Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the question, this is my third time posting this and i dont want to waste all of my questions, THEY ARE 3 different

please answer the question, this is my third time posting this and i dont want to waste all of my questions, THEY ARE 3 different QUESTIONS, not all one

please answer the first question

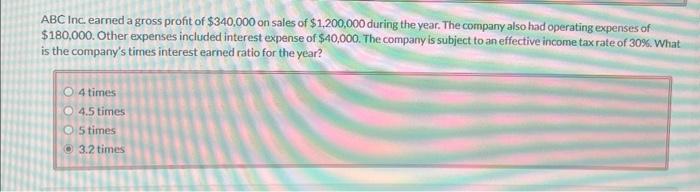

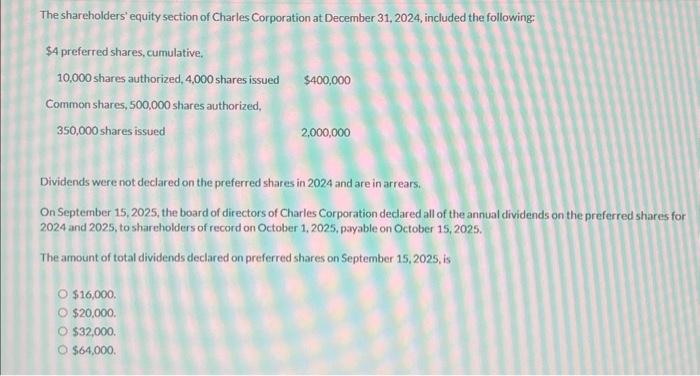

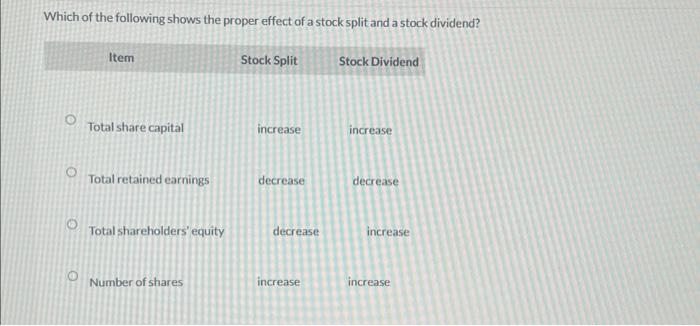

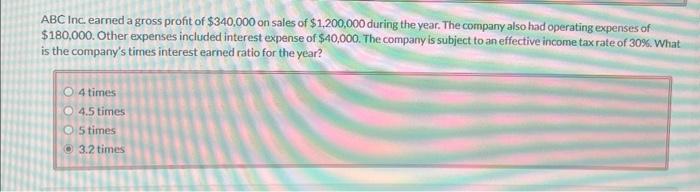

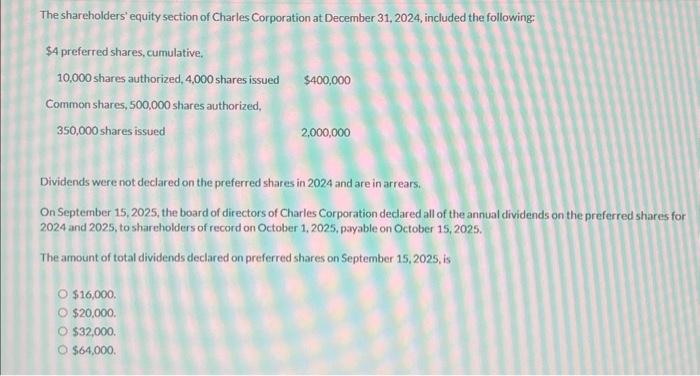

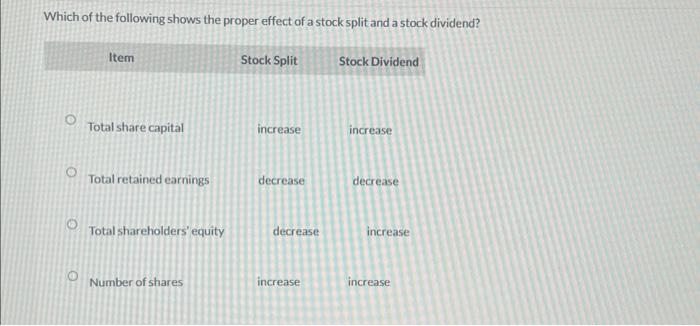

ABC Inc earned a gross profit of $340,000 on sales of $1,200,000 during the year. The company also had operating expenses of $180,000. Other expenses included interest expense of $40,000. The company is subject to an effective income tax rate of 30%. What is the company's times interest earned ratio for the year? 4 times 4.5 times 5 times 3.2 times The shareholders' equity section of Charles Corporation at December 31,2024 , included the following: Dividends were not declared on the preferred shares in 2024 and are in arrears. On September 15,2025, the board of directors of Charles Corporation declared all of the annual dividends on the preferred shares for 2024 and 2025, to shareholders of record on October 1,2025, payable on October 15, 2025. The amount of total dividends declared on preferred shares on September 15,2025, is $16,000. $20,000. $32,000. $64,000. Which of the following shows the proper effect of a stock split and a stock dividend? Item Stock Split Total share capital Total retained earnings Total shareholders' equity Number of shares Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started