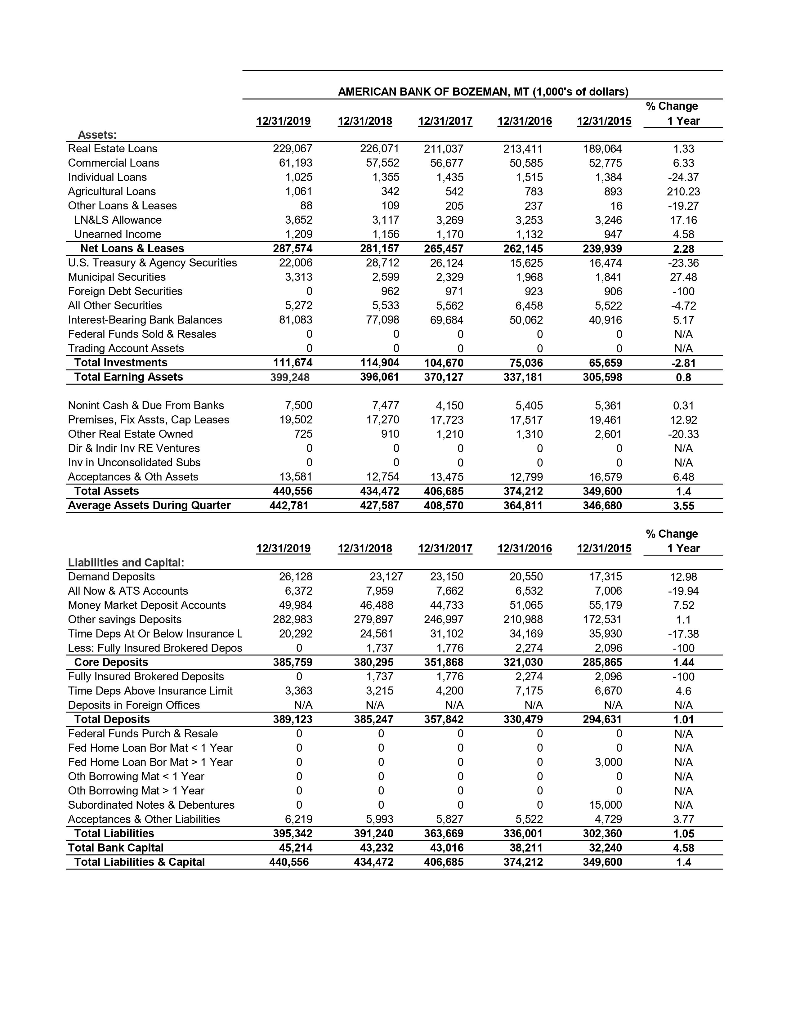

Please Answer the Question #5 only 1. List and describe the types of deposit accounts available for depositors at the bank. 2. The category labeled Core deposits are deposits made in the bank's natural demographic/geographic market. What is the 2019 ratio of core deposits to total deposits? 3. What makes money market and time deposit accounts different from savings accounts (other savings)? 4. From the bank's perspective, why might savings accounts (other savings) be preferable to money market accounts? Why might time deposits be preferable to savings accounts? 5. Brokered deposits are deposits obtained through a broker from outside the bank's demographic/geographic area. Why is it important to separate these from core deposits? AMERICAN BANK OF BOZEMAN, MT (1,000's of dollars) 12/31/2019 12/31/2018 12/31/2017 12/31/2016 12/31/2015 % Change - 1 Year 229,067 61,193 1.025 1,061 211,037 56.677 1,435 189,064 52.775 1,384 893 542 205 16 88 3,652 Assets: Real Estate Loans Commercial Loans Individual Loans Agricultural Loans Other Loans & Leases LN&LS Allowance Unearned Income Net Loans & Leases U.S. Treasury & Agency Securities Municipal Securities Foreign Debt Securities All Other Securities Interest-Bearing Bank Balances Federal Funds Sold & Resales Trading Account Assets Total Investments Total Earning Assets 1.209 287,574 22,006 3,313 226.071 57,552 1.355 342 109 3,117 1,156 281,157 28,712 2,599 962 5,533 77,098 3.269 1,170 265,457 26.124 2.329 971 5,562 69.684 213,411 50,585 1,515 783 237 3,253 1,132 262,145 15,625 1.968 923 6,458 50,062 3.246 947 239,939 16,474 1.841 906 5,522 40,916 1.33 6.33 -24.37 210.23 -19.27 17.16 4.58 2.28 -23.36 27.48 -100 4.72 5.17 NA NA -2.81 0.8 5.272 81,083 111,674 399,248 114.904 396,061 104,670 370,127 75,036 337,181 65,659 305,598 35 7.500 19,502 725 7.477 17,270 910 4,150 17.723 1,210 5,405 17,517 1,310 5,361 19,461 2.601 Nonint Cash & Due From Banks Premises, Fix Assts, Cap Leases Other Real Estate Owned Dir & Indir Inv RE Ventures Inv in Unconsolidated Subs Acceptances & Oth Assets Total Assets Average Assets During Quarter 0.31 12.92 -20.33 NIA N/A 6.48 1.4 3.55 13,581 440,556 442,781 12,754 434,472 427,587 13.475 406,685 408,570 12,799 374,212 364,811 16,579 3 49,600 346.680 % Change 1 Year 12/31/2019 12/31/2018 12/31/2017 12/31/2016 12/31/2015 26,128 6,372 49.984 282.983 20,292 Llabilities and Capital: Demand Deposits All Now & ATS Accounts Money Market Deposit Accounts Other savings Deposits Time Deps At Or Below Insurance L Less: Fully Insured Brokered Depos Core Deposits Fully Insured Brokered Deposits Time Deps Above Insurance Limit Deposits in Foreign Offices Total Deposits Federal Funds Purch & Resale Fed Home Loan Bor Mat 1 Year Oth Borrowing Mat 1 Year Subordinated Notes & Debentures Acceptances & Other Liabilities Total Liabilities Total Bank Capital Total Liabilities & Capital 23,127 7,959 46.488 279.897 24,561 1.737 380.295 1.737 3,215 N/A 385,247 23,150 7.662 44,733 246,997 31, 102 1.776 351,868 1,776 4.200 N/A 357,842 20,550 6,532 51,065 210,988 34,169 2,274 321,030 2,274 7,175 NIA 330,479 17.315 7,006 55.179 172,531 35,930 2,096 285,865 2.096 6,670 NIA 294,631 385.759 3,363 N/A 389,123 12.98 -19.94 7.52 1.1 -17.38 -100 1.44 -100 4.6 N/A 1.01 NA NA N/A N/A NIA N/A 3.77 1.05 4.58 1.4 3,000 6.219 395,342 45,214 440,556 5,993 391.240 43,232 434,472 5,827 363,669 4 3,016 406,685 5,522 336,001 38,211 374,212 15,000 4.729 302.360 32,240 349,600