Answered step by step

Verified Expert Solution

Question

1 Approved Answer

9. Gamble Company, a successful efforts company, owns a working interest in an oil field in Alaska. The field has been producing for a

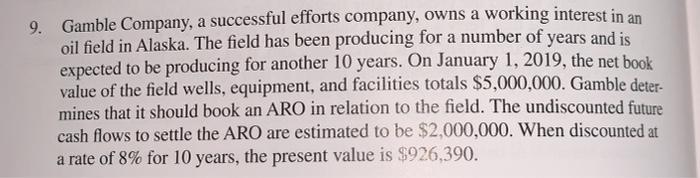

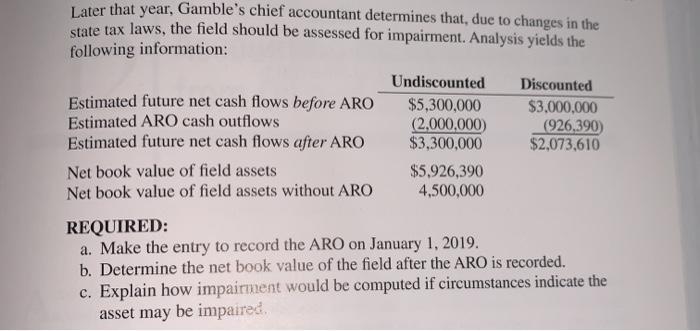

9. Gamble Company, a successful efforts company, owns a working interest in an oil field in Alaska. The field has been producing for a number of years and is expected to be producing for another 10 years. On January 1, 2019, the net book value of the field wells, equipment, and facilities totals $5,000,000. Gamble deter- mines that it should book an ARO in relation to the field. The undiscounted future cash flows to settle the ARO are estimated to be $2,000,000. When discounted at a rate of 8% for 10 years, the present value is $926,390. Later that year, Gamble's chief accountant determines that, due to changes in the state tax laws, the field should be assessed for impairment. Analysis yields the following information: Estimated future net cash flows before ARO Estimated ARO cash outflows Estimated future net cash flows after ARO Net book value of field assets Net book value of field assets without ARO Undiscounted $5,300,000 (2,000,000) $3,300,000 $5,926,390 4,500,000 Discounted $3,000,000 (926,390) $2,073,610 REQUIRED: a. Make the entry to record the ARO on January 1, 2019. b. Determine the net book value of the field after the ARO is recorded. c. Explain how impairment would be computed if circumstances indicate the asset may be impaired. 6. Terry Company, a successful efforts company, has 100% of the working interest in a field in Texas. The field constitutes a cost center and is also an asset group for purposes of testing for impairment. In 2019, the price of oil dropped significantly, therefore, Terry must test for impairment. The table below reflects Terry's latest expected cash flows and risk-free rates for the remainder of the life of the field. Year 2020 2021 2022 2023 2024 2025 Total Net Cash Flow Estimate (Market) (million $) $100.0 90.9 85.3 $91.2 88.3 75.4 $87.5 91.8 65.5 $ 62.4 50.2 45.8 $ 45.9 55.5 36.0 $31.6 21.0 15.4 Probability Assessment 30% 60% 10% 50% 20% 30% 70% 20% 10% 55% 20% 25% 80% 10% 10% 60% 20% 20% Credit-Adjusted Risk-Free Rate 6.2% 6.9% 7.1% 6.7% 5.5% 6.1% REQUIRED: a. Assume that Terry's carrying value for the field is $300 million. Determine whether Terry must book impairment and, if so, record the necessary journal entry. Round the present value factors to four decimal places. b. Assume that Terry's carrying value for the field is $400 million. Determine whether Terry must book impairment and, if so, record the necessary journal entry. Round the present value factors to four decimal places.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

aMake the entry to record the ARO on January 1 2019 ARO Allowance for Impairment 2073610 ARO Asset 2926390 Cash 5000000 Total 9000000 bDetermine the net book value of the field after the ARO is record...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started