Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the question and do explain as much as possible. Thanks. Text is clear tell me what part of it you do not understand.

Please answer the question and do explain as much as possible. Thanks.

Text is clear tell me what part of it you do not understand. Sorry for my handwriting

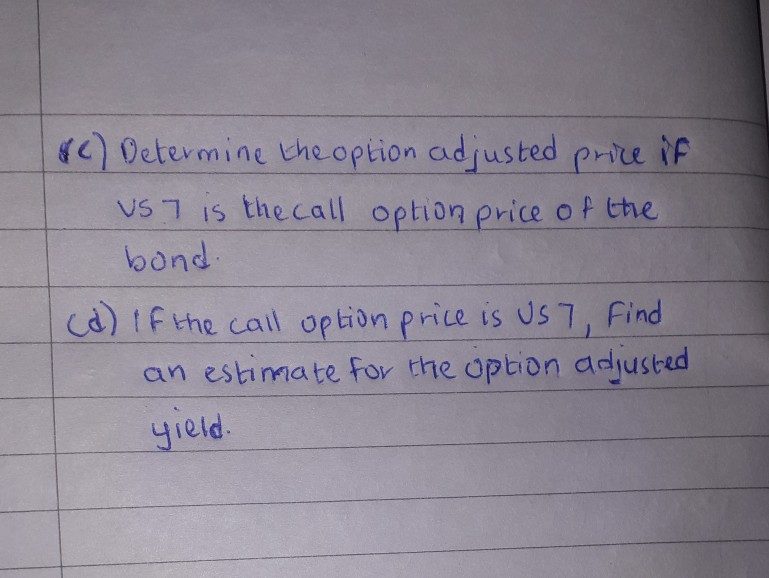

Part C and D

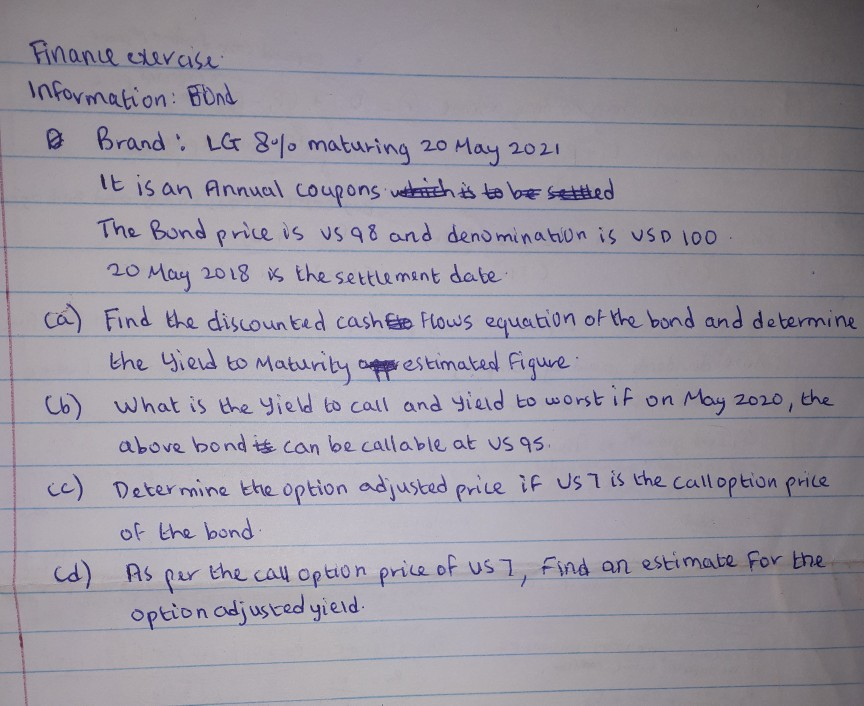

Finance exercise Information Bond Brand: LG 8% maturing 20 May 2021 It is an Annual coupons which is to be settled The Bond price is us 98 and denomination is USD 100 20 May 2018 is the settlement date (a) Find the discounted cashto flows equation of the bond and determine the yield to Maturity apprestimated figure. (6) What is the yield to call and yield to worst if on May 2020, the above bond to can be callable at us as. (c) Determine the option adjusted price if us is the call option price of the bond (d) As per the call option price of us 7 Find an estimate for the option adjusted yield c) Determine the option adjusted price of us 7 is the call option price of the bond. (d) If the call option price is us7, Find an estimate for the option adjusted yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started