Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the question in the first picyure the way it is showed in the second picture of the sample question and answer 3. Analysts

please answer the question in the first picyure the way it is showed in the second picture of the sample question and answer

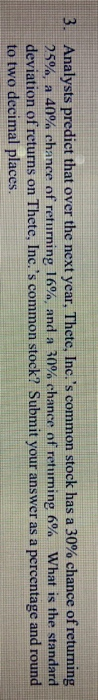

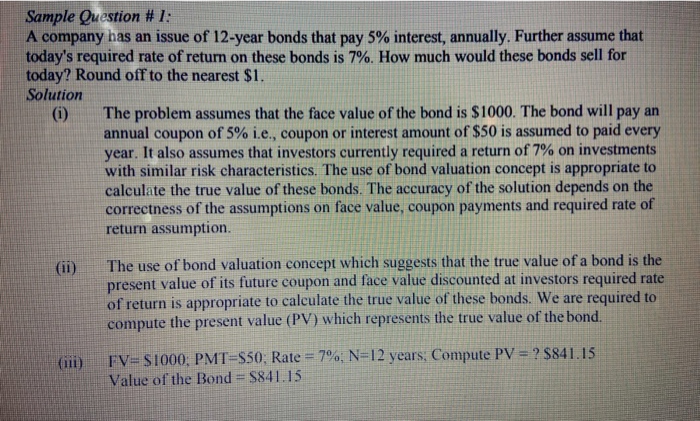

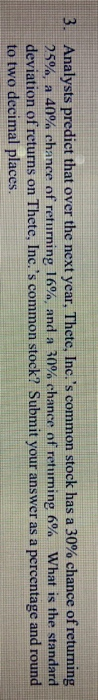

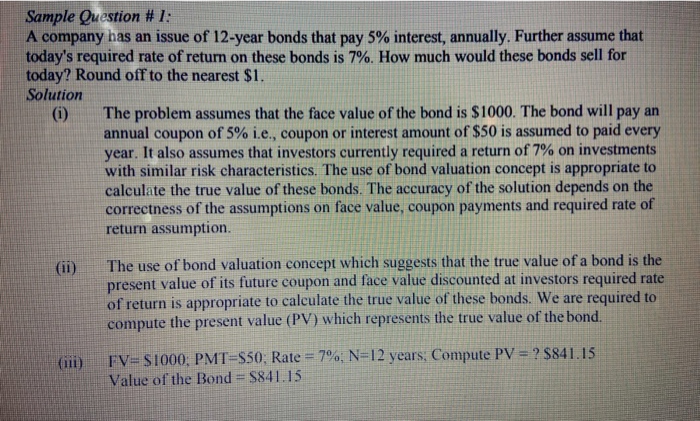

3. Analysts predict that over the next year, Thete, Inc.'s common stock has a 30% chance of returning 25%, a 40% chance of returning 16%, and a 30% chance of retuming 6% What is the standard deviation of returns on Thete, Inc.'s common stock? Submit your answer as a percentage and round to two decimal places. Sample Question # 1: A company has an issue of 12-year bonds that pay 5% interest, annually. Further assume that today's required rate of retum on these bonds is 7%. How much would these bonds sell for today? Round off to the nearest $1. Solution (0) The problem assumes that the face value of the bond is $1000. The bond will pay an annual coupon of 5% i.e., coupon or interest amount of $50 is assumed to paid every year. It also assumes that investors currently required a return of 7% on investments with similar risk characteristics. The use of bond valuation concept is appropriate to calculate the true value of these bonds. The accuracy of the solution depends on the correctness of the assumptions on face value, coupon payments and required rate of return assumption. The use of bond valuation concept which suggests that the true value of a bond is the present value of its future coupon and face value discounted at investors required rate of return is appropriate to calculate the true value of these bonds. We are required to compute the present value (PV) which represents the true value of the bond. (ii) FV=S1000: PMT=S50; Rate = 7%; N=12 years: Compute PV = ? $841.15 Value of the Bond = S841.15

3. Analysts predict that over the next year, Thete, Inc.'s common stock has a 30% chance of returning 25%, a 40% chance of returning 16%, and a 30% chance of retuming 6% What is the standard deviation of returns on Thete, Inc.'s common stock? Submit your answer as a percentage and round to two decimal places. Sample Question # 1: A company has an issue of 12-year bonds that pay 5% interest, annually. Further assume that today's required rate of retum on these bonds is 7%. How much would these bonds sell for today? Round off to the nearest $1. Solution (0) The problem assumes that the face value of the bond is $1000. The bond will pay an annual coupon of 5% i.e., coupon or interest amount of $50 is assumed to paid every year. It also assumes that investors currently required a return of 7% on investments with similar risk characteristics. The use of bond valuation concept is appropriate to calculate the true value of these bonds. The accuracy of the solution depends on the correctness of the assumptions on face value, coupon payments and required rate of return assumption. The use of bond valuation concept which suggests that the true value of a bond is the present value of its future coupon and face value discounted at investors required rate of return is appropriate to calculate the true value of these bonds. We are required to compute the present value (PV) which represents the true value of the bond. (ii) FV=S1000: PMT=S50; Rate = 7%; N=12 years: Compute PV = ? $841.15 Value of the Bond = S841.15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started