Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the question fully.Thank you. ALL DATA IS UNDER INFORMATION!!! QUESTION 1: MANUFACTURING (40 marks; 20 minutes) Sihle Sangweni owns two separate factories that

Please answer the question fully.Thank you.

ALL DATA IS UNDER INFORMATION!!!

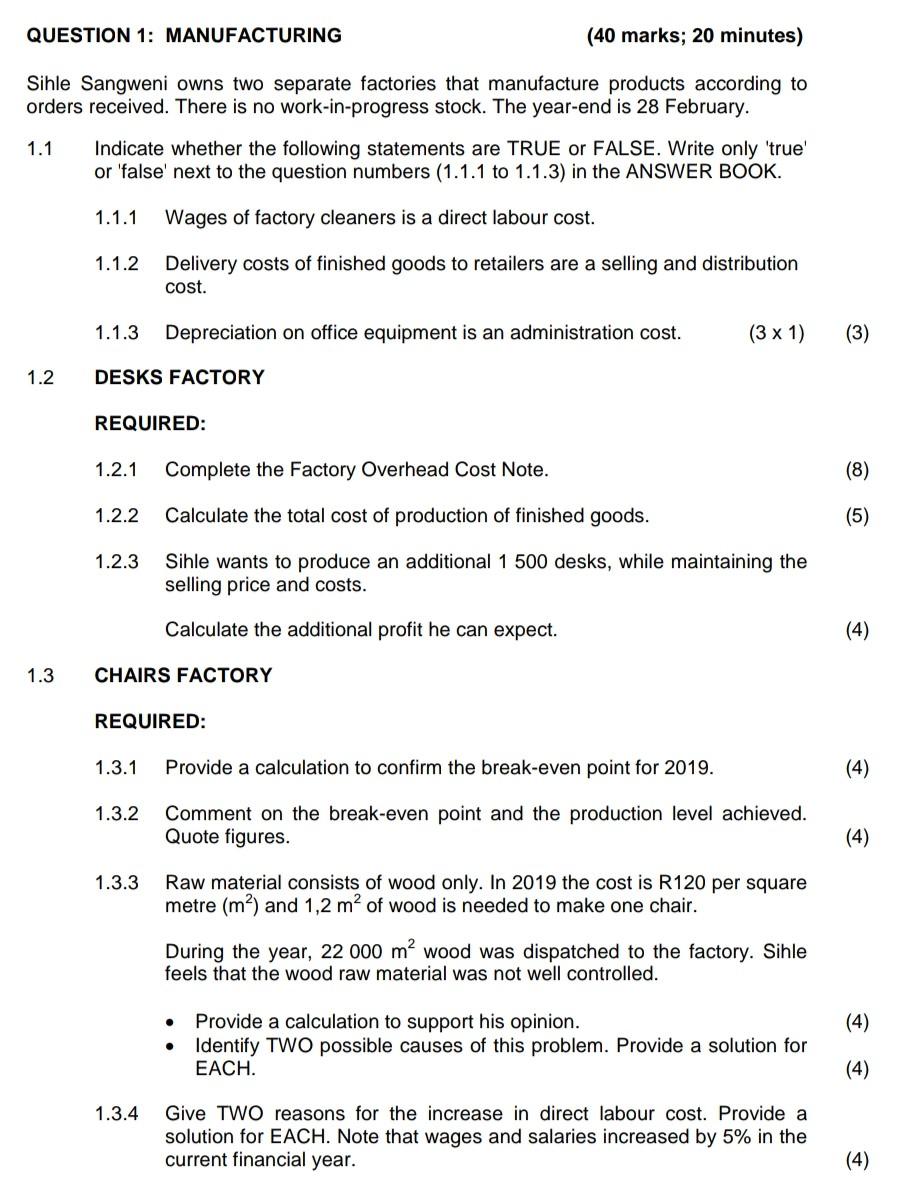

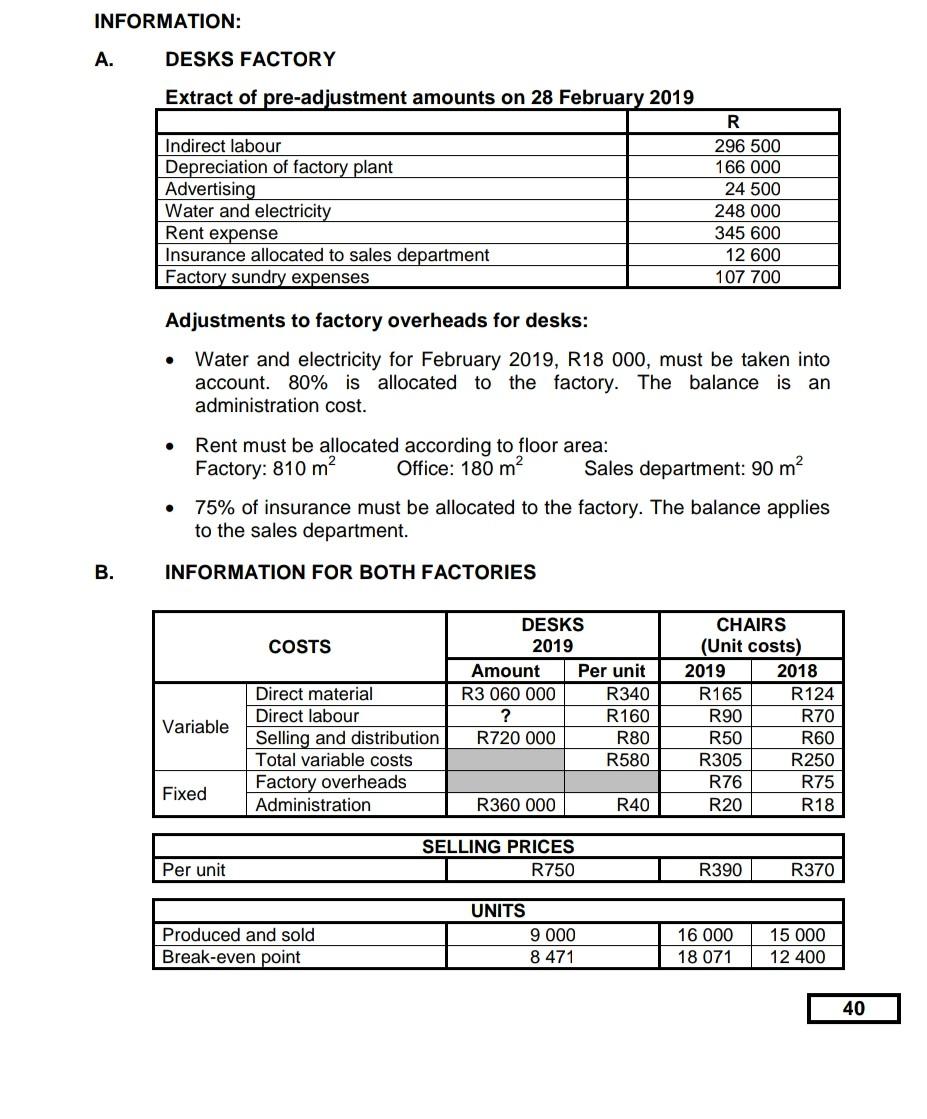

QUESTION 1: MANUFACTURING (40 marks; 20 minutes) Sihle Sangweni owns two separate factories that manufacture products according to orders received. There is no work-in-progress stock. The year-end is 28 February. 1.1 Indicate whether the following statements are TRUE or FALSE. Write only 'true' or 'false' next to the question numbers (1.1.1 to 1.1.3) in the ANSWER BOOK. 1.1.1 Wages of factory cleaners is a direct labour cost. 1.1.2 Delivery costs of finished goods to retailers are a selling and distribution cost. 1.1.3 Depreciation on office equipment is an administration cost. (31) (3) 1.2 DESKS FACTORY REQUIRED: 1.2.1 Complete the Factory Overhead Cost Note. 1.2.2 Calculate the total cost of production of finished goods. 1.2.3 Sihle wants to produce an additional 1500 desks, while maintaining the selling price and costs. Calculate the additional profit he can expect. 1.3 CHAIRS FACTORY REQUIRED: 1.3.1 Provide a calculation to confirm the break-even point for 2019 . 1.3.2 Comment on the break-even point and the production level achieved. Quote figures. 1.3.3 Raw material consists of wood only. In 2019 the cost is R120 per square metre (m2) and 1,2m2 of wood is needed to make one chair. During the year, 22000m2 wood was dispatched to the factory. Sihle feels that the wood raw material was not well controlled. - Provide a calculation to support his opinion. - Identify TWO possible causes of this problem. Provide a solution for EACH. 1.3.4 Give TWO reasons for the increase in direct labour cost. Provide a solution for EACH. Note that wages and salaries increased by 5% in the current financial year. (4) INFORMATION: A. DESKS FACTORY Extract of pre-adjustment amounts on 28 February 2019 Adjustments to factory overheads for desks: - Water and electricity for February 2019, R18 000, must be taken into account. 80% is allocated to the factory. The balance is an administration cost. - Rent must be allocated according to floor area: Factory:810m2Office:180m2Salesdepartment:90m2 - 75% of insurance must be allocated to the factory. The balance applies to the sales department. B. INFORMATION FOR BOTH FACTORIESStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started