please answer the questions at the bottom of the second picture

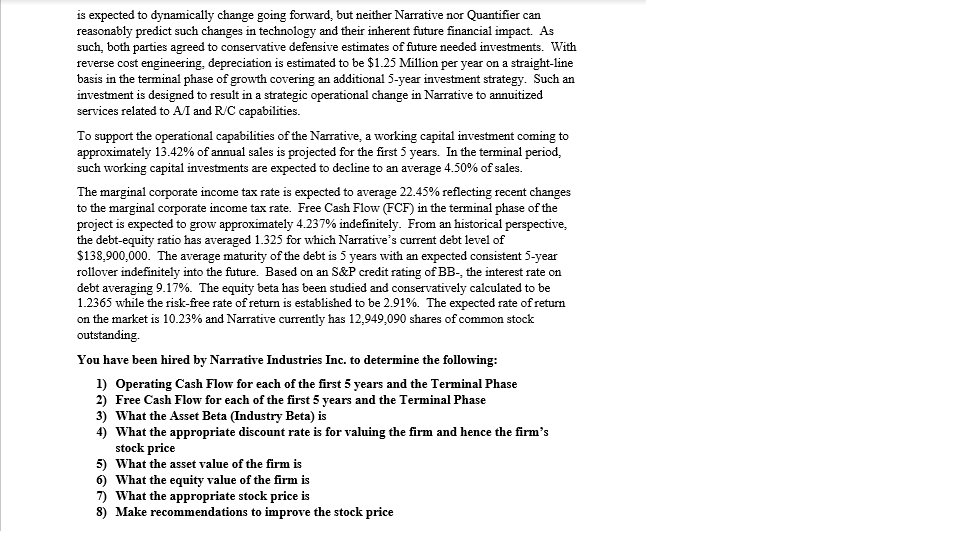

Narrative Industries, Inc. is a newly created firm that came into existence through an equity spin- off from Ocean Capital- a private equity firm specializing in technology recapitalizations. Narrative developed a specialization in artificial intelligence (AT) and robotics capabilities (RC) and is headquartered in Lexington, Kentucky Currently, Narrative has hired a technology and AI related consulting firm Quantifier, Inc. to build unit sales projections for the company. This is expected to give the company insight into quickly evolving markets and changes therein to assist in corporate planning for possible new investments. After diligent research, Quantifier established pro forma projections for Narrative's only product -Mequafir (due to the special dynamics of A/I and RC, the firm focuses its efforts and resources on a single product line). which cover the following five years: 177,389 units 231,335 units 259,450 units 221,900 units 186,850 units ear ear ear ear ear Such estimates established by Quantifier are based on the premise that the current average selling price (ASP) of $567 per unit holds for the first two years and a subsequent reduction to $415 per unit prevails in years three through five. To derive an estimate for terminal cash flows to Narrative, it is assumed that unit sales will decline by an average of 4.35% per year starting in the terminal time per year lasting indefinitely thereafter. Because of expected competitive pressures, the ASP is expected to decline by 6% per year starting in the terminal period with the trend expected to continue indefinitely thereafter The Special Task Force for Internal Corporate Finance Issues has cost accounting and engineering studies that Narrative is able to produce its Mequafir product at a variable cost approximating $67/unit. Due to a tight labor market and resource constraints nationwide, the VC cost/unit is expected to rise by 2.85% per year for the first 5 years and increase by an average of 3.55% per year starting in the terminal time period with an indefinitely continuing trend thereafter. Due to growing capacity needs, Narrative's total annual fixed costs are projected to start at $15,879,000 annually and grow by an estimated 3.79% per year indefinitely into the future d through various To maintain market advantage well into the future, necessary capital expenditures for the firm are projected to be an initial $31,667,000 up front for which an IRS ruling requested by the company places such an investment in the five-year MACRS depreciation schedule. The market is expected to dynamically change going forward, but neither Narrative nor Quantifier can reasonably predict such changes in technology and their inherent future financial impact. As such, both parties agreed to conservative defensive estimates of future needed investments. With reverse cost engineering, depreciation is estimated to be $1.25 Million per year on a straight-line basis in the terminal phase of growth covering an additional 5-year investment strategy. Such an investment is designed to result in a strategic operational change in Narrative to annuitized services related to AI and R/C capabilities. To support the operational capabilities of the Narrative, a working capital investment coming to approximately 13.42% of annual sales is projected for the first 5 years. In the terminal period. such working capital investments are expected to decline to an average 4.50% of sales. The marginal corporate income tax rate is expected to average 22.45% reflecting recent changes to the marginal corporate income tax rate. Free Cash Flow (FCF) in the terminal phase of the project is expected to grow approximately 4.237% indefinitely. From an historical perspective. the debt-equity ratio has averaged 1.325 for which Narrative's current debt level of $138,900,000. The average maturity of the debt is 5 years with an expected consistent 5-year rollover indefinitely into the future. Based on an S&P credit rating of BB-, the interest rate on debt averaging 9.17%. The equity beta has been studied and conservatively calculated to be 1.2365 while the risk-free rate of return is established to be 2.91%. The expected rate of return on the market is 10.23% and Narrative currently has 12,949,090 shares of common stock You have been hired by Narrative Industries Inc. to determine the following: 1) Operating Cash Flow for each of the first 5 years and the Terminal Phase 2) Free Cash Flow for each of the first 5 years and the Terminal Phase 3) What the Asset Beta (Industry Beta) is 4) What the appropriate discount rate is for valuing the firm and hence the firm's stock price 5) What the asset value of the firm is 6) What the equity value of the firm is 7) What the appropriate stock price is 8) Make recommendations to improve the stock price