please answer the question

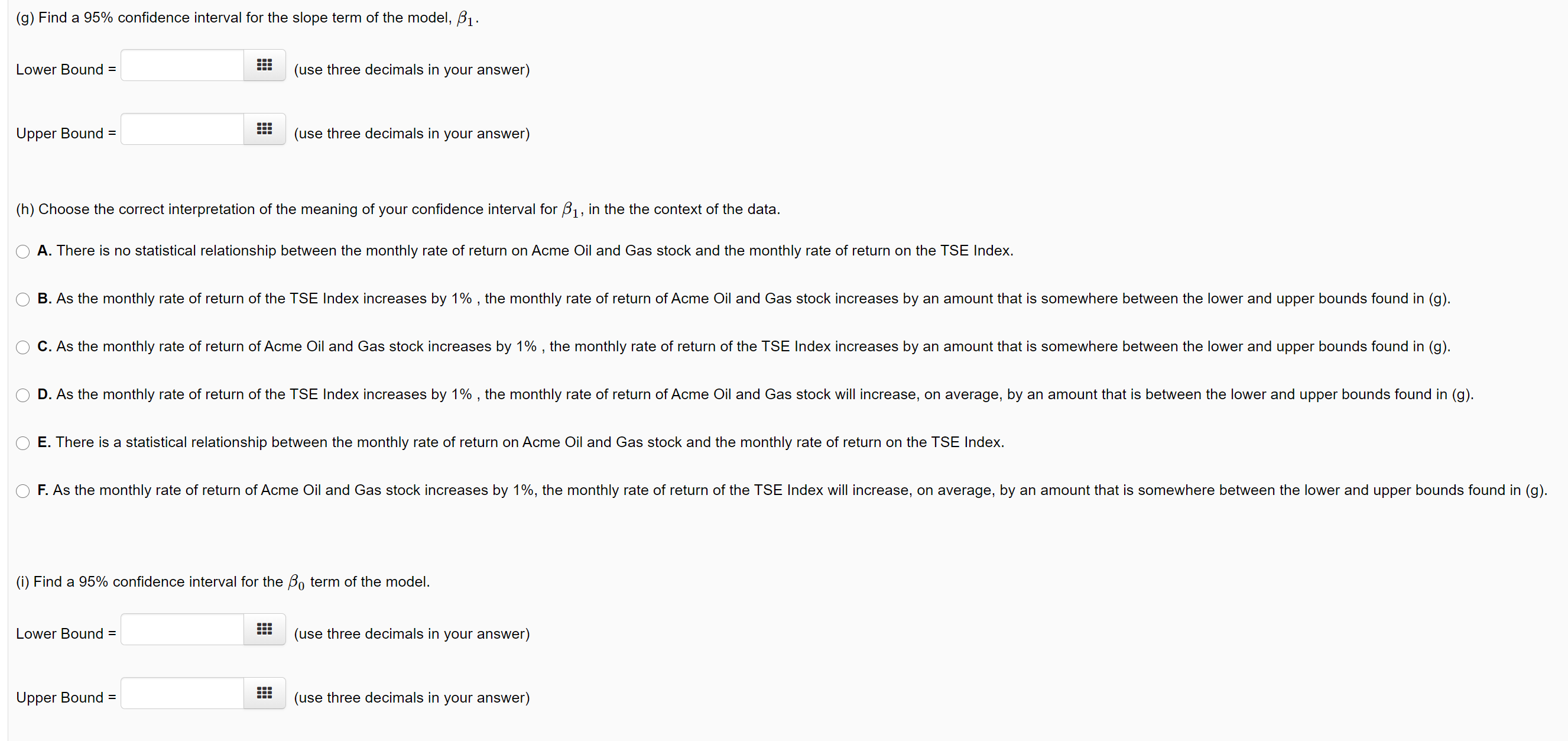

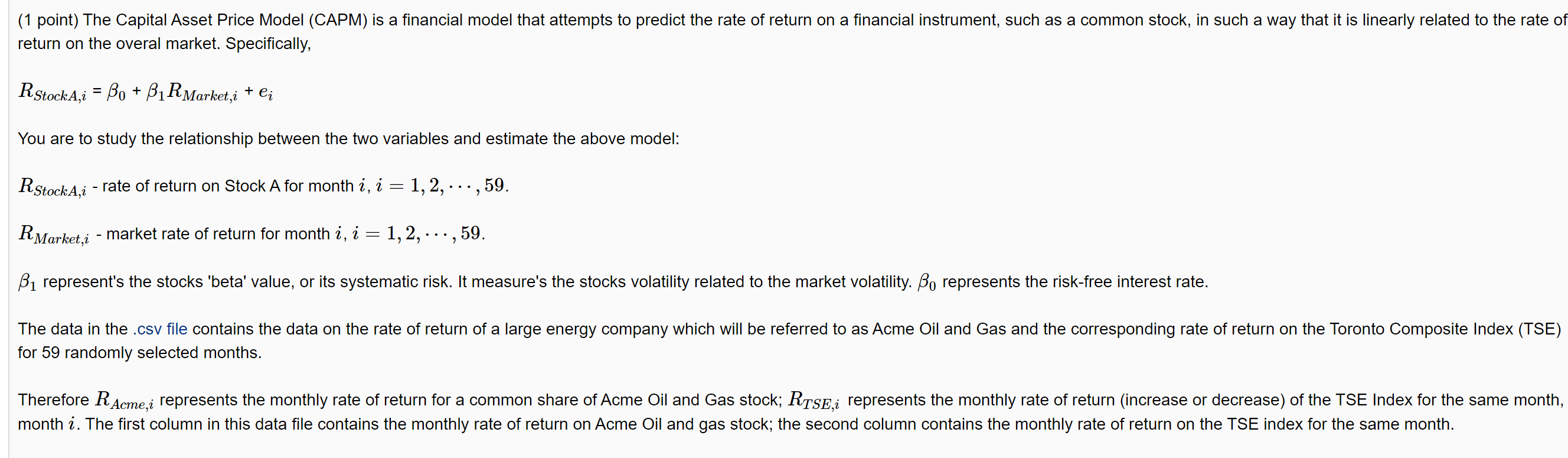

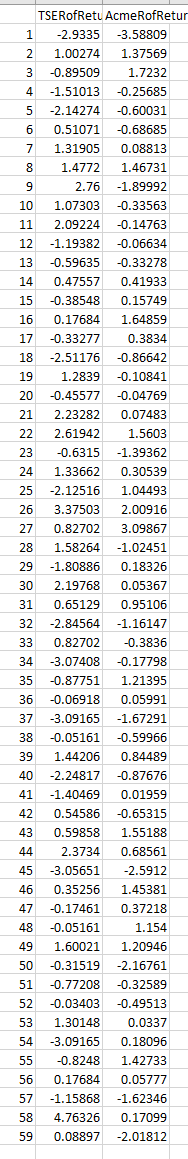

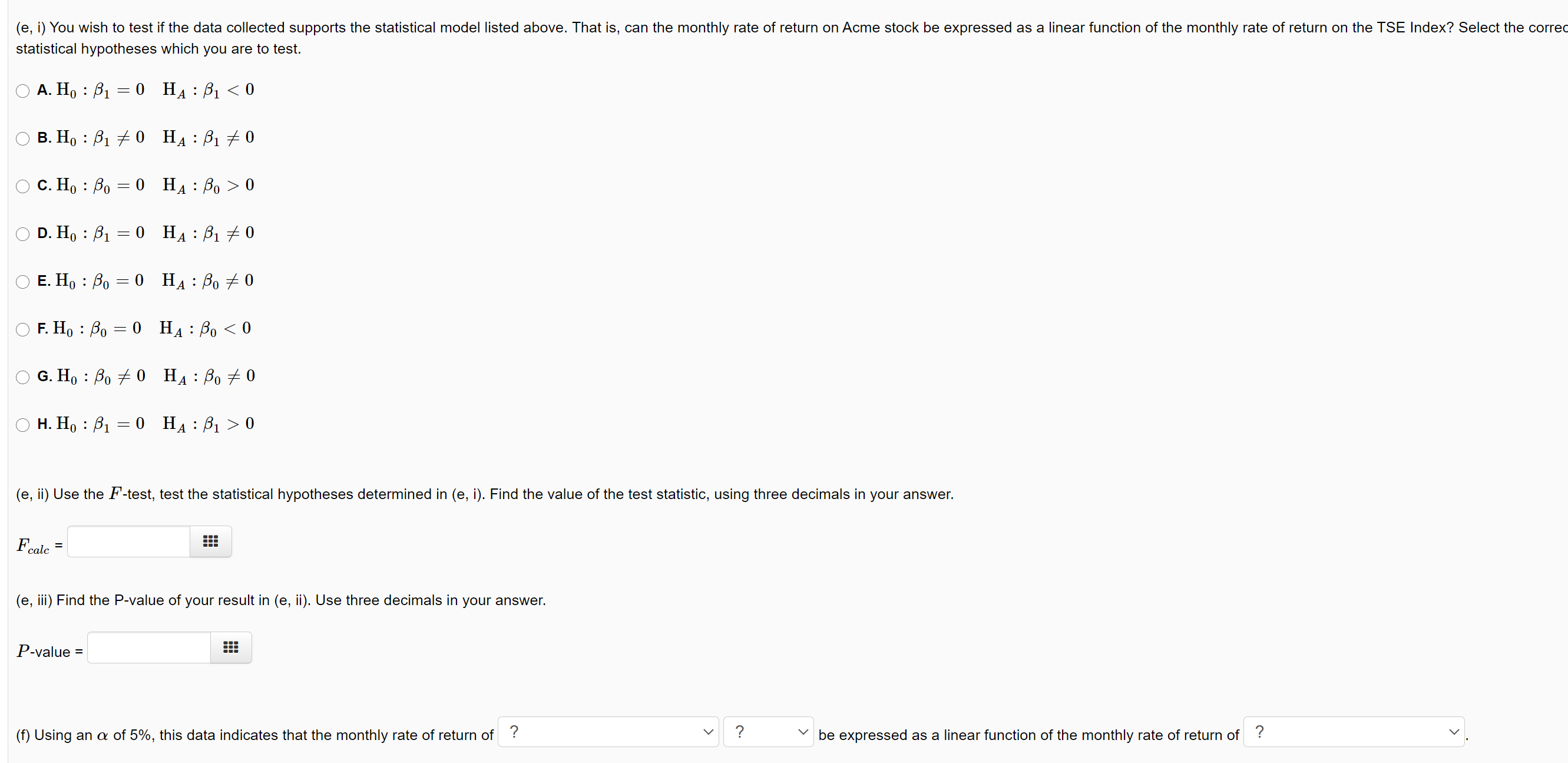

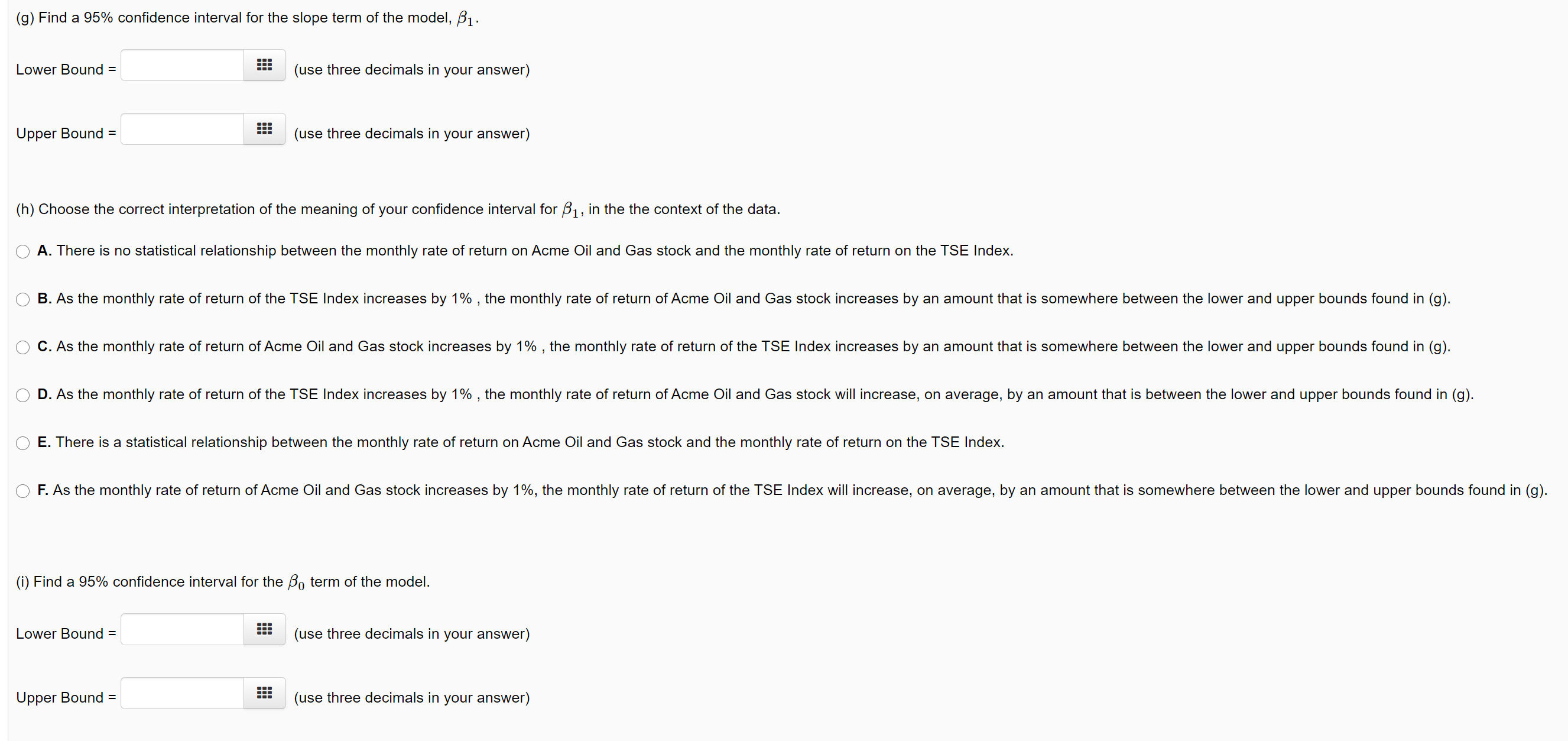

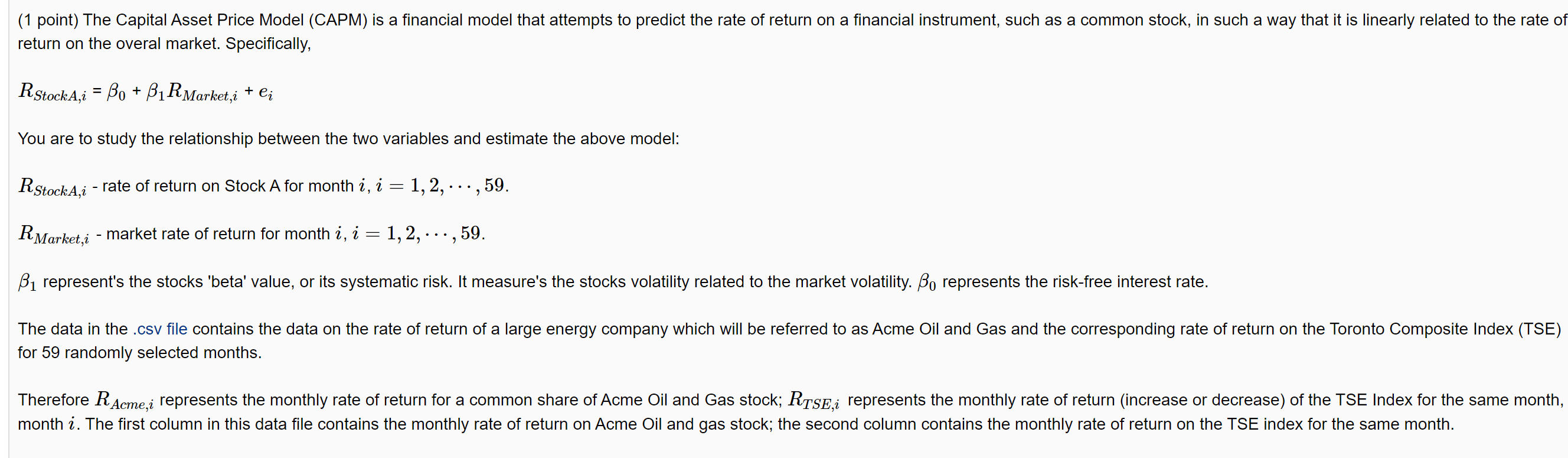

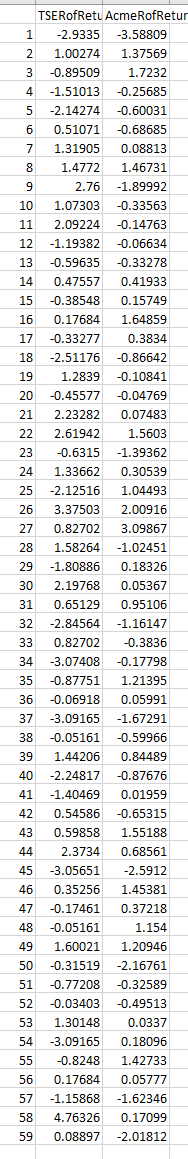

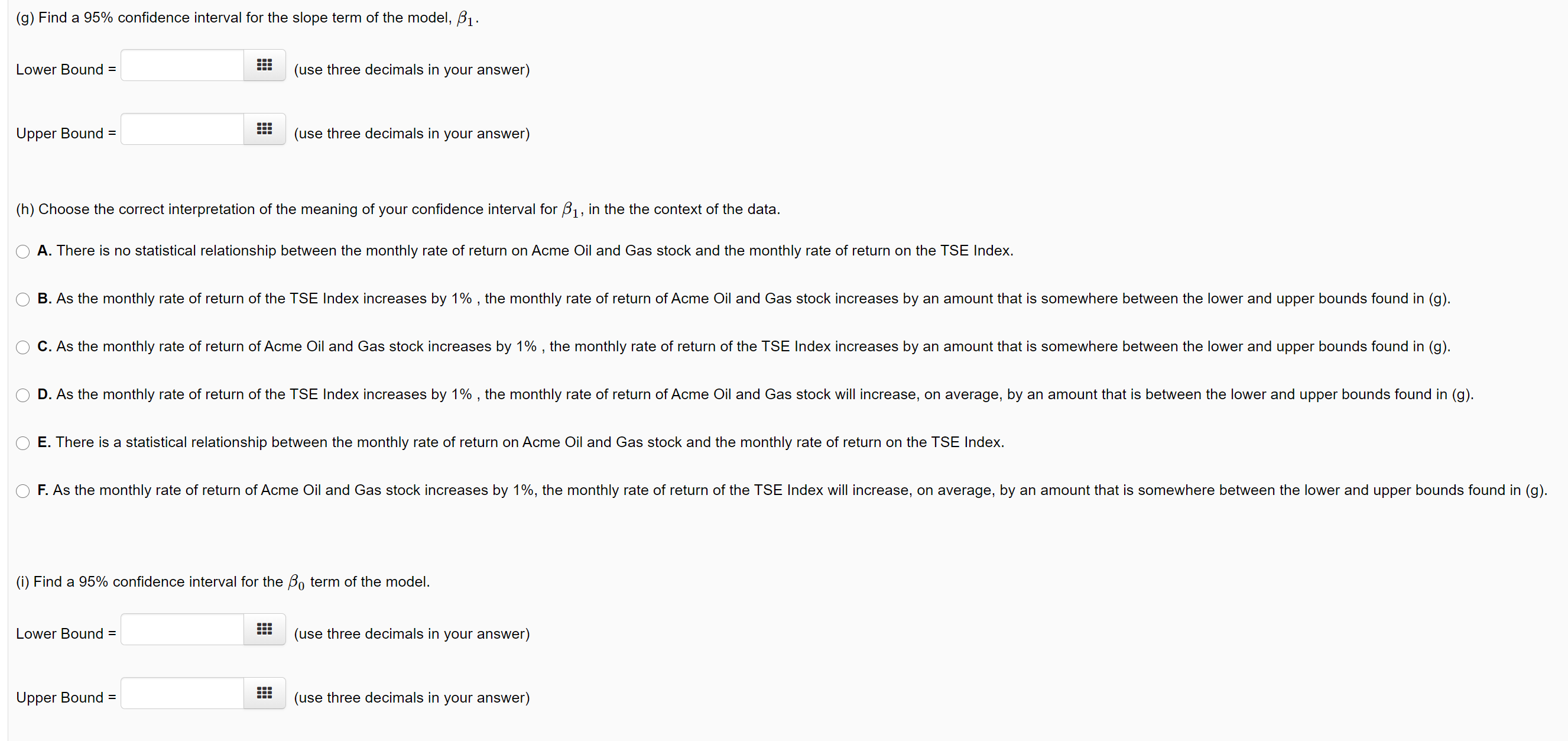

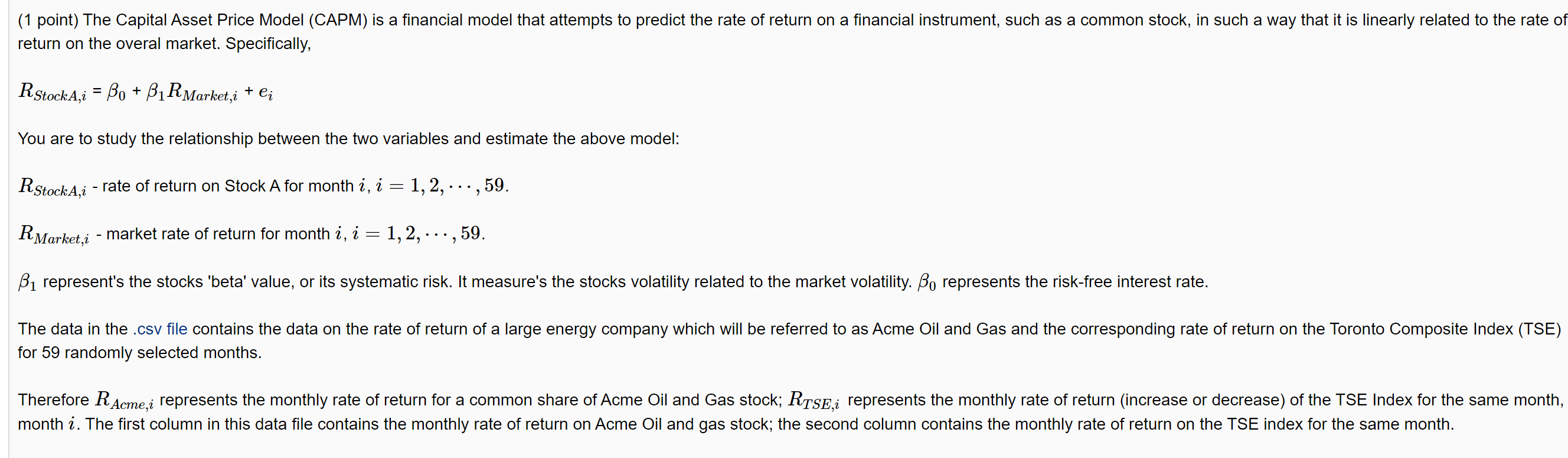

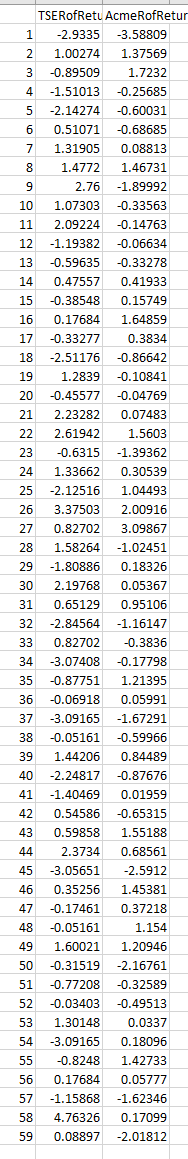

(e, i) You wish to test if the data collected supports the statistical model listed above. That is, can the monthly rate of return on Acme stock be expressed as a linear function of the monthly rate of return on the TSE Index? Select the corred statistical hypotheses which you are to test. O A. Ho : B1 = 0 HA : B1 0 O D. Ho : B1 = 0 HA : B1 0 E. Ho : Bo = 0 HA : Bo # 0 OF. Ho : Bo = 0 HA : Bo 0 (e, ii) Use the F-test, test the statistical hypotheses determined in (e, i). Find the value of the test statistic, using three decimals in your answer. Fcalc = (e, iii) Find the P-value of your result in (e, ii). Use three decimals in your answer. P-value = (f) Using an a of 5%, this data indicates that the monthly rate of return of ? V ? be expressed as a linear function of the monthly rate of return of ?(9) Find a 95% condence interval for the slope term of the model, [31. Lower Bound = (use three decimals in your answer) Upper Bound = (use three decimals in your answer) (h) Choose the correct interpretation of the meaning of your condence interval for [31, in the the context of the data. 0 A. There is no statistical relationship between the monthly rate of return on Acme Oil and Gas stock and the monthly rate of return on the TSE Index. 0 B. As the monthly rate of return of the TSE Index increases by 1% , the monthly rate of return ofAcme Oil and Gas stock increases by an amount that is somewhere between the lower and upper bounds found in (g). Q C. As the monthly rate of return ofAcme Oil and Gas stock increases by 1% , the monthly rate of return of the TSE Index increases by an amount that is somewhere between the lower and upper bounds found in (g). O D. As the monthly rate of return of the TSE Index increases by 1% , the monthly rate of return ofAcme Oil and Gas stock will increase, on average, by an amount that is between the lower and upper bounds found in (g). Q E. There is a statistical relationship between the monthly rate of return on Acme Oil and Gas stock and the monthly rate of return on the TSE Index. 0 F. As the monthly rate of return ofAcme Oil and Gas stock increases by 1%, the monthly rate of return of the TSE Index will increase, on average, by an amount that is somewhere between the lower and upper bounds found in (g). (i) Find a 95% confidence interval for the g term of the model. Lower Bound = (use three decimals in your answer) Upper Bound = (use three decimals in your answer) (1 point) The Capital Asset Price Model (CAPM) is a financial model that attempts to predict the rate of return on a financial instrument, such as a common stock, in such a way that it is linearly related to the rate of return on the overal market. Specifically, RStockA,i = Bo + BIRMarket,i + ei You are to study the relationship between the two variables and estimate the above model: RStockA,i - rate of return on Stock A for month i, i = 1, 2, . . ., 59. R Market,i - market rate of return for month i, i = 1, 2, . . ., 59. B1 represent's the stocks 'beta' value, or its systematic risk. It measure's the stocks volatility related to the market volatility. Bo represents the risk-free interest rate. The data in the .csv file contains the data on the rate of return of a large energy company which will be referred to as Acme Oil and Gas and the corresponding rate of return on the Toronto Composite Index (TSE) for 59 randomly selected months. Therefore R Acme,i represents the monthly rate of return for a common share of Acme Oil and Gas stock; RISE,; represents the monthly rate of return (increase or decrease) of the TSE Index for the same month, month 2. The first column in this data file contains the monthly rate of return on Acme Oil and gas stock; the second column contains the monthly rate of return on the TSE index for the same month.TSERofRetu AcmeRofRetu -2.9335 -3.58809 IN 1.00274 1.37569 -0.89509 1.7232 4 -1.51013 -0.25685 5 -2.14274 -0.60031 6 0.51071 -0.68685 7 1.31905 0.08813 8 1.4772 1.46731 9 2.76 -1.89992 10 1.07303 -0.33563 11 2.09224 -0.14763 12 -1.19382 -0.06634 13 -0.59635 -0.33278 14 0.47557 0.41933 15 -0.38548 0.15749 16 0.17684 1.64859 17 -0.33277 0.3834 18 -2.51176 -0.86642 19 1.2839 -0.10841 20 -0.45577 -0.04769 21 2.23282 0.07483 22 2.61942 1.5603 23 -0.6315 -1.39362 24 1.33662 0.30539 25 -2.12516 1.04493 26 3.37503 2.00916 27 0.82702 3.09867 28 1.58264 -1.02451 29 -1.80886 0.18326 30 2.19768 0.05367 31 0.65129 0.95106 32 -2.84564 -1.16147 33 0.82702 -0.3836 34 -3.07408 -0.17798 35 -0.87751 1.21395 36 -0.06918 0.05991 37 -3.09165 -1.67291 38 -0.05161 -0.59966 39 1.44206 0.84489 40 -2.24817 -0.87676 41 -1.40469 0.01959 42 0.54586 -0.65315 43 0.59858 1.55188 44 2.3734 0.68561 45 -3.05651 -2.5912 46 0.35256 1.45381 47 -0.17461 0.37218 48 -0.05161 1.154 49 1.60021 1.20946 50 -0.31519 -2.16761 51 -0.77208 -0.32589 52 -0.03403 -0.49513 53 1.30148 0.0337 54 -3.09165 0.18096 55 -0.8248 1.42733 56 0.17684 0.05777 57 -1.15868 -1.62346 58 4.76326 0.17099 59 0.08897 -2.01812