Please answer the question in their respective formats and tables and amounts as that is what is very important for me. Thank you!

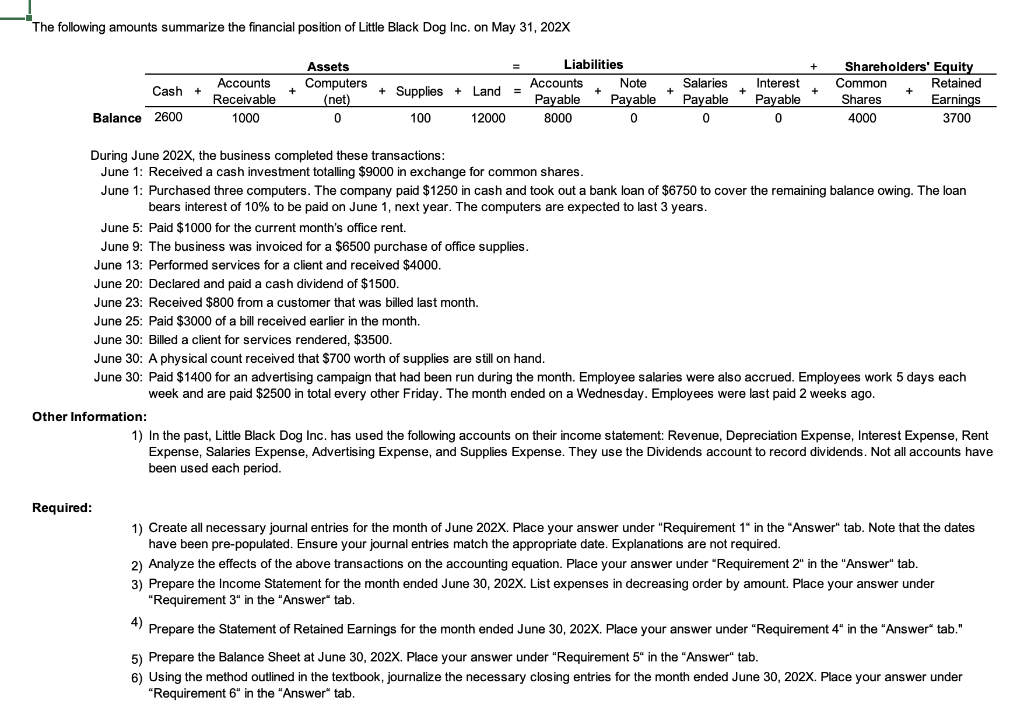

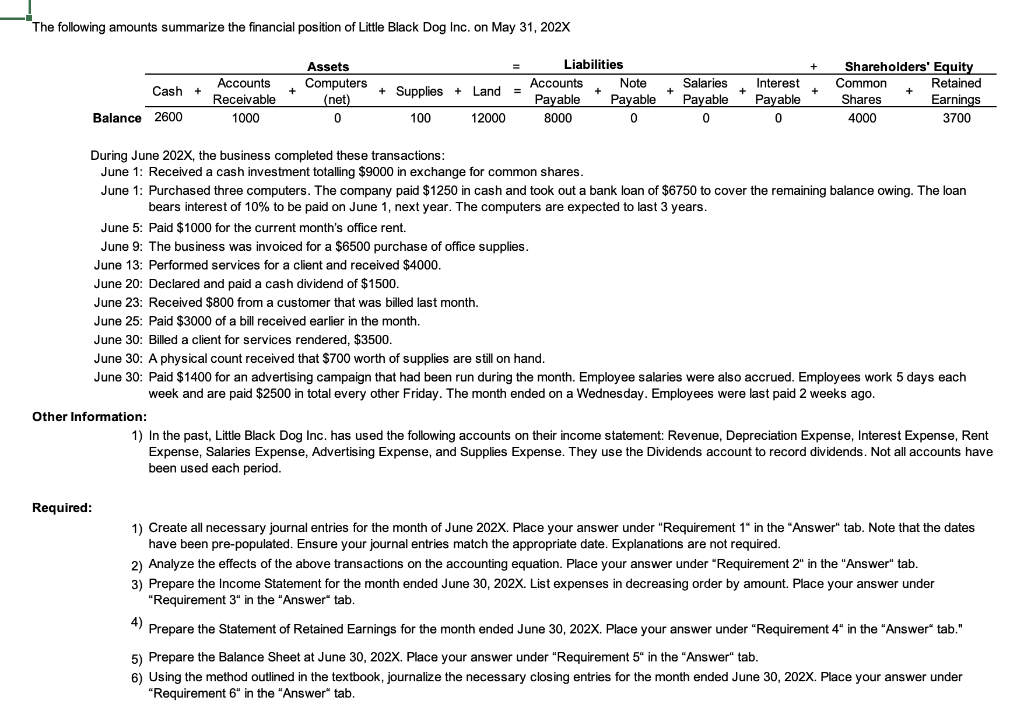

The following amounts summarize the financial position of Little Black Dog Inc. on May 31, 202X B During June 202X, the business completed these transactions: June 1: Received a cash investment totalling $9000 in exchange for common shares. bears interest of 10% to be paid on June 1 , next year. The computers are expected to last 3 years. June 5: Paid $1000 for the current month's office rent. June 9: The business was invoiced for a $6500 purchase of office supplies. June 13: Performed services for a client and received $4000. June 20: Declared and paid a cash dividend of $1500. June 23: Received $800 from a customer that was billed last month. June 25: Paid $3000 of a bill received earlier in the month. June 30: Billed a client for services rendered, $3500. June 30: A physical count received that $700 worth of supplies are still on hand. June 30: Paid $1400 for an advertising campaign that had been run during the month. Employee salaries were also accrued. Employees work 5 days each week and are paid $2500 in total every other Friday. The month ended on a Wednesday. Employees were last paid 2 weeks ago. Other Information: 1) In the past, Little Black Dog Inc. has used the following accounts on their income statement: Revenue, Depreciation Expense, Interest Expense, Rent Expense, Salaries Expense, Advertising Expense, and Supplies Expense. They use the Dividends account to record dividends. Not all accounts have been used each period. Required: 1) Create all necessary journal entries for the month of June 202X. Place your answer under "Requirement 1 " in the "Answer" tab. Note that the dates have been pre-populated. Ensure your journal entries match the appropriate date. Explanations are not required. 2) Analyze the effects of the above transactions on the accounting equation. Place your answer under "Requirement 2 " in the "Answer" tab. 3) Prepare the Income Statement for the month ended June 30, 202X. List expenses in decreasing order by amount. Place your answer under "Requirement 3 " in the "Answer" tab. 4) Prepare the Statement of Retained Earnings for the month ended June 30,202X. Place your answer under "Requirement 4 " in the "Answer" tab." 5) Prepare the Balance Sheet at June 30, 202X. Place your answer under "Requirement 5 in the "Answer" tab. 6) Using the method outlined in the textbook, journalize the necessary closing entries for the month ended June 30 , 202X. Place your answer under "Requirement 6 " in the "Answer" tab. The following amounts summarize the financial position of Little Black Dog Inc. on May 31, 202X B During June 202X, the business completed these transactions: June 1: Received a cash investment totalling $9000 in exchange for common shares. bears interest of 10% to be paid on June 1 , next year. The computers are expected to last 3 years. June 5: Paid $1000 for the current month's office rent. June 9: The business was invoiced for a $6500 purchase of office supplies. June 13: Performed services for a client and received $4000. June 20: Declared and paid a cash dividend of $1500. June 23: Received $800 from a customer that was billed last month. June 25: Paid $3000 of a bill received earlier in the month. June 30: Billed a client for services rendered, $3500. June 30: A physical count received that $700 worth of supplies are still on hand. June 30: Paid $1400 for an advertising campaign that had been run during the month. Employee salaries were also accrued. Employees work 5 days each week and are paid $2500 in total every other Friday. The month ended on a Wednesday. Employees were last paid 2 weeks ago. Other Information: 1) In the past, Little Black Dog Inc. has used the following accounts on their income statement: Revenue, Depreciation Expense, Interest Expense, Rent Expense, Salaries Expense, Advertising Expense, and Supplies Expense. They use the Dividends account to record dividends. Not all accounts have been used each period. Required: 1) Create all necessary journal entries for the month of June 202X. Place your answer under "Requirement 1 " in the "Answer" tab. Note that the dates have been pre-populated. Ensure your journal entries match the appropriate date. Explanations are not required. 2) Analyze the effects of the above transactions on the accounting equation. Place your answer under "Requirement 2 " in the "Answer" tab. 3) Prepare the Income Statement for the month ended June 30, 202X. List expenses in decreasing order by amount. Place your answer under "Requirement 3 " in the "Answer" tab. 4) Prepare the Statement of Retained Earnings for the month ended June 30,202X. Place your answer under "Requirement 4 " in the "Answer" tab." 5) Prepare the Balance Sheet at June 30, 202X. Place your answer under "Requirement 5 in the "Answer" tab. 6) Using the method outlined in the textbook, journalize the necessary closing entries for the month ended June 30 , 202X. Place your answer under "Requirement 6 " in the "Answer" tab