Please answer the questions below using the information provided.

please answer with calculations so I can understand how you got to the answer.

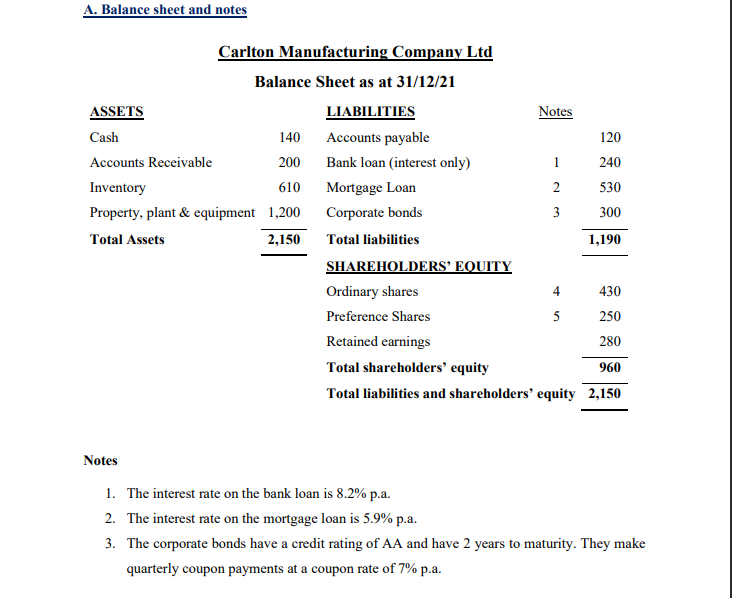

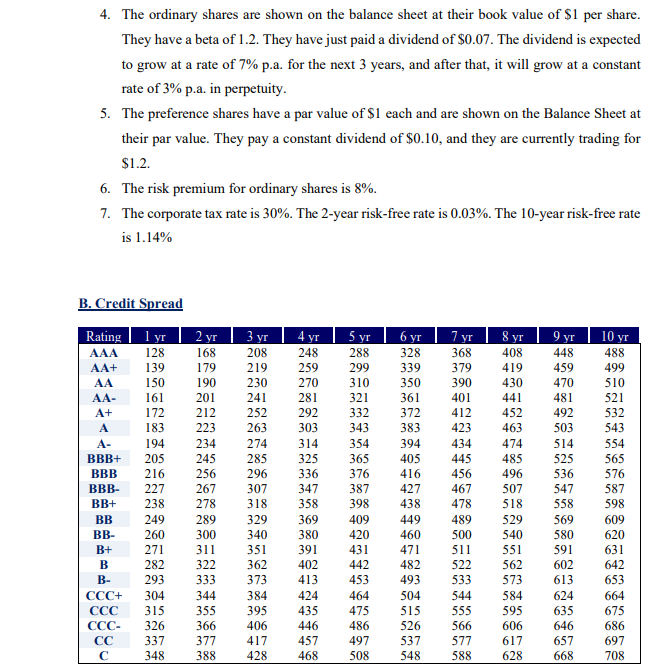

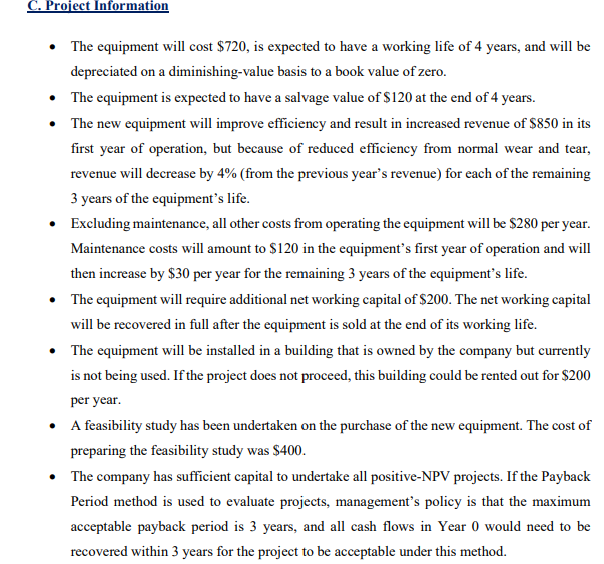

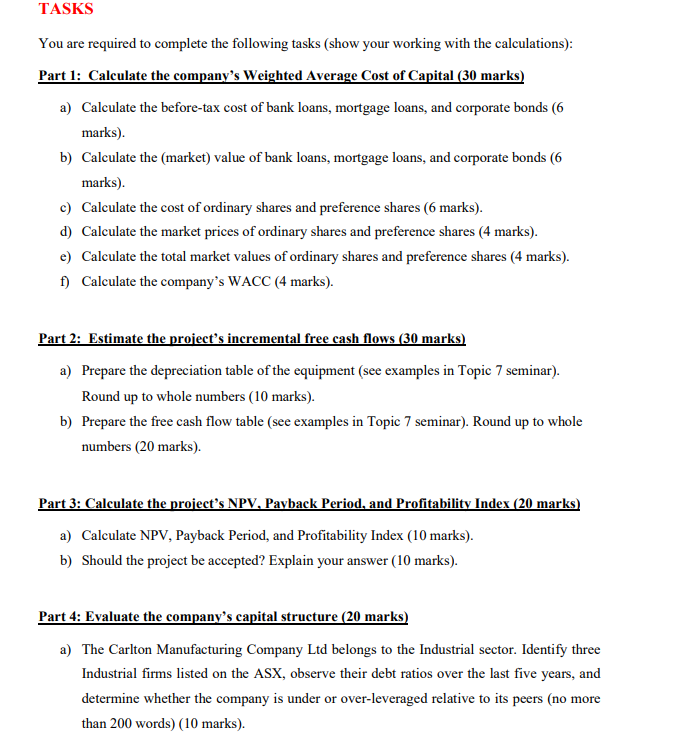

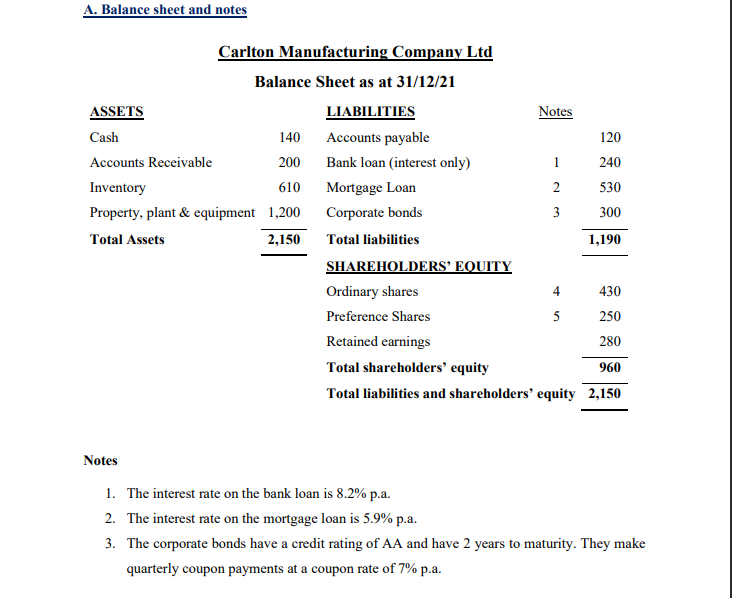

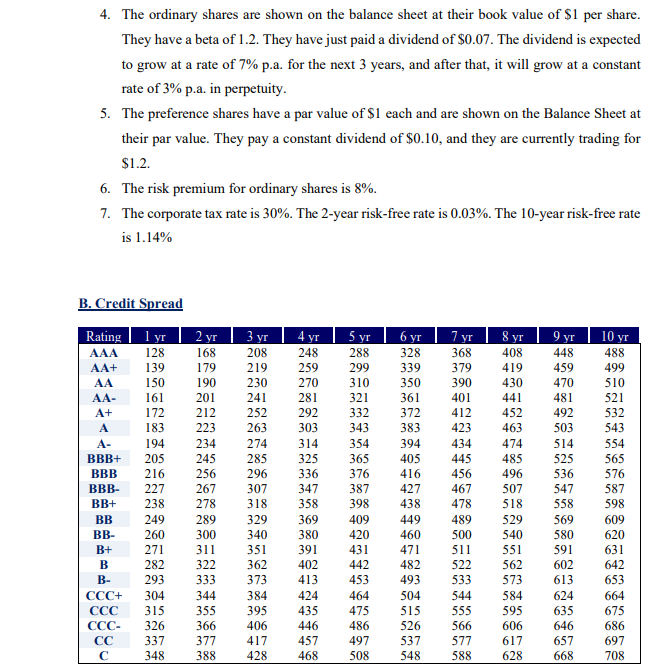

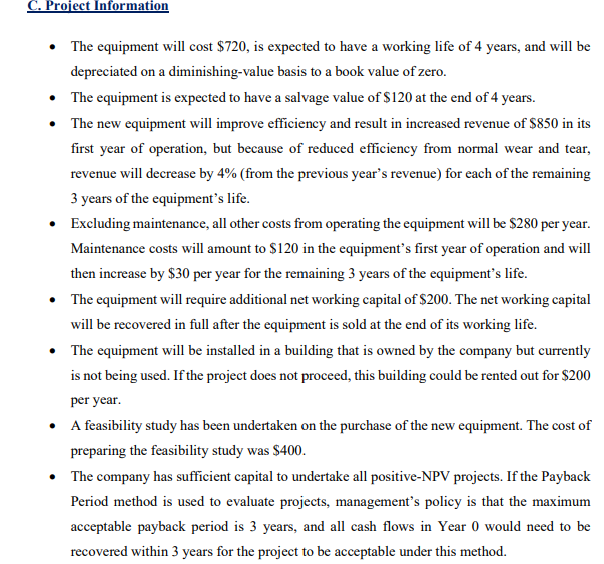

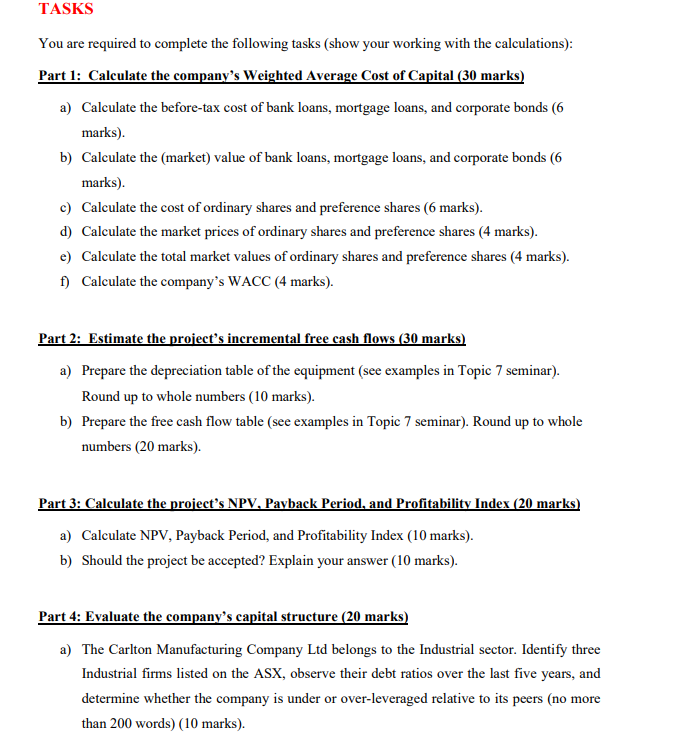

A. Balance sheet and notes Carlton Manufacturing Company Ltd Balance Sheet as at 31/12/21 ASSETS LIABILITIES Notes Cash 140 Accounts payable 120 Accounts Receivable 200 Bank loan interest only) 1 240 Inventory 610 Mortgage Loan 2 530 Property, plant & equipment 1,200 Corporate bonds 3 300 Total Assets 2,150 Total liabilities 1,190 SHAREHOLDERS' EQUITY Ordinary shares 430 Preference Shares 5 250 Retained earnings 280 Total shareholders' equity 960 Total liabilities and shareholders' equity 2,150 Notes 1. The interest rate on the bank loan is 8.2% p.a. 2. The interest rate on the mortgage loan is 5.9% p.a. 3. The corporate bonds have a credit rating of AA and have 2 years to maturity. They make quarterly coupon payments at a coupon rate of 7% p.a. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.2. They have just paid a dividend of $0.07. The dividend is expected to grow at a rate of 7% p.a. for the next 3 years, and after that, it will grow at a constant rate of 3% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.10, and they are currently trading for $1.2. 6. The risk premium for ordinary shares is 8%. 7. The corporate tax rate is 30%. The 2-year risk-free rate is 0.03%. The 10-year risk-free rate is 1.14% B. Credit Spread 2 yr 3 yr 4 y 5 y 7 y 8 y 9 yr 10 yr 208 219 230 241 252 263 Rating | lyr AAA 128 AA+ 139 AA 150 AA- 161 A+ 172 A 183 A- 194 BBB+ 205 BBB 216 BBB- 227 BB+ 238 BB 249 BB- 260 B+ 271 B 282 B- 293 CCC+ 304 CCC 315 CCC- 326 CC 337 348 168 179 190 201 212 223 234 245 256 267 278 289 300 311 322 274 285 296 307 318 329 340 351 362 373 384 395 406 417 428 248 259 270 281 292 303 314 325 336 347 358 369 380 391 402 413 424 435 446 457 468 288 299 310 321 332 343 354 365 376 387 398 409 420 431 442 453 464 475 486 497 6 yr 328 339 350 361 372 383 394 405 416 427 438 449 460 471 482 493 504 515 526 537 548 368 379 390 401 412 423 434 445 456 467 478 489 500 511 522 533 544 555 566 577 588 408 419 430 441 452 463 474 485 496 507 518 529 540 551 562 573 584 595 606 617 628 448 459 470 481 492 503 514 525 536 547 558 569 580 591 602 613 624 635 646 657 488 499 510 521 532 543 554 565 576 587 598 609 620 631 642 653 664 675 686 697 708 333 344 355 366 377 388 508 668 C. Project Information The equipment will cost $720, is expected to have a working life of 4 years, and will be depreciated on a diminishing-value basis to a book value of zero. The equipment is expected to have a salvage value of $120 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $850 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 4% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $280 per year. Maintenance costs will amount to $120 in the equipment's first year of operation and will then increase by $30 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $200. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company but currently is not being used. If the project does not proceed, this building could be rented out for $200 per year. A feasibility study has been undertaken on the purchase of the new equipment. The cost of preparing the feasibility study was $400. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year 0 would need to be recovered within 3 years for the project to be acceptable under this method. TASKS You are required to complete the following tasks (show your working with the calculations): Part 1: Calculate the company's Weighted Average Cost of Capital (30 marks) a) Calculate the before-tax cost of bank loans, mortgage loans, and corporate bonds (6 marks). b) Calculate the (market) value of bank loans, mortgage loans, and corporate bonds (6 marks). c) Calculate the cost of ordinary shares and preference shares (6 marks). d) Calculate the market prices of ordinary shares and preference shares (4 marks). e) Calculate the total market values of ordinary shares and preference shares (4 marks). f) Calculate the company's WACC (4 marks). Part 2: Estimate the project's incremental free cash flows (30 marks) a) Prepare the depreciation table of the equipment (see examples in Topic 7 seminar). Round up to whole numbers (10 marks). b) Prepare the free cash flow table (see examples in Topic 7 seminar). Round up to whole numbers (20 marks). Part 3: Calculate the project's NPV, Payback Period, and Profitability Index (20 marks) a) Calculate NPV, Payback Period, and Profitability Index (10 marks). b) Should the project be accepted? Explain your answer (10 marks). Part 4: Evaluate the company's capital structure (20 marks) a) The Carlton Manufacturing Company Ltd belongs to the Industrial sector. Identify three Industrial firms listed on the ASX, observe their debt ratios over the last five years, and determine whether the company is under or over-leveraged relative to its peers (no more than 200 words) (10 marks). A. Balance sheet and notes Carlton Manufacturing Company Ltd Balance Sheet as at 31/12/21 ASSETS LIABILITIES Notes Cash 140 Accounts payable 120 Accounts Receivable 200 Bank loan interest only) 1 240 Inventory 610 Mortgage Loan 2 530 Property, plant & equipment 1,200 Corporate bonds 3 300 Total Assets 2,150 Total liabilities 1,190 SHAREHOLDERS' EQUITY Ordinary shares 430 Preference Shares 5 250 Retained earnings 280 Total shareholders' equity 960 Total liabilities and shareholders' equity 2,150 Notes 1. The interest rate on the bank loan is 8.2% p.a. 2. The interest rate on the mortgage loan is 5.9% p.a. 3. The corporate bonds have a credit rating of AA and have 2 years to maturity. They make quarterly coupon payments at a coupon rate of 7% p.a. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.2. They have just paid a dividend of $0.07. The dividend is expected to grow at a rate of 7% p.a. for the next 3 years, and after that, it will grow at a constant rate of 3% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.10, and they are currently trading for $1.2. 6. The risk premium for ordinary shares is 8%. 7. The corporate tax rate is 30%. The 2-year risk-free rate is 0.03%. The 10-year risk-free rate is 1.14% B. Credit Spread 2 yr 3 yr 4 y 5 y 7 y 8 y 9 yr 10 yr 208 219 230 241 252 263 Rating | lyr AAA 128 AA+ 139 AA 150 AA- 161 A+ 172 A 183 A- 194 BBB+ 205 BBB 216 BBB- 227 BB+ 238 BB 249 BB- 260 B+ 271 B 282 B- 293 CCC+ 304 CCC 315 CCC- 326 CC 337 348 168 179 190 201 212 223 234 245 256 267 278 289 300 311 322 274 285 296 307 318 329 340 351 362 373 384 395 406 417 428 248 259 270 281 292 303 314 325 336 347 358 369 380 391 402 413 424 435 446 457 468 288 299 310 321 332 343 354 365 376 387 398 409 420 431 442 453 464 475 486 497 6 yr 328 339 350 361 372 383 394 405 416 427 438 449 460 471 482 493 504 515 526 537 548 368 379 390 401 412 423 434 445 456 467 478 489 500 511 522 533 544 555 566 577 588 408 419 430 441 452 463 474 485 496 507 518 529 540 551 562 573 584 595 606 617 628 448 459 470 481 492 503 514 525 536 547 558 569 580 591 602 613 624 635 646 657 488 499 510 521 532 543 554 565 576 587 598 609 620 631 642 653 664 675 686 697 708 333 344 355 366 377 388 508 668 C. Project Information The equipment will cost $720, is expected to have a working life of 4 years, and will be depreciated on a diminishing-value basis to a book value of zero. The equipment is expected to have a salvage value of $120 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $850 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 4% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $280 per year. Maintenance costs will amount to $120 in the equipment's first year of operation and will then increase by $30 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $200. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company but currently is not being used. If the project does not proceed, this building could be rented out for $200 per year. A feasibility study has been undertaken on the purchase of the new equipment. The cost of preparing the feasibility study was $400. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year 0 would need to be recovered within 3 years for the project to be acceptable under this method. TASKS You are required to complete the following tasks (show your working with the calculations): Part 1: Calculate the company's Weighted Average Cost of Capital (30 marks) a) Calculate the before-tax cost of bank loans, mortgage loans, and corporate bonds (6 marks). b) Calculate the (market) value of bank loans, mortgage loans, and corporate bonds (6 marks). c) Calculate the cost of ordinary shares and preference shares (6 marks). d) Calculate the market prices of ordinary shares and preference shares (4 marks). e) Calculate the total market values of ordinary shares and preference shares (4 marks). f) Calculate the company's WACC (4 marks). Part 2: Estimate the project's incremental free cash flows (30 marks) a) Prepare the depreciation table of the equipment (see examples in Topic 7 seminar). Round up to whole numbers (10 marks). b) Prepare the free cash flow table (see examples in Topic 7 seminar). Round up to whole numbers (20 marks). Part 3: Calculate the project's NPV, Payback Period, and Profitability Index (20 marks) a) Calculate NPV, Payback Period, and Profitability Index (10 marks). b) Should the project be accepted? Explain your answer (10 marks). Part 4: Evaluate the company's capital structure (20 marks) a) The Carlton Manufacturing Company Ltd belongs to the Industrial sector. Identify three Industrial firms listed on the ASX, observe their debt ratios over the last five years, and determine whether the company is under or over-leveraged relative to its peers (no more than 200 words) (10 marks)