please answer the question in the same format

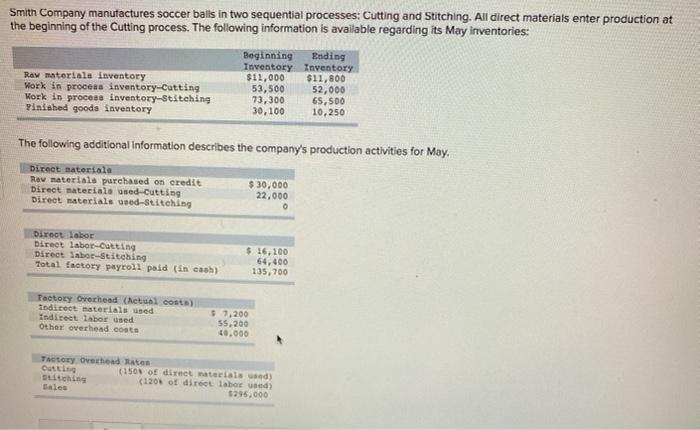

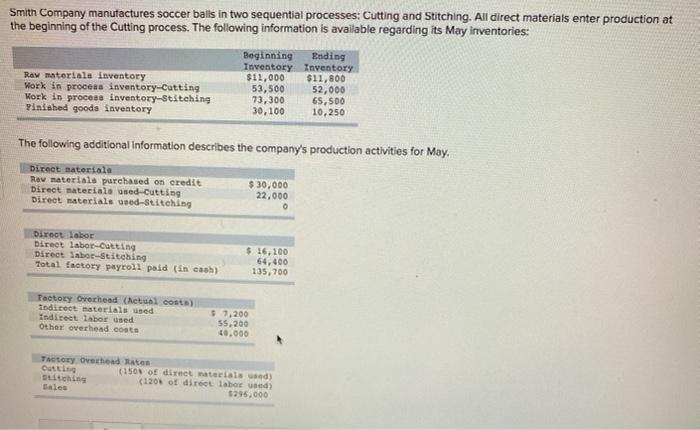

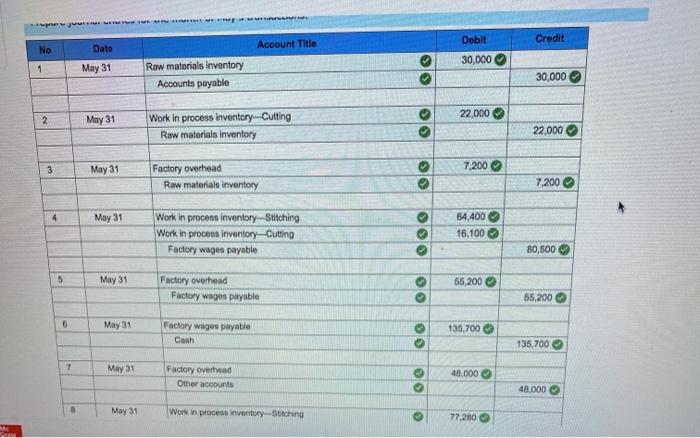

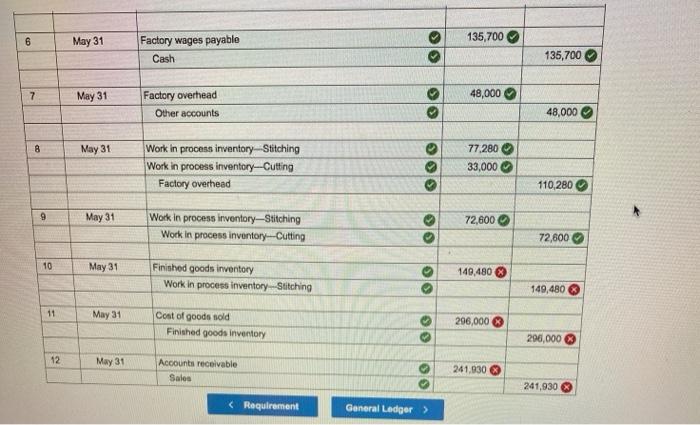

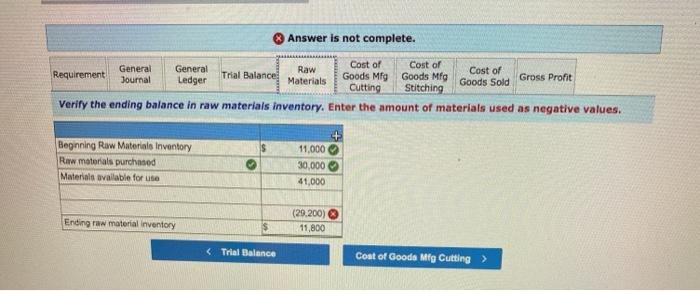

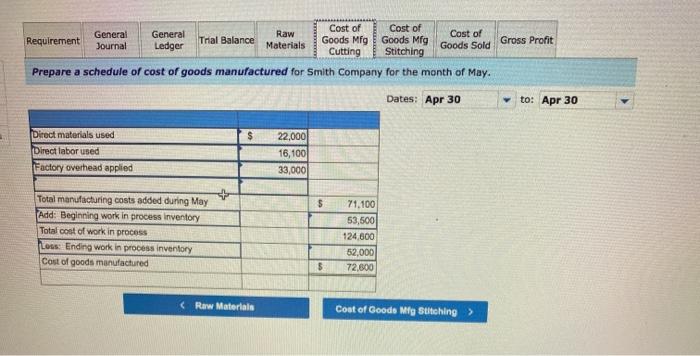

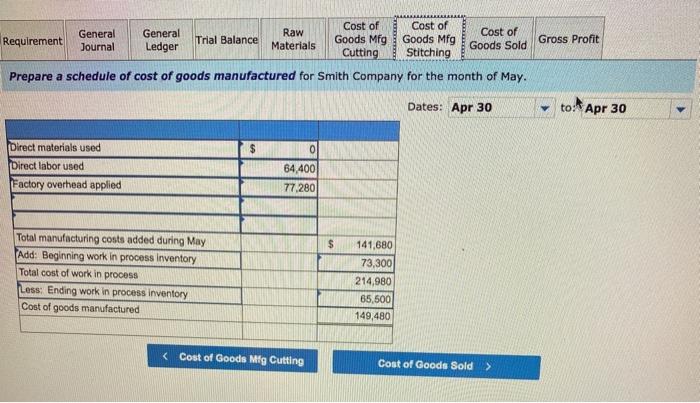

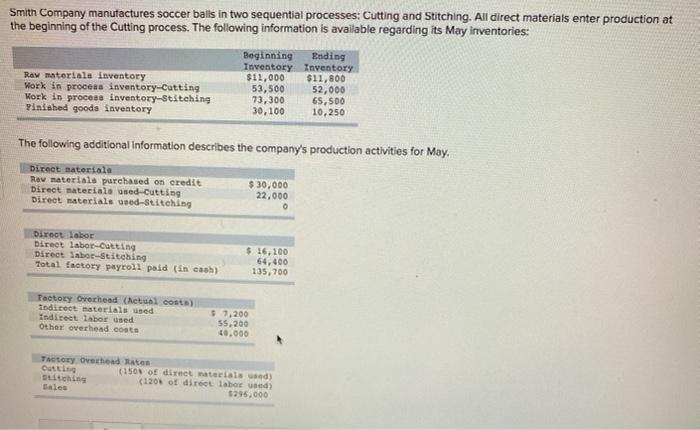

Smith Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: Raw materials inventory Work in procesa inventory-Cutting Work in process inventory-stitching Finished goods inventory Beginning Ending Inventory Inventory $11,000 $11,800 53,500 52,000 73,300 65,500 30,100 10,250 The following additional Information describes the company's production activities for May, Direet materiala Raw materials purchased on credit Direct materials used-cutting Direct materials used-stitching $ 30,000 22,000 Direct Labor Direct labor-cutting Direct labor-stitching Total factory payroll paid (in cash) $ 16,100 64.400 135,700 Factory Overhead (Actual costa) Indirect materials used Indiceet Labor used Other overhead coats 7,200 55.200 40,000 Tactory Overhead Rates Cutting (1501 of direct materials wed) (120 of direct laborund Sales $295,000 AN Dobit Credit No Dato Account Title > 30,000 1 May 31 Raw materials inventory Accounts payable 30.000 2 22,000 May 31 Work in process inventory--Cutting Raw materials inventory SIS 22.000 3 May 31 7.200 > Factory overhead Raw materials inventory O 7,200 4 May 31 Work in process inventory Stitching Work in process inventory--Cutting Factory wages payable 64,400 16,100 80,500 5 May 31 55,200 Factory overhead Factory wagos payable 55,200 6 May 31 Factory wages payable Cash 135,700 135,700 7 May 31 Factory overhead Other accounts 48,000 48.000 8 May 31 Work in process inventory Stitching 77,280 6 May 31 135,700 Factory wages payable Cash 135,700 7 May 31 48,000 Factory overhead Other accounts 48,000 8 May 31 Work in process inventory Stitching Work in process inventory-Cutting Factory overhead 77,280 33,000 110,280 9 May 31 72,600 Work in process inventory Stitching Work in process inventory--Cutting 0 72,600 10 May 31 Finished goods inventory Work in process inventory Stitching 140,480 149,480 11 May 31 Cost of goods sold Finished goods inventory 296,000 296,000 12 May 31 Accounts receivable Sales 241.930 241,930 Answer is not complete. General General Raw Requirement Cost of Cost of Trial Balanced Cost of Journal Ledger Materials Goods Mfg Goods Mfg Goods Sold Gross Profit Cutting Stitching Verify the ending balance in raw materials inventory. Enter the amount of materials used as negative values. Beginning Raw Materiale Inventory Raw materials purchased Materials available for use 11,000 30,000 41,000 Ending raw material Inventory (29.200) 11,800 Cost of Cost of General General Raw Cost of Requirement Trial Balance Goods Mfg Goods Mfg Journal Materials Ledger Gross Profit Goods Sold Cutting Stitching Prepare a schedule of cost of goods manufactured for Smith Company for the month of May. Dates: Apr 30 to: Apr 30 Direct materials used Direct labor used Factory overhead applied 22,000 16,100 33,000 5 Total manufacturing costs added during May Add: Beginning work in process inventory Total cost of work in process Lou: Ending work in process inventory Cost of goods manufactured 71,100 53,500 124.600 52,000 72,800 $ Raw Materials Coat of Goods Mig Sutching > Goods Mfg Goods Sold Gross Profit Cost of Cost of General General Raw Cost of Requirement Trial Balance Goods Mfg Journal Ledger Materials Cutting Stitching Prepare a schedule of cost of goods manufactured for Smith Company for the month of May. Dates: Apr 30 to: Apr 30 0 Direct materials used Direct labor used Factory overhead applied 64,400 77,280 $ Total manufacturing costs added during May Add: Beginning work in process inventory Total cost of work in process Less: Ending work in process inventory Cost of goods manufactured 141,680 73,300 214,980 65,500 149,480