Answered step by step

Verified Expert Solution

Question

1 Approved Answer

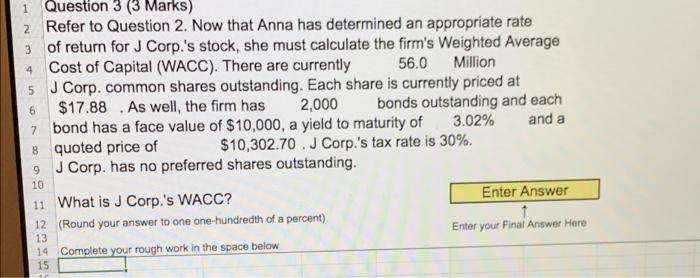

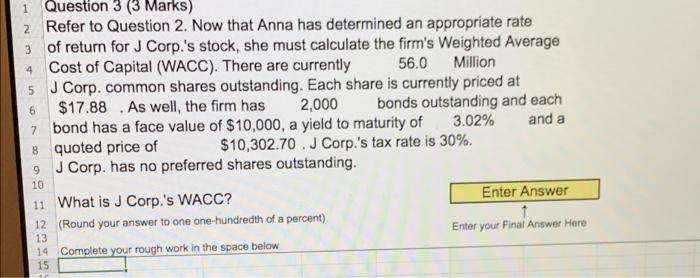

please answer the question tittled 3 I am also adding question 2 because the questuon refers to it. 4 6 1 Question 3 (3 Marks)

please answer the question tittled "3" I am also adding question 2 because the questuon refers to it.

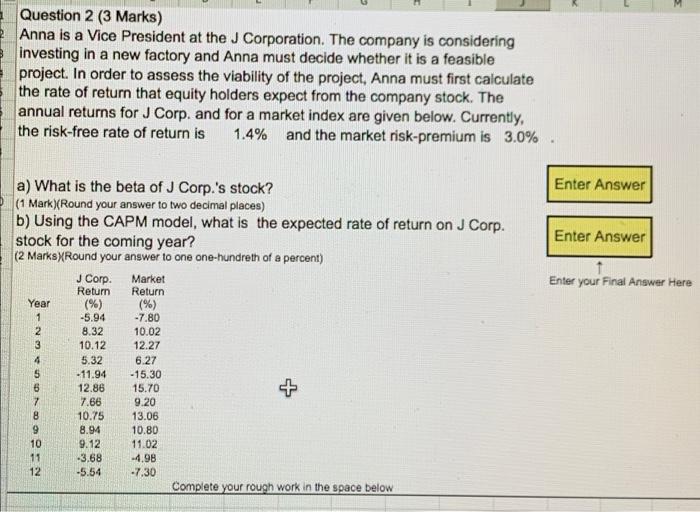

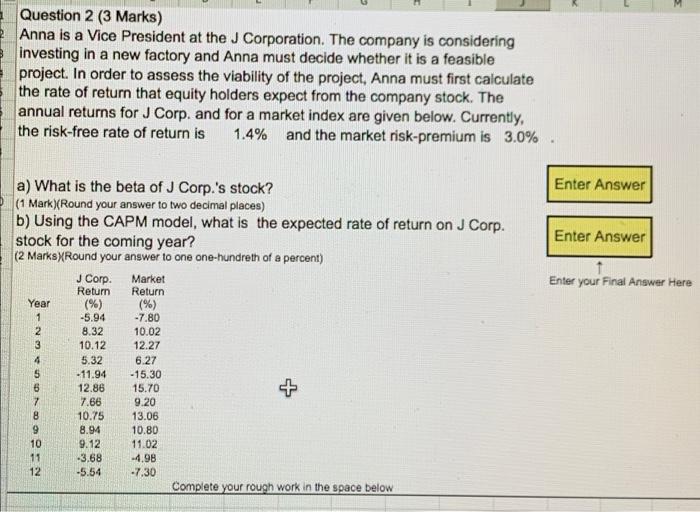

4 6 1 Question 3 (3 Marks) 2. Refer to Question 2. Now that Anna has determined an appropriate rate 3 of return for J Corp.'s stock, she must calculate the firm's Weighted Average Cost of Capital (WACC). There are currently 56.0 Million 5 J Corp. common shares outstanding. Each share is currently priced at $17.88 . As well, the firm has 2,000 bonds outstanding and each bond has a face value of $10,000, a yield to maturity of 3.02% and a 8 quoted price of $10,302.70 . J Corp.'s tax rate is 30%. J Corp. has no preferred shares outstanding. 11 What is J Corp.'s WACC? Enter Answer 12 (Round your answer to one one-hundredth of a percent) Enter your Final Answer Here 14 Complete your rough work in the space below 7 9 10 13 15 Question 2 (3 Marks) Anna is a Vice President at the J Corporation. The company is considering a investing in a new factory and Anna must decide whether it is a feasible project. In order to assess the viability of the project, Anna must first calculate the rate of return that equity holders expect from the company stock. The annual returns for J Corp. and for a market index are given below. Currently, the risk-free rate of return is 1.4% and the market risk-premium is 3.0%. Enter Answer Enter Answer Enter your Final Answer Here a) What is the beta of J Corp.'s stock? (1 Mark)(Round your answer to two decimal places) b) Using the CAPM model, what is the expected rate of return on J Corp. stock for the coming year? (2 Marks Round your answer to one one-hundreth of a percent) J Corp. Market Return Return Year (%) (%) 1 -5.94 -7.80 2 8.32 10.02 3 10.12 12.27 4 5.32 6.27 5 -11.94 -15.30 6 12.86 15.70 7 7.66 9.20 8 10.75 13.06 9 8.94 10.80 10 9.12 11.02 11 -3.68 -4.98 12 -5.54 -7.30 Complete your rough work in the space below +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started